Davis merger improves Yuma’s liquidity, reserves, and daily production

Houston-based Yuma Energy (ticker: YUMA) and privately held Davis Petroleum Acquisition Corp. jointly announced today that the merger of the two companies was approved by shareholders and completed. Davis will become a wholly-owned subsidiary of Yuma following the all-stock transaction, although Davis shareholders will control 61.1% of the combined company, with Yuma shareholders owning the remaining 38.9% of the company.

The combination will increase Yuma’s proved reserves by approximately 4.8 MMBOE, and more than double the company’s daily production by 1.8 MBOPD, according to a presentation that accompanied the merger. Yuma expects $9 million of annual savings at the midpoint of its estimate on synergies following the deal.

In connection with the Davis merger, Yuma announced that it has entered into a credit agreement with SG Americas Securities LLC for a $75 million 3-year revolving credit facility. The initial borrowing base on the facility will be $44 million, and is subject to redetermination on January 1, 2017, as well as April 1 and October 1 of each year.

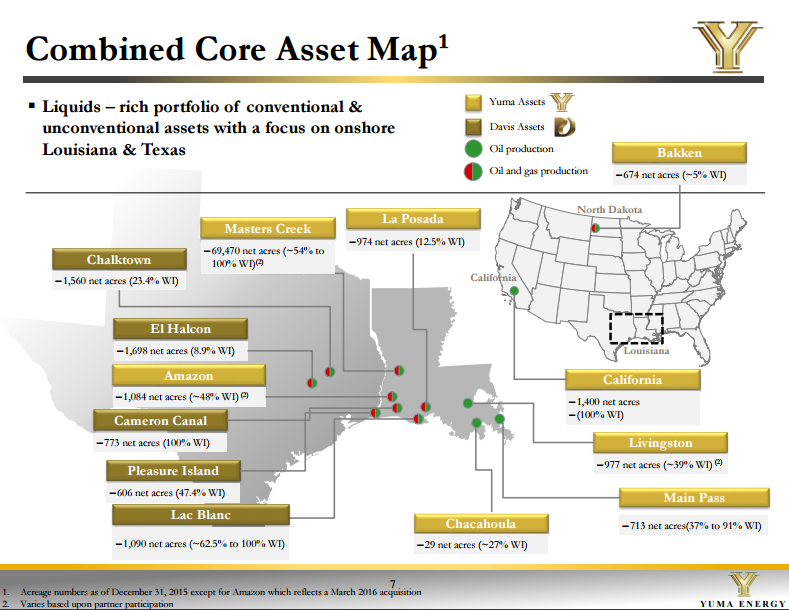

The company’s new revolving credit facility will strengthen its balance sheet and improve liquidity. Yuma plans to use its stronger finical position to pursue near-term growth by investing in “low risk, low cost, high ROR projects,” and to actively pursue more M&A deals, it said in the presentation. The focus of potential future M&A deals will be in the Louisiana and Texas Gulf Coast where the company already has experience operating, Yuma said.

As part of the transaction, Yuma reincorporated from California into Delaware, converted each share of its existing Series A Preferred Stock into 35 shares of common stock and implemented a 1-for-20 reverse split of its common stock. Also, in the merger, Yuma issued approximately 1.75 million shares of a new Series D Preferred Stock to former Davis preferred stockholders, which has a conversion price of approximately $11.074 per share, with a liquidation preference of approximately $19.4 million. The Series D Preferred Stock will be paid dividends in the form of additional shares of Series D Preferred Stock at a rate of 7% per annum. The merger is being treated as a tax-deferred reorganization under Section 368(a) of the Internal Revenue Code.

Yuma’s newly constituted board of directors will consist of Richard K. Stoneburner (non-executive Chairman), Sam L. Banks, James W. Christmas, Frank A. Lodzinski, and new directors Stuart E. Davies, Neeraj Mital and J. Christopher Teets. Sam Banks, Paul McKinney and James Jacobs will retain their positions as CEO and chairman of the board, EVP and COO, and CFO, respectively.