Blackbird Energy (ticker: BBI) announced today that it has successfully drilled, logged and cased its third well at Elmworth, in the Montney, located at 2-20-70-7W6 (the “2-20” well). Blackbird has a 100% working interest in the 2-20 well, as it does in its other two wells, the 6-26 and the 5-26.

The 2-20 well drill program included the drilling of a vertical pilot well from surface location 10-8-70-7W6 to a vertical depth of 2,582 meters. The vertical pilot well was then logged using state of the art logging technology, from surface to the bottom of the Lower Montney. Upon completion of logging operations, Blackbird drilled a horizontal leg of approximately 2,000 meters targeting the Middle Montney formation to downhole location 2-20-70-7W6. The total measured depth of the 2-20 well is 4,660 meters.

The 2-20 well was spud on September 24, 2015 and drilling operations were completed in 32 days from spud to rig release, including 8 days to drill and log the vertical pilot well. The company’s 6-26 well took 49 days from spud-to-rig release, representing a 35% decrease in the amount of time needed to drill the 2-20 well.

During EnerCom’s The Oil & Gas Conference 20® (TOGC20), Blackbird CEO Garth Braun said he was able to secure the rig for approximately 36% less than its typical day-rate, which also reduced costs. “We were able to secure the rig for about $16,000 per day, as opposed to $25,000 per day.”

Innovation drives long-term value – Garth Braun, CEO Blackbird

During TOGC20, Blackbird CEO Garth Braun said that he would like to see the company drill its third well and make the shift towards production over the course of the next year. Oil & Gas 360® spoke with Braun about the company’s 2-20 well, following the announcement today, and asked where the company is setting its sights next.

“We have a line of sight on infrastructure, and we believe that will happen in the first half of next year,” Braun said, “but what is really important about the 2-20 well is the innovation involved.”

Blackbird’s 2-20 well is the first monobore Montney well in Elmworth/Gold Creek Corridor, a decision that saved the company approximately $500,000 in drilling costs, according to Blackbird. Including the pilot well, the 2-20 cost $3.52 million to drill. Excluding the pilot well, the actual cost on the 2-20 was $2.81 million, 49% less than the company’s 6-26 well, which cost $5.55 million.

Blackbird is planning to complete the 2-20 well using sliding sleeve hydraulic fracturing technology run on coiled tubing. The completion will consist of 71 individual foam fracs over the horizontal length of approximately 2,000 meters. Subsequent to completion operations, the 2-20 well will be production tested. The company expects to announce results from the 2-20 production test in January 2016.

The use of foam versus slickwater will allow the company to reduce its water disposal and reduce the associated costs involved, Blackbird said in a release.

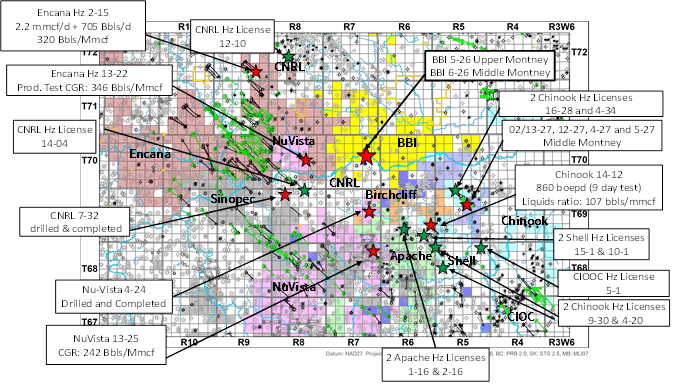

Blackbird holds 81 sections in the liquids-rich Montney, which it has built up at a cost of approximately $85,000 per section, much lower than some of its neighbors. NuVista Energy (ticker: NVA) purchased 12.5 sections located two and a half miles from Blackbird’s acreage for approximately $2.9 million per section.

The 6-26 well, which targeted the Middle Montney, tested at over 130 barrels of condensate per million cubic feet of gas (bbls/mmcf) and the 5-26 well, which targeted the Upper Montney, tested at over 340 bbls/mmcf, according to the company. The play has been further delineated by companies including Encana (ticker: ECA) which drilled a well west of Blackbird’s position that tested at over 346 bbls/mmcf, Braun said at TOGC20.

Braun told OAG360® that Blackbird plans to continue driving innovation in the Montney. “In a time of price compression, it is easy to get drilling costs down, but we’ve focused on long-term innovation [in drilling the 2-20 well]. That’s what creates long-term value.”