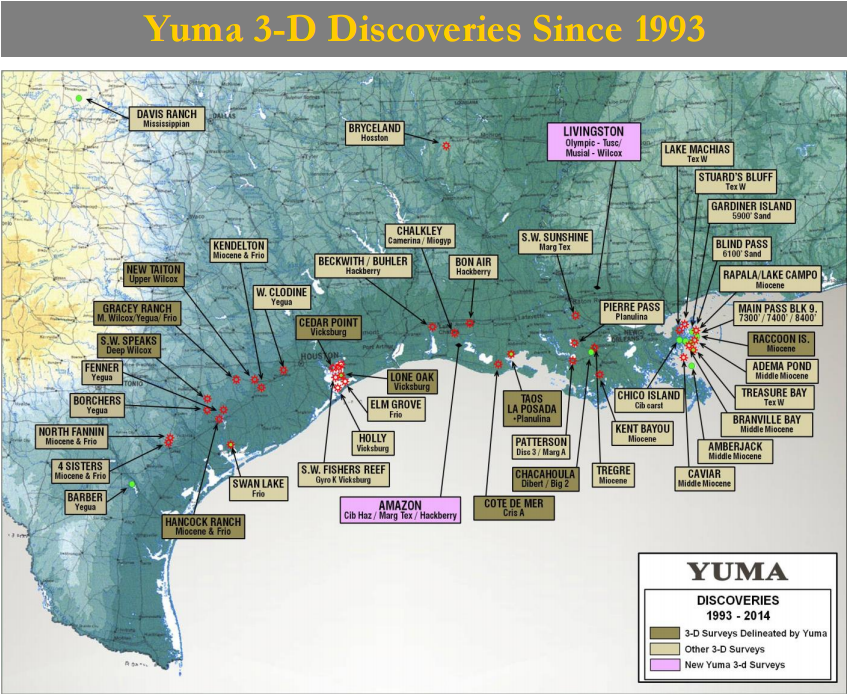

Exploration drilling success rate of 78% on its 3-D projects

Yuma Energy (ticker: YUMA) is one of the companies leading the technological approach on the exploration front of the oil and gas industry. Since its predecessor was founded in 1983, the company has amassed more than 75,000 net leasehold acres in three different states and has partnered with some of the top E&Ps in the industry to develop their discoveries. Yuma employs a 3-D seismic-based strategy to establish prospects in onshore liquids-rich projects and high impact deep onshore prospects. The Company also has substantial focus on unconventional oil plays.

“One of the things we’re known for is being able to generate quality prospects and collaborate with industry partners,” said Jay Jacobs, Vice President of Corporate and Business Development for Yuma Energy, in an interview with Oil & Gas 360®.

