Planning in the supply chain: industry expects service costs to rise 10%-15%, but WPX has a firm handle on costs in the Permian

Everyone knew it would happen eventually: service costs are going on the rise. Halliburton (ticker: HAL) talked about it as early as July of 2016, and over the course of the EnerCom Dallas oil and gas investment conference we heard it again and again.

As activity continues to pick up on the drilling side of the equation, E&P companies need more services from the oilfield side of the industry. After two years of layoffs and slower drilling programs that will translate into more demand for fewer crews and less equipment, which is starting to play out in a 10%-15% expected increase in service costs for the coming year, according to a number of sources ranging from E&P decision makers to buyside and sellside analysts.

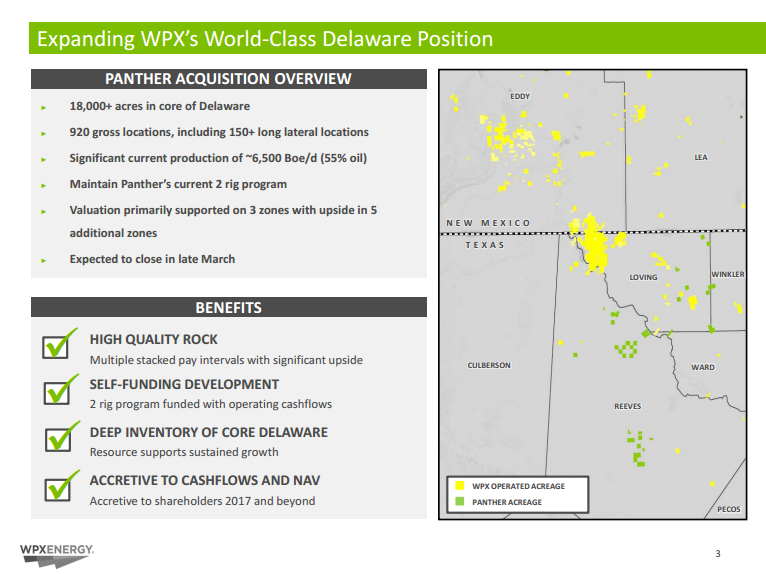

Nowhere is this becoming more apparent than in the Permian, where strong returns have attracted a rush of capital and drilling activity outpaces the next most active basin by 4.5 times, according to information from Baker Hughes Industries (ticker: BHI). Many companies had the forethought to plan ahead, though, and they intend to reap the rewards moving forward.

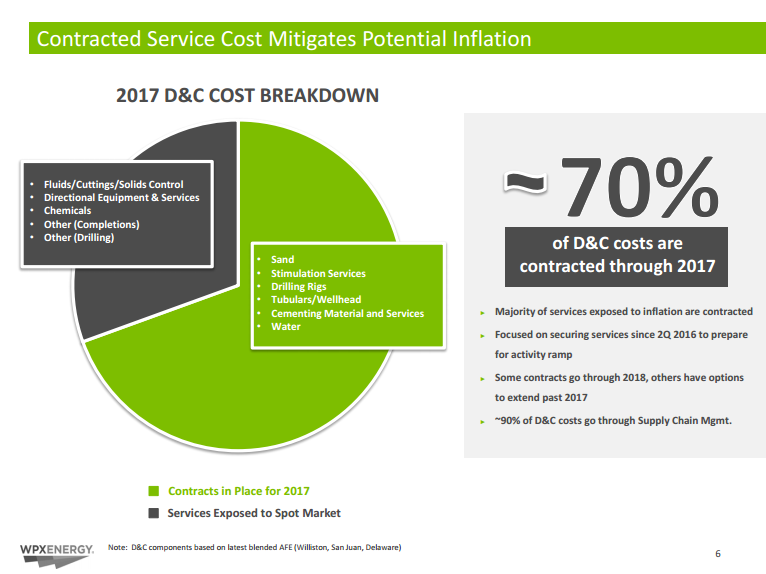

WPX Energy (ticker: WPX) operates in the Delaware Basin, right at the heart of the Permian, and the company has been able to contract approximately 70% of its drilling and completion costs through 2017, mitigating the company’s exposure to service cost inflation.

