Canada’s Fortis acquires largest independent pure-play electric transmission company in the U.S.

Fortis Inc. (ticker: FTS, FortisINC.com) announced today that it will acquire ITC Holdings Corp. for total consideration of $11.3 billion. Under the terms of the deal, ITC shareholders will receive $22.57 in cash and 0.752 Fortis shares for each ITC share, valuing each share of ITC at about $44.90 based on Fortis’ closing price Monday. In addition to the cash and stocks, which combined equal about $6.9 billion, Fortis will also assume $4.4 billion of ITC’s debt, according to a company press release.

The per-share consideration represents a 33% premium to the unaffected closing share price on November 27, 2015 and a 37% premium to the 30-day average unaffected share price prior to November 27, 2015. Pro forma, ITC shareholders will own approximately 27% of the combined company. Fortis said it plans to retain all of ITC’s employees.

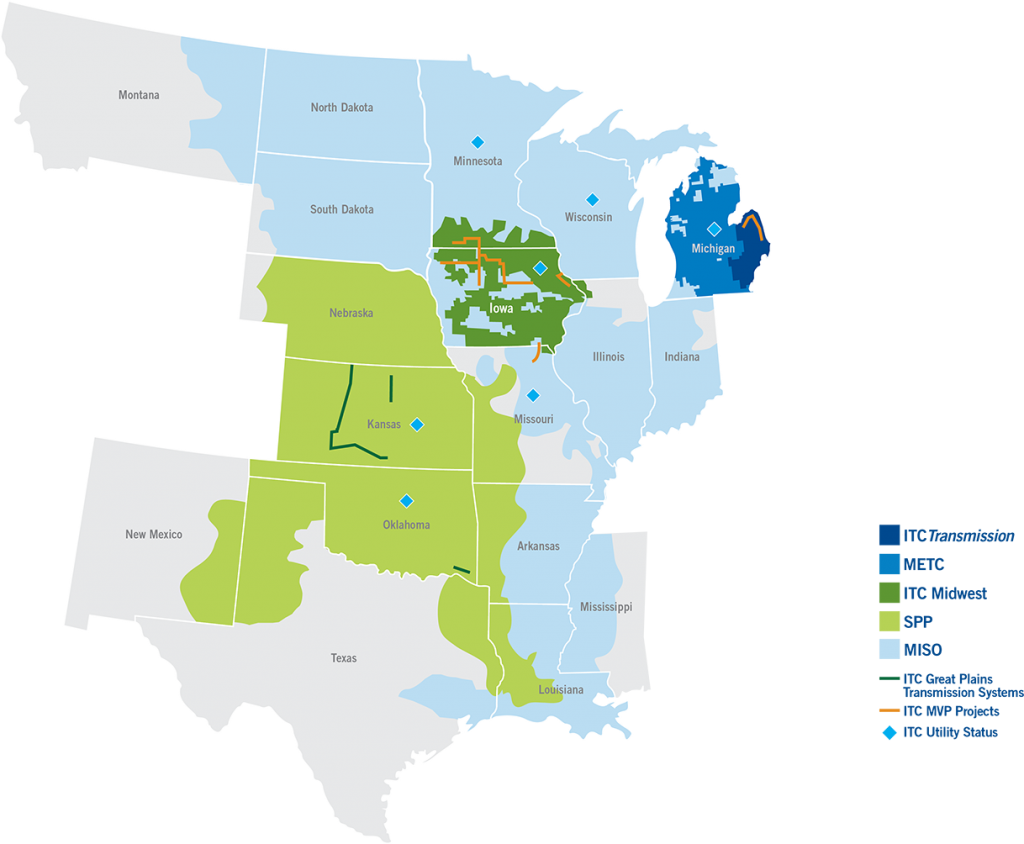

ITC is the largest independent pure-play electric transmission company in the U.S., giving Newfoundland-based Fortis a significantly increased footprint in the United States. On a pro forma basis, the consolidated mid-year 2016 rate base of Fortis would increase by approximately $6 billion to about $18 billion.

Fortis anticipates a 5% earnings per common share accretion in the first full year following the closing of the deal, excluding the one-time acquisition-related expenses. The company is targeting a 6% average annual dividend growth rate through the end of the decade.

The boards of both companies have approved the deal, but regulatory and shareholder approvals are still required. Fortis expects the deal to close in late 2016.

Originally a unit of DTE Energy Co. (ticker: DTE, DTEEnergy.com), ITC was sold in 2003 for approximately $610 million to a group that included New York private equity firms KKR& Co. and Trimaran Capital Partners LLC., reports The Wall Street Journal.