An Oil & Gas 360® Exclusive Interview with WPX Energy VP of Drilling and Completions Tom Hellman

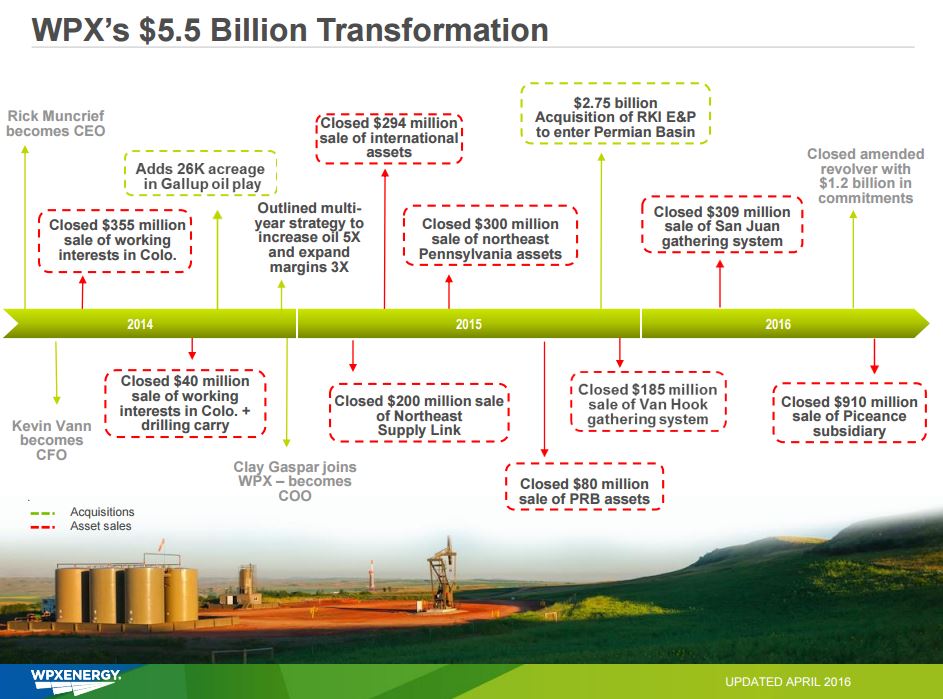

Since 2014, WPX Energy (ticker: WPX) has been neck-deep in a full speed turnaround.

Its management team has completed more than $5 billion in transactions under the leadership of CEO Rick Muncrief, who joined the company after developing a reputation as one of the chief contributors to the success of Continental Resources (ticker: CLR).

WPX has assets and operations in three major U.S. basins: the Permian, the Williston and the San Juan. But for anyone who is casually reading the trades even with both eyes closed, you can’t miss the fact that the Permian basin is where the action is. The Permian is the most active basin in the country with 201 rigs working as of last week. That’s almost 40% of all rigs working in the U.S. The next most active basin is the Eagle Ford with just 37 active rigs.