Yuma’s Portfolio

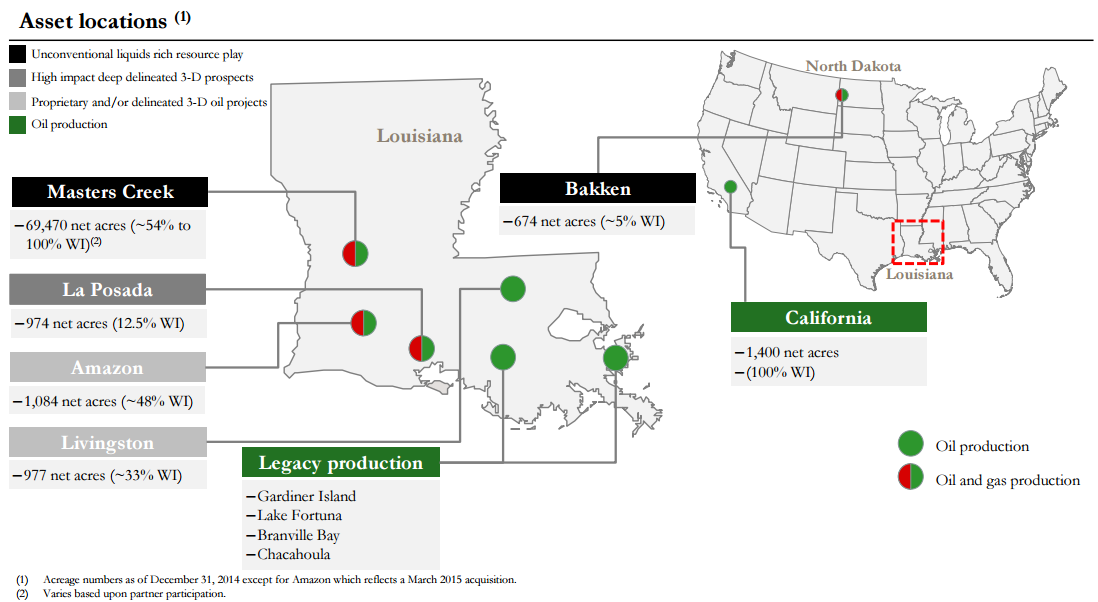

Yuma’s core operations are focused primarily in Louisiana onshore development, along with interests in California and North Dakota. Production in Q1’15 averaged about 1,774 BOEPD and its total proved reserves are 19.9 MMBOE, according to an independent study by Netherland, Sewell & Associates. Approximately 70% of its reserves are liquids, while the production mix was an even 50/50 split between liquids and gas in its latest quarterly report.

Yuma Energy uses a balanced portfolio approach with a mix of high impact opportunities and lower risk development wells. The scale of its working interest varies by each prospect, as the company aims to retain a high percentage of its development projects while promoting and partnering a piece of its working interest on its higher risk exploration prospects.

A Louisiana Mainstay

Yuma’s exploration expertise has generated approximately 225 total prospects dating back to its beginning in 1983, and has partnered with industry household names like ConocoPhillips (ticker: COP), Petrohawk (ticker: HAWK), Energy XXI (ticker: EXXI), Carrizo (ticker: CRZO), Hess Corporation (ticker: HES), Occidental Petroleum (ticker: OXY) and PetroQuest Energy (ticker: PQ). Yuma itself carries an exploration drilling success rate of 78% on its 3-D projects.

“Our success starts with our geophysical team. Point in fact you can look at the 78% 3-D drilling success rate we’ve had in the Gulf Coast since 1993,” said Jacobs. “Our ability to organically generate prospects is what sets us apart from many of the other E&P companies.”

