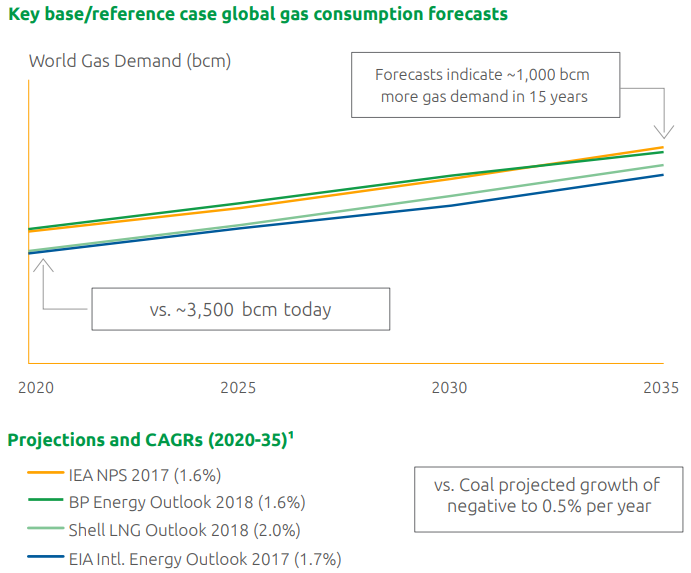

Gas consumption predicted to grow ~1.7% annually

Natural gas demand has significant growth on the horizon, and is projected to overtake coal in the coming years, according to the International Gas Union’ Global Gas Report 2018.

Global gas consumption has grown steadily over the past eight years, with demand rising by 1.8% per year. This makes gas the fastest-growing nonrenewable energy source, a position it is almost guaranteed to retain in the coming decades. Most major forecasters predict gas consumption will rise even during the most aggressive shifts to renewable energy.

Perhaps the largest major trend in global gas consumption comes from China, as the country recently became the world’s largest gas importer. The country is attempting to replace its coal consumption with gas, though totally replacing coal will take years. China has not been dissuaded by the supply crunch it experienced last winter, when prices shot up to six-year highs. China’s 2018 gas imports thus far are up 37% year-over-year.

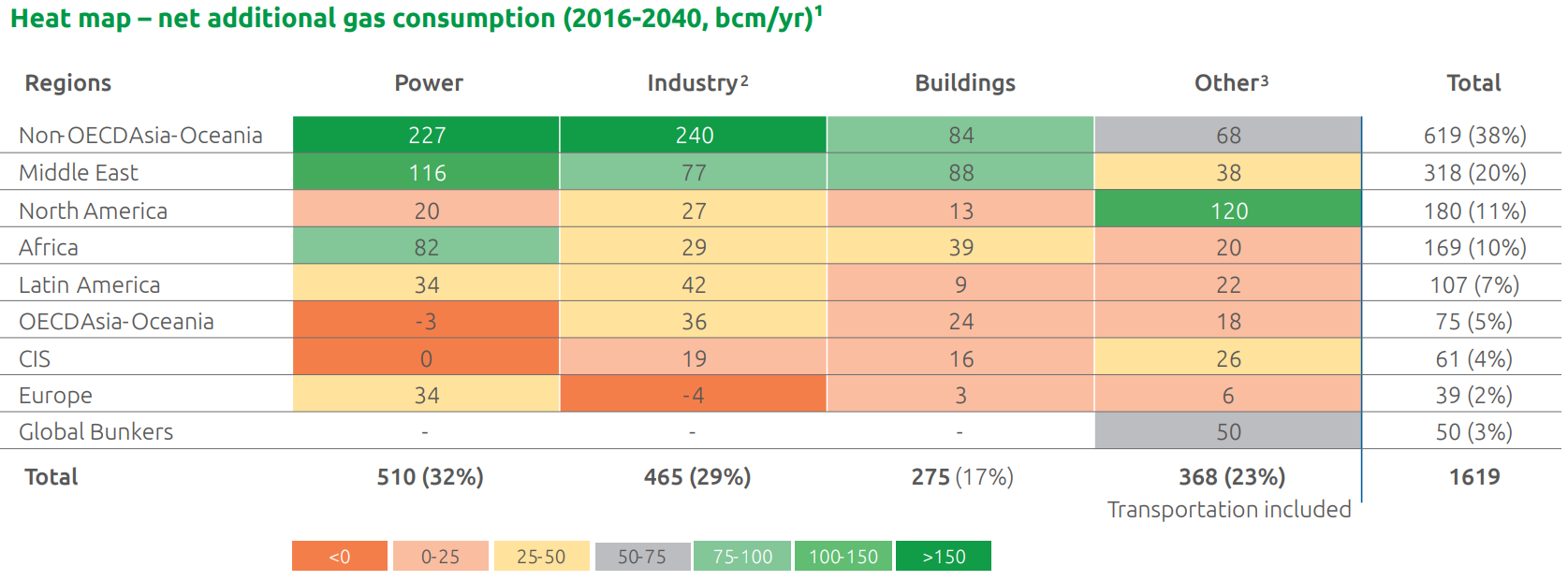

Asian demand is expected to drive much of the growth in global gas consumption through 2040. Non-OECD Asia is expected to contribute 38% of overall growth, primarily the result of increased Chinese demand. Demand will stem from both power generation and industrial consumption, as Chinese production of petrochemicals is projected to grow significantly over the next year.

North America, Europe, Russia have extensive gas infrastructure – the rest of the world is way behind

This growth in demand will require a similar growth in infrastructure, as widespread use of natural gas requires pipelines to move gas to demand centers and storage systems to balance out variability of supply and demand. This is a major obstacle to development, as only North America, Europe and Russia have large amounts of gas infrastructure already in place.

North America has 72% of major gas pipelines; Middle East and Africa are severely limited

The U.S., Canada and Mexico in particular have extensive supporting infrastructure. In 2016, there were an estimated 2,780 kilometers of major gas pipelines in the world. North America alone accounts for 72% of this total, with more than 2,000 kilometers of pipe.

The regions with large expected demand growth, Asia-Oceania, the Middle East and Africa, will need significant infrastructure buildout to support this consumption. While Asia-Oceania has significant pipelines already constructed, almost as much as Europe, the Middle East and Africa have almost no major pipelines.

Underground storage will require even more buildout in the coming years.

North America, Russia and Europe account for 94% of all underground natural gas storage in the world. Asia-Oceania currently has only 16 Bcm of storage capacity, compared to 144 Bcm in North America and 113 Bcm in Europe. The Middle East has even less adequate storage, only 7 Bcm of capacity. Africa has no major underground gas storage at all, and will need to either construct capacity or find a different way to counter variable supply and demand.