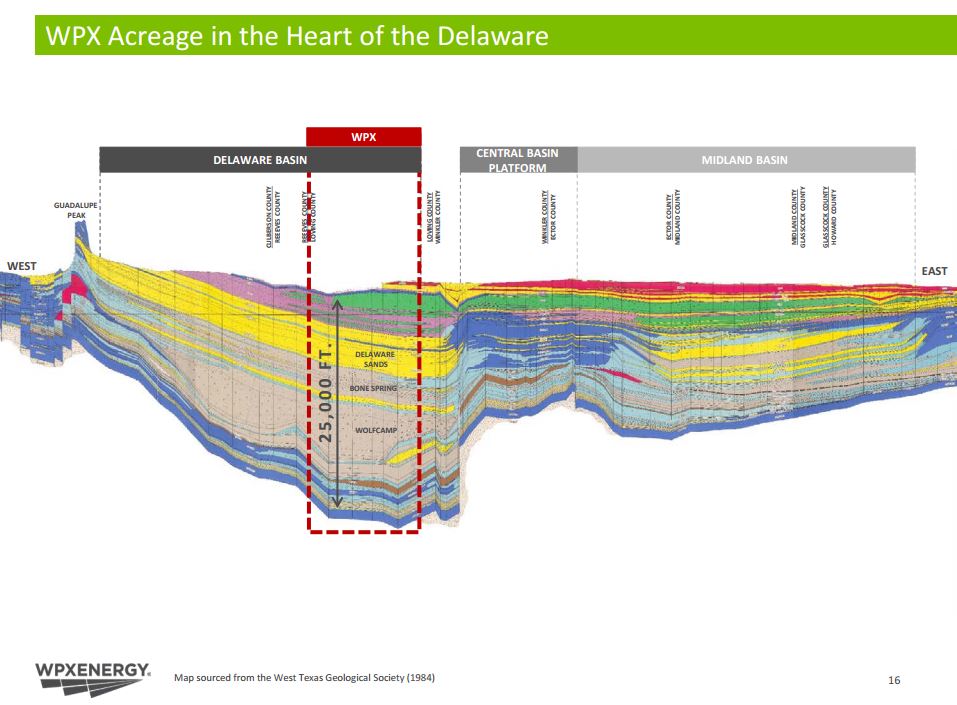

Last year, WPX announced a game-changing transaction to acquire assets in the core of the oil-rich Permian Basin with the purchase of RKI Exploration & Production, LLC. WPX’s position in the Permian’s Delaware Basin represents an estimated 1.1 billion barrels of equivalent net resource potential. The Delaware has numerous stacked pay reservoirs in a column that’s almost two miles deep with layers of rock stacked up, in plain speak, like a pile of pancakes.

“We have quickly amassed more than 100,000 net acres in the Delaware portion of the Permian and more than 5,500 gross drillable locations across stacked pay intervals. This represents decades of drilling opportunities,” WPX outlines on its website. The majority of the WPX holdings are in Loving County, Texas, and Eddy County, N.M. The assets have existing production from 10 of 13 prospective benches in the Delaware play.

WPX posted 2Q 2016 oil production averaging 41,900 barrels per day, and its total liquids volumes accounted for 60% of 2Q 2016 production.

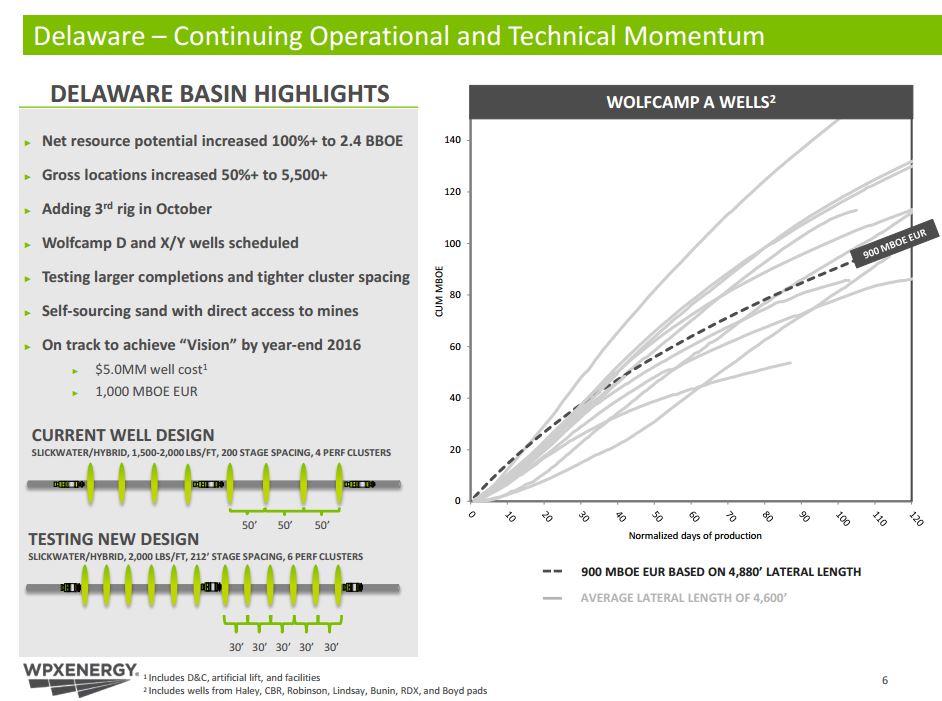

The company has increased EURs for its Delaware basin wells to 900 Mboe, which is up 34% from its acquisition type curve of 670 Mboe.

How are they doing it?

