Capital will be raised in Five Tranches

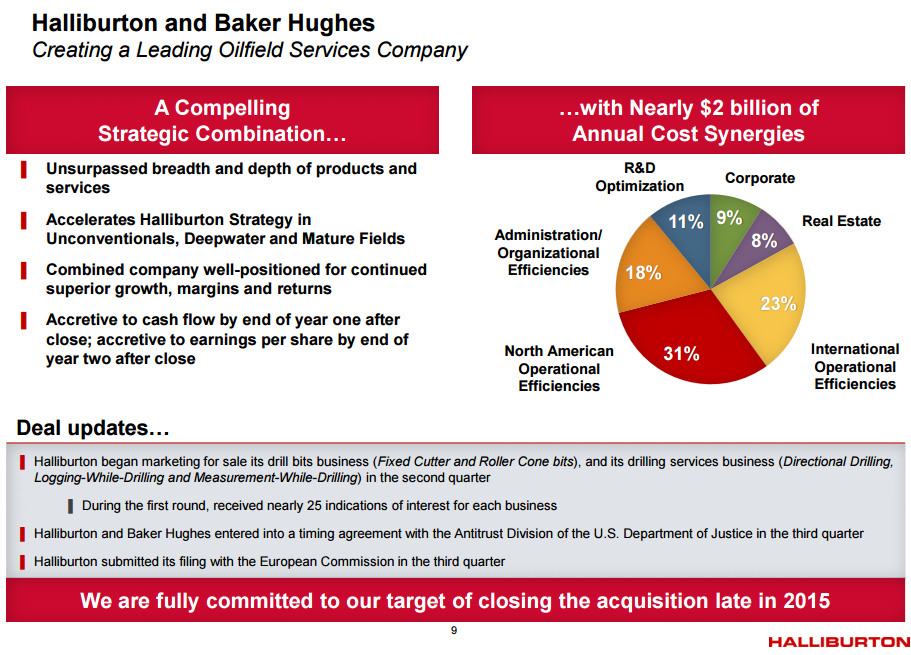

Advocates for the highly scrutinized merger between Halliburton (ticker: HAL) and Baker Hughes (ticker: BHI) possibly received the most positive news to date in a news release issued on November 5, 2015.

Halliburton, the world’s second largest oilservice provider by market capitalization, will issue a total of $7.5 billion in senior notes to “[finance] a portion of the cash consideration component” associated with the BHI merger. The note breakdown includes:

| Amount (Billion) | Length (Years) | Interest (Fixed Rate) | Mature Date |

| $1.25 | 5 | 2.70% | 11/15/2020 |

| $1.25 | 7 | 3.375% | 11/15/2022 |

| $2.00 | 10 | 3.80% | 11/15/2025 |

| $1.00 | 20 | 4.85% | 11/15/2035 |

| $2.00 | 30 | 5.00% | 11/15/2045 |

The offering is expected to close on November 13, 2015. If the merger is ultimately unsuccessful, HAL will use the proceeds from the last three notes listed above for general corporate purposes. The other two notes will be subject to a special mandatory redemption.

According to the terms of the original $34.6 billion deal, the payment would consist of about 76% stock and 24% cash, equating to about 1.12 HAL shares and $19 cash for each BHI share. Cash considerations amount to approximately $8.3 billion.

Light at the End of the Tunnel?

Investors and analyst firms alike have become increasingly wary of the HAL/BHI deal clearing the numerous regulatory hurdles. Halliburton, meanwhile, has remained adamant that the deal will be completed before year-end, with the possibility of a slight extension into the early months of 2016.

Jefferies Group LLC paid little attention to HAL’s claims, saying yesterday that the deal held only a 15% probability of being approved. The latest equity raise prompted optimism from Barclays in a research note, saying, “While some investor angst is to be expected as a number of opened-ended questions remained unanswered, particularly as we close in on year end, there has been no real evidence that suggests this deal still won’t be consummated.”

Timelines Looming

Halliburton will receive some big news just before Christmas, with the U.S. Department of Justice scheduled to release their review no later than December 15. Regulators in Australia plan to reach a conclusion no later than December 17. The European Commission, meanwhile, it awaiting HAL to address a multitude of data required for a final determination. The Barclays note explains the European Commission process is “not as streamlined” as the U.S. review and companies generally tend to underestimate the amount of data required.

Halliburton intends on selling as much as $10 billion in assets to meet antitrust demands, and roughly $3.5 billion has been sold to date. The New York Post reported in September that HAL may have to sell $7.5 billion of assets to a single buyer, based on a determination from the U.S. Department of Justice.