Mountaintop removal makes up most of West Virginia’s surface production

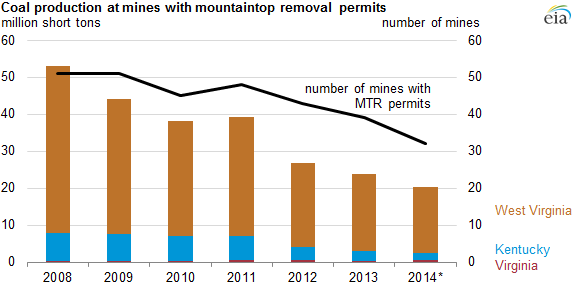

Coal production from the use of mountaintop removal (MTR) has declined by 62% since 2008, according to information from the Energy Information Administration (EIA). Total U.S. coal production was down just 15% from 2008 to 2014, while coal mined through surface production methods, which includes MTR, was down 21% in the same time period.

Total U.S. coal production includes both surface and underground mining activity. Surface mining includes contour strip, area, open pit and MTR. In mountaintop removal, coal seams running through the upper portion of a mountain are mined by removing all of the overlying rock and soil.

The EIA’s calculations are based off the number of permits received by companies to conduct MTR operations, but do not show the actual tonnage of coal production from the process. Because of those limitations, the EIA’s information represents just the upper bound of MTR production.

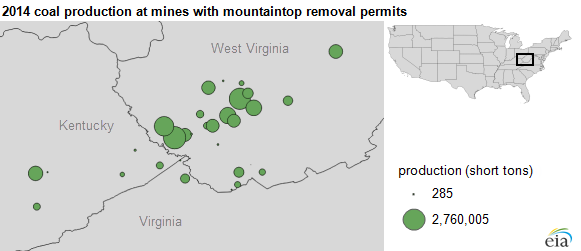

MTR is prevalent in the Central Appalachia, especially in West Virginia, Kentucky, Virginia and, in the past, Tennessee. While not outright banned in Tennessee, legislation passed in the state in 2013 prevents specific coal mining operations more than 2,000 feet above sea level, effectively ending MTR operations in the state. No new MTR permits have been issued in Tennessee since 2007.

West Virginia accounts for most domestic MTR production, with mountaintop removal making up 61% of the state’s surface production in 2013.

Coal Production Sliding

MTR production is not the only facet of coal losing ground in the energy production race. Coal in general is continuously losing market share to, most specifically, natural gas and renewables.

In the EIA’s 2015 Annual Energy Outlook, U.S. coal production in 2013 fell below one billion short tons of output for the first time in two decades. 2013 numbers declined by 3.1% on a year-over-year basis. On a forecast basis, coal production is expected to rise in line with increased worldwide energy demand, but the reports do not take into account the proposed Clean Power Plan from the Environmental Protection Agency (EPA).

If the Plan is implemented, EIA analysis predicts that levels of coal production will fall to levels last seen in the late 1970’s, with coal production in the West being particularly hard-hit. In all cases, production recovers by 2040, but never reaches the same levels as the EIA forecasts without the Clean Power Plan.

The North American Electric Reliability Corporation published the findings from its new grid reliability study, reporting that the EPA’s Clean Power Plan would require a “transformative shift” in energy infrastructure to meet the EPA goals, which calls for a 30% reduction in carbon emissions from power plants by 2030.