Much of that increase has sprung from the efforts of a new hire that WPX made in the spring of 2015 when Muncrief and his management team brought in a petroleum engineer by the name of Tom Hellman. Previously, Hellman had built a world of knowledge and experience working for Amoco, BP, Apache and others. His most recent stint was with Apache Corporation, where he served the company as manager of Completions and Production Optimization, then Director of Worldwide Completions, then Director of Horizontal Well Drilling and Completion Applications, and finally as Vice President of Operations—before joining WPX.

WPX published high expectations for Hellman: “Tom will be instrumental in driving more knowledge sharing, talent development, cross training, best practices and innovation at WPX.”

Spurred by the company’s consistent improvements to well economics and the drilling efficiencies it has been reporting, Oil & Gas 360® reached out to WPX to find out what exactly they are doing in the Permian, and top management sent us straight to the source: Tom Hellman.

An exclusive interview with WPX VP of Drilling and Completions Tom Hellman

Oil & Gas 360®: You joined WPX in April 2015. What opportunity set did you see at WPX that attracted you to the company?

Tom Hellman: From a high level perspective, I loved the idea that WPX was working through a transition that required both a cultural reset and help with their move to horizontal oil growth. Cultural in terms of bringing in an action- oriented approach and a sense of urgency to increasing their technical staff. This was something I admired about Apache. Rick [Muncrief-CEO] and Clay [Gaspar-COO] impressed me as well. It was immediately clear to me that they have the right mindset and ability to rebuild and take this company to the next level.

At ground level, WPX primarily was a vertical gas development company. They were a little late to the horizontal oil technical world because of their prolonged success drilling vertical wells in the Piceance. I saw this at other companies prior to 2008 that actually were caught outside the wave of horizontal activity. I believed a renewed D&C team could make a difference by applying many of the industry lessons learned working horizontal wells over the past several years.

OAG360: What one lesson did you learn at Apache that’s helped you overcome challenges or hurdles at WPX?

TH: One major difference between low cost vertical well projects and today’s horizontal well development is you have no choice but to accelerate the learning curve. We are consuming capital much faster, drilling our best acreage and continually resetting our assumptions. This cannot happen fast enough. So the D&C team and asset teams must have the ability to test and analyze results in real time.

OAG360: Let’s talk about the company’s ‘Vision’ wells, specifically in the Delaware Basin. What are you doing differently than the previous operator (RKI) during the drilling and completion phases that gives you confidence you can reach the company’s vision of 1 MMBOE EURs.

TH: First I’m happy to say two of my top engineers in my team came from RKI (one was from drilling and the other from completions) and they’ve really stepped up in our culture in WPX where we get the most out of everyone.

We all immediately agreed the objectives had to change. As the ex-RKI engineers would say, we had stuck to the same design and we were making good wells (due to the great rock) and delineating the acreage. But they were looking only a few wells out. Now we needed to see what’s possible…and leverage that upside across years and years of development.

The new objective is to truly harvest this rock for all it’s worth. Extend the laterals, dramatically increase frac volumes, and perforation coverage along the lateral. We also immediately redesigned the fracs so we could rebid everything and incorporate much larger volumes at lower costs. Despite increasing job size, we reduced completion costs by $1 million per well. And we identified multiple sand and frac chemical direct source options. We also have a long list of frac horsepower vendors that we like to work with.

OAG360: How much of the ‘Vision’ well goal is the rock, and how much is technology/frac design/WPX’s expertise?

TH: To me, phase one of achieving the VISION well goals is all about getting everything we can out of this tier-1 rock. It’s bringing together the best of everything. Starting with all the “first order” horizontal best practices – targeting, lateral isolation, pushing the limits on diversion thru more perf clusters. And the real magic isn’t a secret. But it’s rarely done to the extent that it needs to be done, even at the best competitors. Our horizontal expertise isn’t just about our individual experts – but expert integration. WPX is the perfect size for this – we all meet daily and mash thru each rig line – across three basins. Challenging each other and learning daily. There’s enough critical mass and transparency of performance that allows us to really get to the essence of what makes each play perform better.

OAG360: What are some of the biggest obstacles you’ve had to overcome in your pursuit of the ‘Vision’ wells?

TH: I will pick two. On the well performance/EUR side of the equation, we have a high class problem. That is to say, looking back at our Wolfcamp well results, it was difficult to clearly pick optimum landing zones. Not because poor landing zones were so poor, but because they were all quite good. The petrophysical and reservoir work needed to be integrated with the completion trials in order to sort out the sweet spot. We just have a lot of options. Obviously those are good problems to have.