To better understand how WPX keeps its service costs in check in the most active oilfield in the U.S., Oil & Gas 360® spoke with WPX Director of E&P Services Alan Killion about the company’s supply chain management.

WPX Energy offers insight into what it takes to manage costs in the Permian Basin

“WPX has been proactive over the past year to work with the service providers on longer-term partnerships that are shielding WPX from the brisk pace of inflation,” said Killion. “Our goals are to find partners who want to grow with WPX long-term. Contracting with those companies requires an understanding of not only the current marketplace but also an alignment of goals.”

At WPX, Killion’s group specializes in contracts, negotiating, analytics and technical aspects, such as understanding the pipe market all the way back to the mill, according to WPX. Killion’s experience as both a production engineer and trader for Occidental Petroleum (ticker: OXY) before moving into his role at WPX made him the right fit to understand markets and develop those partnerships.

“The environment at WPX is an advantage because there’s so much emphasis on planning and forecasting. Since things are more predictable, we can make more of an impact,” said Killion.”

Stimulation services and sand look to be the most pressing matters for now

“The stimulation side of the business has seen the most constraint in the supply chain. As we know from economics, anytime there’s a constraint in an area we tend to see inflationary dynamics,” explained Killion.

“Pressure pumping crews are in short supply. We estimate that the market is approximately at a 95% utilization rate. Until future crews hit the market, pricing in the marketplace will be pressured. We have seen the pressure pumping market increase approximately 250% to 300% for horsepower since Q4 2016. As companies continue to add crews some of the price inflation will start to subside.”

Sand will also continue to be a source of cost inflation for many companies moving forward. “Current sand capacity is listed at 110 million tons per year. In 2016, demand was approximately 40 million tons per year. 2017 projections are around 50 million tons per year, with 2018 pushing more toward 80 million tons,” said Killion, but those numbers include all types of sand, not just the fine sand that is in high demand for the increasingly intense frac jobs completed across the United States.

Sand has seen 75%-100% inflation since late 2016

“With this move to finer sand types, longer laterals and higher proppant concentrations, the sand market has experienced inflation of 75%-100% since late in 2016,” said Killion. “We see the same dynamics starting to occur in the OCTG (Oil Country Tubular Goods) market as well.”

Because of the increasing demand in those particular areas, WPX worked to ensure that it would have long-term contracts to mitigate as much inflation as possible, explained Killion. “WPX has hydraulic horsepower and frac sand contracts in place into 2018.”

Killion and his team expect to see similar increases in service cost across all basins, as well. “We have seen the inflation agnostic to basins at this time. As frac crews and frac sand is somewhat fungible, these services try to migrate toward the most active basins when possible,” he explained.

Don’t discount continued improvements in efficiency

Many E&P companies are already including the 10%-15% increase in service costs in their forward-looking projections, but that does not mean that drilling and completion costs will rise in lock-step with price inflation. Companies continue to improve their drilling designs and increase the speed at which they can drill higher-performing wells.

“It is somewhat difficult to say [what a 10% to 15% increase in service costs would mean for well economics] because each basin and each formation holds different economics, but it could wind up being a wash when you think about how much better we’re getting on the performance side,” said Killion. “The industry continues to find ways to drill and complete wells that yield reduced drill times and increased EURs.

“WPX continues to set the bar higher on each of these fronts.

“Last year we raised EURs in all three of our basins. And we completed a 16-day well in the Permian, and we’re still in the early learning phase. We also reduced drilling times in the Bakken by 5 days from 2015 to 2016. We have seen approximately 10% to 15% increase in the number of stages our stimulation partners can frac in a single day. These improvements should offset inflation at a minimum,” he said.

It’s all about communication and credibility

Successfully finding the sweet spot between supply chain management, operations and vendors will help Killion and his team continue to improve WPX’s supply chain moving forward, he explained.

“The two most critical pieces to making everything work are the 2 Cs – communication and credibility,” said Killion. “That ongoing, open dialogue is paramount, and the supply chain management team has to be credible and earn the trust of operations. We are not the tail wagging the dog. Our role is to support our asset teams and their business objectives. We make recommendations. They make decisions.”