Expects 2015 Net Debt to be Reduced by $3.0 Billion – 50% higher than expected.

Calgary-based Encana Corporation (ticker: ECA) is leaving behind its second United States shale play since August, selling its Denver Julesburg assets for $900 million. The company is just six weeks removed from selling the entirety of its Haynesville acreage for $850 million. The aggressive divestures are part of an ongoing process to strengthen its balance sheet and narrow the operational focus to its four core areas.

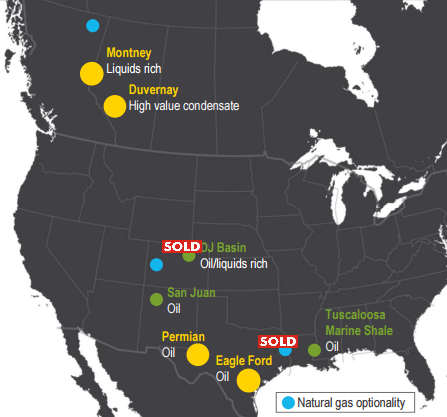

Moving forward, ECA’s plans are centered on the Permian and Eagle Ford basins of the United States, along with the Duvernay and Montney of Alberta, Canada. The core group produced 257 MBOEPD in Q2’15 and are in line to receive 80% of ECA’s 2015 capital budget.

Encana will have divested $2.7 billion worth of assets once its DJ sale is closed in Q4’15, and management it will ultimately reduce net debt by approximately $3.0 billion in 2015 – up from a previous estimate of $2.0 billion. A 50% midstream stake in its Montney asset was also divested earlier this year for CN$461 million.

Encana will have divested $2.7 billion worth of assets once its DJ sale is closed in Q4’15, and management it will ultimately reduce net debt by approximately $3.0 billion in 2015 – up from a previous estimate of $2.0 billion. A 50% midstream stake in its Montney asset was also divested earlier this year for CN$461 million.

DJ Basin Review

ECA’s DJ Basin position spanned 51,000 net acres and produced an average of roughly 23.4 MBOEPD (63% liquids) in H1’15. Proved reserves, as of year-end 2014, totaled 96.8 MMBOE (about 60% liquids). Extensive comments on the asset, however, have been few and far between.

“The DJ is a very solid asset with good returns in today’s environment,” said Doug Suttles, President and Chief Executive Officer of Encana, in the company’s Q2’15 conference call. “We’ve got a great track record there… In fact, I think one of the consulting houses not too long ago actually issued a report saying we had the most economic wells in the play.”

Company presentations for the majority of 2015 have focused exclusively on ECA’s four core plays, and production from its other assets are not even included in company volumes. Its remaining assets, upon closing of the Haynesville and DJ Basin divestures, exist in the San Juan Basin and Tuscaloosa Marine Shale. Global Hunter Securities speculated the San Juan and DJ were “on the chopping block” a few months ago after the Haynesville announcement.

ECA’s Divesture Gameplan

The DJ Basin transaction has an effective date of April 1, 2015, implying that a considerable amount of time went into finalizing the deal. Suttles touched briefly on the company’s sales process in the company’s Q2’15 conference call. “We actually never think it’s wise to announce these things, either specific targets or asset sales,” he said. “Clearly, if we do something, we’ll announce it at the time we do.”