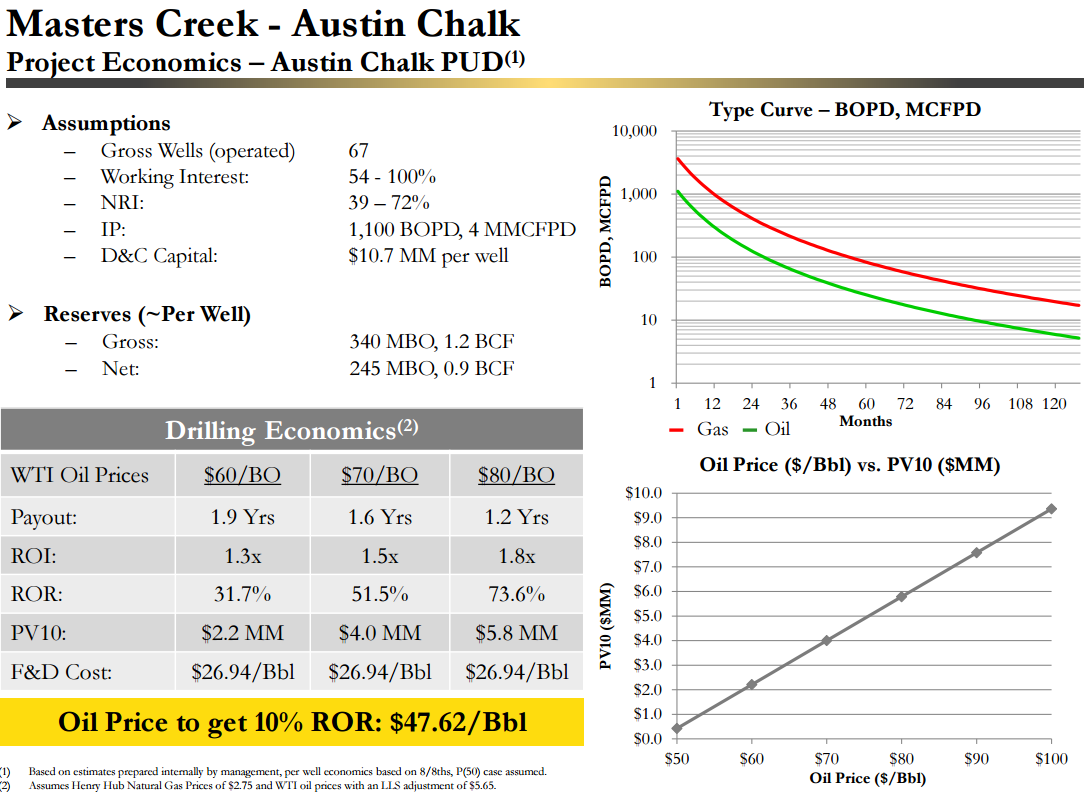

Its strategy in the region revolves primarily around discovering 3-D conventional opportunities and entering unconventional prospects at a low cost. The Masters Creek – Austin Chalk position is its top asset by reserves and wells there are estimated to have ultimate recoveries of 500 to 600 MBOE. Yuma’s footprint spans 99,721 gross (69,470 net) acres and is supported by existing infrastructure and premiums to current West Texas Intermediate prices.

The creation of a joint interest partnership is a near-term priority and can be used to accelerate development in the region.

Yuma also holds a 12.5% working interest in La Posada (i.e. “La Cantera”), a high impact deep producing asset operated by PetroQuest in Vermilion Parish. The Bayou Herbert field was one of the top 20 fields in all of Louisiana in 2013 and produced on average over 8.5 Bcf per well throughout the course of 2013.

In the latest quarter, Yuma successfully drilled its Anaconda prospect (45% working interest) in its Amazon 3-D shoot and expects the well to be turned to sales in Q2’15. The prospect encountered a total of 90 feet of pay in six different sands. In addition, production improvements from its core areas was a focal point in the latest quarter and Yuma management believes the work performed will yield positive benefits going forward.

Additional Interests

Its California assets, acquired from Pyramid Energy in a merger that closed in September 2014, are purely conventional and 100% operated by Yuma. Drilling and completion costs per well are minimal (no more than $1.5 million) and carry estimated net reserves of 144 MBO. Yuma believes six gross wells can be drilled on its existing acreage, not including possible recompletions and comingling opportunities.

Yuma’s stake in North Dakota includes a 5% working interest in 18,553 gross acres targeting the Bakken/Three Forks formations. The company believes approximately 140 drilling locations remain and holds partnerships with respected operators like Emerald Oil (ticker: EOX) and Zavanna, LLC.

In Yuma’s Q1’15 release, Sam Banks, President and Chief Executive Officer, acknowledged an uptick in acquisition opportunities, and his company is an active player in the market. “We are optimistic about finding an accretive opportunity in this low commodity priced environment that will be cash flow positive to the company,” he said. “We believe we have put together the right team to successfully develop our significant inventory of diversified assets and grow the company.”

Q1’15 Results

According to its Q1’15 report released on May 15, 2015, Yuma completed the first quarter of 2015 with $70.1 million in book equity. At this time of writing, its debt-to-market-cap percentage is 47%. The 88 companies listed in EnerCom’s E&P Weekly Benchmarking report carry a median debt-to-market-cap percentage of 63%, while the majority of micro-cap companies are much higher at a clip of 248%.

The company held approximately $17.6 million in liquidity for the period ended March 31, 2015, assuming its approved borrowing base of $36.0 million. Yuma management says it plans to use its liquidity, along with ongoing cash flow, to satisfy future capital expenditures.

A Yuma Energy company profile with financial data, reserve history and operational metrics, prepared by EnerCom Analytics, may be accessed here as a PDF download.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.