Per well efficiencies up 2.6x in the Marcellus and 22.3x in the Utica since 2012

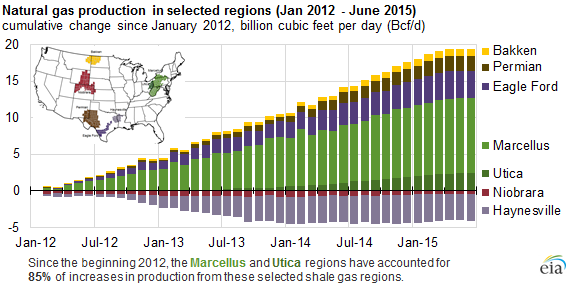

Increased productivity of natural gas wells in the Marcellus and Utica Shale basins is responsible for 85% of increased natural gas production in the United States since 2012, according to the Energy Information Administration (EIA). Natural gas from shale basins is now responsible for 56% of U.S. dry natural gas production. Collectively, shale production from the Marcellus and Utica regions increased by 12.6 Bcf/d from January 2012 to June 2015, making them the driving force behind overall growth.

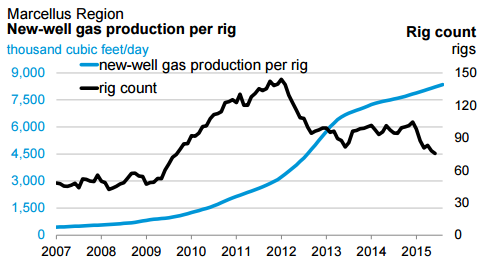

The EIA’s Drilling Productivity Report (DPR) tracks total production and rig productivity in major U.S. basins, illustrating how increased efficiencies have pushed production higher. In the Marcellus, new-well production per rig in January 2012 was 3.2 MMcf/d. By July 2015, that number increased 160% to 8.3 MMcf/d. The trend of new-well production per rig also follows the trend in overall production, which increased to 16.5 Bcf/d in July 2015 from 6.3 Bcf/d at the beginning of 2012.

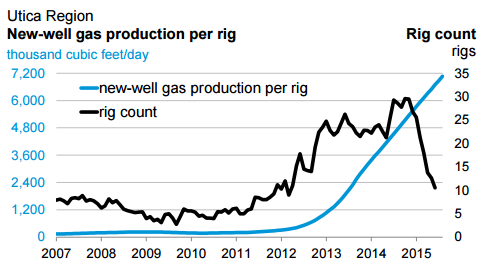

New-well production per rig in the Utica saw an even more significant increase during the same time period, increasing by a factor of 2230%. In July 2015, new-well gas production per rig in the Utica Shale was 6.9 MMcf/d, compared to just 0.31 MMcf/d in January 2012. Overall production in the Utica increased by a factor of 1730%, reaching 2.6 Bcf/d in July of this year from 0.15 Bcf/d in January 2012.

According to the EIA, the increases in natural gas production from these two plays were largely the result of four factors:

- Greater use of advanced drilling techniques

- Increased number of stages used in hydraulic fracturing operations

- Increased use of techniques such as zipper fracturing

- Use of specific components during well completion that aid in increasing fracture size and porosity of the geologic formation being targeted

Growth expected to continue

Goldman Sachs reported that the Marcellus/Utica region will continue to account for 85% of net production growth in the U.S. from 2014 to 2018, continuing the basins’ trends as the driving force behind natural gas production growth in the United States.

Goldman believes the buildout in the Utica will result in $21 billion of investment to reverse pipelines and build new pipelines from Appalachia to support substantial changes in gas flows for supply to meet demand. For a more in-depth look at the Utica, see OAG 360’s full coverage of one of the most prolific plays in the U.S. here.