The Delaware Basin is becoming an increasingly attractive asset, but takeaway could become an issue

The Delaware Basin has become an extremely sought after asset since the decline of oil prices that began in 2014. Even at $50 oil, many operators feel the area offers good returns, and they’re willing to pay for them.

The hunters

PDC Energy (ticker: PDCE) entered the basin in August, paying $1.5 billion to acquire two privately held companies with 57,000 net acres in Reeves and Culberson counties, Texas. The company said the deal would expand its inventory life by at least 15 years.

Smaller acquisitions in the area have included Resolute Energy’s (ticker: REN) $135 million acquisition of Firewheel Energy for 3,293 acres in Reeves County, and Silver Run Acquisition Corp.’s purchase of Centennial Resources, a Delaware Basin pure-play company with 42,500 net acres primarily in Reeves and Ward counties.

Oil production in the Delaware Basin has increased 258% since January 2010 to 721.5 MBOPD, according to Bloomberg Intelligence. Growth in the last year has only reached 4.7%, likely due to low oil prices, fueling skepticism that output can increase further, but the recent influx of capital and improved well performance may help to boost production from the region.

The gatherers

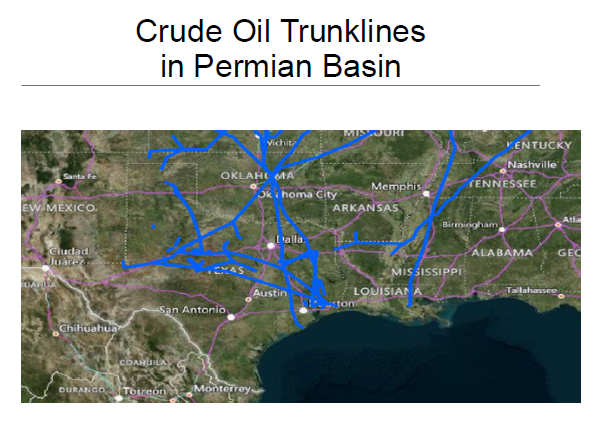

With such rapid growth in production, gathering constraints have been a concern in the Permian sub-basin, however. Sunoco Logistics (ticker: SXL) started its Delaware Basin Extension in the second quarter, adding 100 MBOPD, and the company recently purchased Netherlands-based energy trader Vitol Group’s Permian midstream assets for $760 million, as SXL and others try to keep pace with demand for gathering.

Here is how Bloomberg breaks out the midstream business in the Delaware:

- Plains All American (ticker: PAA), the largest gatherer in the Delaware Basin, gathered 133 MBOPD in June, or 18% of the regions total output;

- Enterprise Production Partners (ticker: EPD) piped about 10%;

- HollyFrontier Corp. (ticker: HFC) 9%;

- Shell (ticker: RDSA) about 7% in June;

- EOG Resources (ticker: EOG) has seen its share of the market grow the fastest in the region, with the company currently gathering 33 MBOPD, or 5% of the total.

Permian DUCs

Even with $50 oil prices, the number of drilled uncompleted (DUC) wells in the Permian remains elevated compared to other plays in the United States. Bloomberg Intelligence reported 533 DUCs at the start of June, second-most of any basin after the Bakken, which had 689 wells awaiting completion. The Niobrara followed closely behind the Permian with 501 uncompleted wells on June 1, 2016.