On the cost side, I think the major obstacle has been managing the amount of optimization. This last year has been extraordinary. Vendors are getting incredibly competitive and efficient. Our casing designs have changed. And we’re also high-grading rigs and supervision in the field. In fact, we’re on our first multi-well pad with all of the upgrades at our disposal. And the cost saving and efficiencies are looking great as we start to make the most of the reps and well-to-well learnings.

OAG360: Your bio says you like to test new concepts, run pilot programs, step beyond the known and embrace prudent risk taking. How do you balance the pursuit of new technologies and processes with creating stable returns in this market?

TH: That’s a great question. First off, a huge luxury we have at WPX is depth in tier-1 acreage and low D&C costs. That means we can make great returns on pilot wells. For example, we can be bold in our field trials so we’re sure we see differential performance. And still fully expect to make good returns. It’s incredibly hard to manage an aggressive trial program if the base case doesn’t make money.

Second, the industry is still in the early innings of horizontal well efficiency so there’s a long list of methods and techniques to try. We need to focus our trials testing “good risk” with minimal downside and an opportunity to leverage the upside across a huge amount of wells. A great example of that is a new type of perf diversion we are trying. It’s cheap. Worst case is we make another good type curve well. But if it works…

OAG360: Talk a little about the trend for companies starting to source sand direct. WPX has been an early adopter of this practice. What benefits do you generate and where do you see the industry going with this? What do you look for in choosing a supplier?

TH: The benefits: first, the vendors are smart. They don’t bid their absolute lowest price. They bid to win the work. Meaning, if we can show we have the know-how to direct source, vendors bring us more competitive pricing right from the start. We’ve also have shown that our direct sourcing is as efficient as any other option. That’s incredibly important. My pitch to our vendors is simple: the company with the best cost structure and supply chain will get the work. Or bring us super frac horsepower pricing and we’ll handle the supply chain work for you. And once you are awarded the work, we’ll do everything we can to help you utilize your equipment to get a return on your money, too. Just the other day we helped our frac vendor in Williston to frac over 20 plug-n-perf frac stages in one day. That’s incredible. And that news travels fast. Vendors know that they can bid aggressively with us because we’ll work with them to get the work done efficiently.

Second, direct sourcing makes us smart too. We understand the market and pricing infinitely better because we have the hands-on know how. It helps us negotiate, react to pricing trends and customize our frac designs to make the most of market conditions on the fly.

OAG360: What technologies or processes will unlock the most value from Permian/Delaware players moving forward?

TH: The simple truth here is integration. Horizontal wells require an order of magnitude more integration than conventional well development. Seismic, petrophysics, frac design, well spacing, lateral placement – each element is separately evolving, and it’s critical to bring them together.

If I had to pick one element that could be a real surprise to the upside, it will be unlocking how we quickly understand optimum well spacing. There is some really brilliant work in this area. Our reservoir advisors are working with our subsurface managers. New methods could quickly help us optimize to the exact well spacing for each zone/well cost/oil price combination.

OAG360: Will there be a movement toward longer laterals in the Permian like we’ve seen in the Marcellus and the Utica?

TH: We have some great three-mile laterals in the Bakken, so our staff has great experience delivering longer laterals. I believe the industry will work together to help get more of the Permian land stitched together – we’ll make better returns with longer laterals.

OAG360: What is the “next big technology” out there for E&Ps – what’s coming in the future that you think could further change the economics for operators?

TH: We have some really talented people working very hard on the upside of enhanced oil recovery. There are new ideas that are just now being modelled for pilot tests to overcome some of the challenges of re-pressurizing tight hydraulically fractured reservoir rock.

It’s not crazy to think about increasing EURs by 5% (equal to another 150,000 barrels of oil per well) or a lot more substantially by going back to partially depleted reservoirs and pumping them back up with state-of-the-art techniques producing the additional oil at a fraction of the original well cost.

Some of the other technologies mentioned by Hellman include:

- Shale rock mechanics to assist in better lateral placement and frac coverage

- Automated geosteering

- Dissolvable plugs (no coil tubing clean-outs)

- Advancements in 3D seismic – converting seismic properties into rock mechanics – searching for sweet spots.