20-year contracts already set for 96% of capacity

Atlantic Coast Pipeline LLC (ACP), a joint venture between Dominion Resources (ticker: D), Duke Energy (ticker: DUK), Piedmont Natural Gas (ticker: PNY) and AGL Resources (ticker: GAS), filed with the Federal Energy Regulatory Commission (FERC) for the construction of its 564-mile pipeline that would supply natural gas to Virginia and North Carolina. The main portion of the project would be a 42-inch wide pipeline running from Harrison County, West Virginia, run to Greensville County, Virginia, and then south into North Carolina through a 36-inch pipeline, according to ACP. ACP also plans to include a connected 20-inch lateral to bring additional supplies to Hampton Roads, and two 16-inch laterals that will connect to two Dominion Virginia Power electric generating facilities in Brunswick and Greensville Counties.

The paperwork filed with the FERC last Friday put the estimated cost at $5.1 billion for the 1.5 billion cubic feet per day (Bcf/d) pipeline, which will be supplied by production from the Utica and Marcellus. Both the price and the length of the pipeline were increased in the recent filings, up from $4.5 billion and 550 miles, respectively, reports the Charlotte Business Journal. The primary cause for the increase in both cases was the decision to reroute the pipeline along an existing right of way.

According to Atlantic Coast Pipeline’s FERC application, the project already has 20-year contracts for 96% of its 1.5 Bcf/d capacity with Duke Energy Carolinas and Duke Energy Progress, which combined will be the pipeline’s largest customer, as well as Dominion, Piedmont, AGL and PSNC Energy.

Atlantic Coast Pipeline will create 2,200 permanent jobs, according to independent study

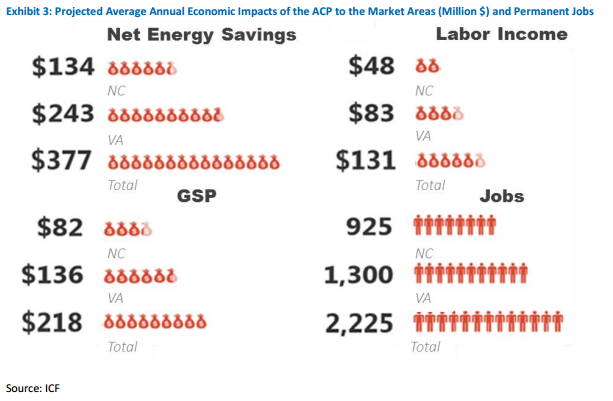

An independent study conducted by IFC International for Dominion Resources, has forcast that the ACP will bring significant economic benefits to Virginia and North Carolina. IFC ran projections from the pipelines expected in-service date of 2019 to 2038, and found that the net annual average energy cost savings for the two markets would be over $377 million dollars – $243 million in Virginia, and $134 million in North Carolina.

IFC’s study predicts that the “consumer cost savings to households and businesses in Virginia and North Carolina will also trigger stimulus effects that create jobs, boost labor income, and grow the state economies.” IFC believes the economic activity associated with Atlantic Coast Pipeline enabled energy cost savings will create over 2,200 permanent full-time jobs, $131 million in annual labor income, and $218 million in annual gross state product (GSP) to the two states over the 20-year period.

The large job figure comes from businesses being able to reinvest their energy savings in growth, once an abundant supply of affordable natural gas is assured.

A study done on the project in 2014 by Chmura Economics & Analytics, estimated the one-time construction activity of the ACP could inject an annual average of $456.3 million into the economics of the Atlantic Coast Pipeline project’s three states, supporting 2,873 annual jobs in the region from 2014 to 2019.

“The ACP will enhance overall energy reliability in the region, bringing natural gas that will heat homes and power businesses, support thousands of jobs and promote lower energy prices and economic development,” said Diane Leopold, president of Dominion Energy. “It will be used to fuel a new generation of efficient power stations being built to achieve future federal and state environmental regulations.”

Infrastructure shortage

A separate study conducted by IFC estimated that $313 billion of infrastructure investment is needed by 2035 to keep pace with growing domestic natural gas operations. The Northeast, in particular, has suffered from the lack of midstream assets in the region. Due to the lack of optionality for transporting natural gas to the Northeast, the region is susceptible to high prices, particularly in cold months. In January 2014, for example, stalled operations and frozen pipelines sent spot prices at a northeastern hub to $123.63/MMBtu.

Kinder Morgan (ticker: KMI) also commissioned IFC to show the benefits of its Northeast Energy Direct project, which would deliver 1.3 Bcf/d to northeast markets, saving a projected $2.1 billion annually in wholesale electricity costs from 2019 to 2028.

Opposition voices concern over environmental issues

The decision to reroute the pipeline to its longer route was made to alleviate concerns in Nelson County, Virginia, but many remain concerned about the environmental impact the pipeline could have in the area. Last month, neighborhood groups in Nelson issued a report they commissioned from the Center for Urban Habitats, which contends that even the altered route through Nelson County would threaten several rare species of plants and animals in the area’s wetlands.

“If you open this canopy up and now the sun comes through here and it dries this all up all year round, well it’s not a wetland anymore, and all these species die,” Randy Whiting of Horizons Village told a local television station. “The pipeline basically hits dead center in the wetlands area.”

The groups have filed with FERC to voice their concerns. ACP will have to demonstrate to FERC that the project can avoid or mitigate environmental issues in order to receive a positive Environmental Impact Statement from the regulatory body. The draft impact statement is the next step in the process, and is expected to be issued in early 2016. There will be a comment period following the release of the draft, and then a finial statement issued in the spring.

Piedmont spokesman David Trusty says ACP hopes to receive its construction permit soon after the statement is finalized.