Marcellus, Utica natural gas producers take a step closer to U.S. Gulf Coast markets

“The Marcellus and Utica basins – the fastest-growing natural gas supply region in North America – have the lowest development and production costs along with the highest growth prospects of any large basin on the continent.” That’s how TransCanada (ticker: TRP) characterized the upside for Appalachian natural gas producers last summer when it announced its $15 billion acquisition of Columbia Pipeline Group.

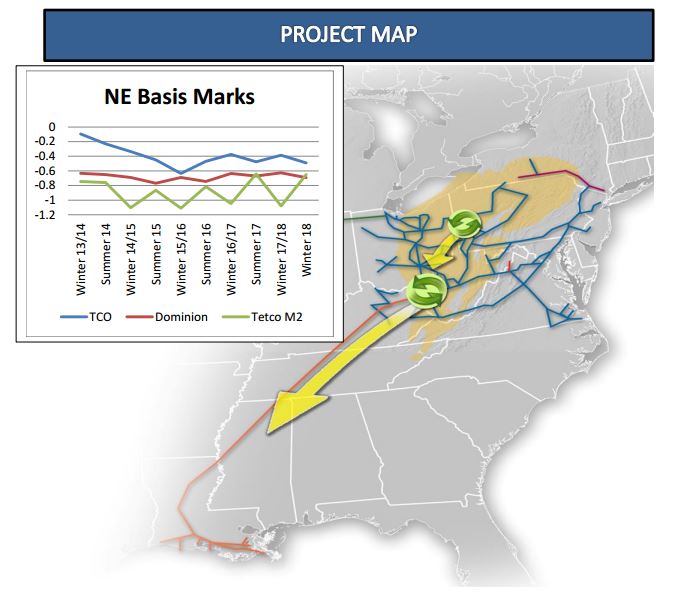

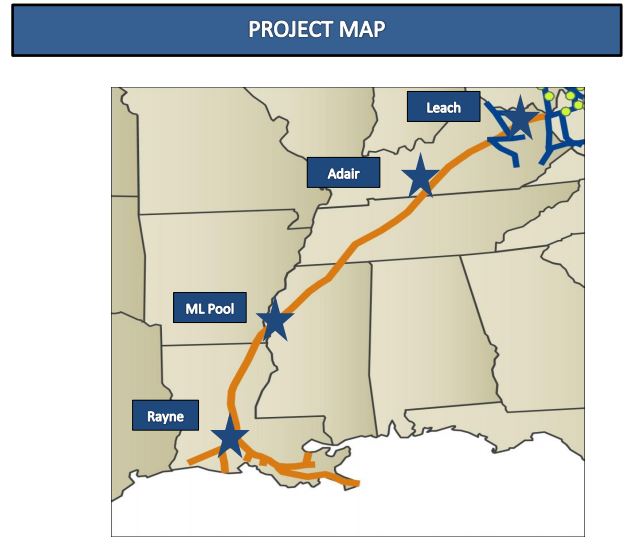

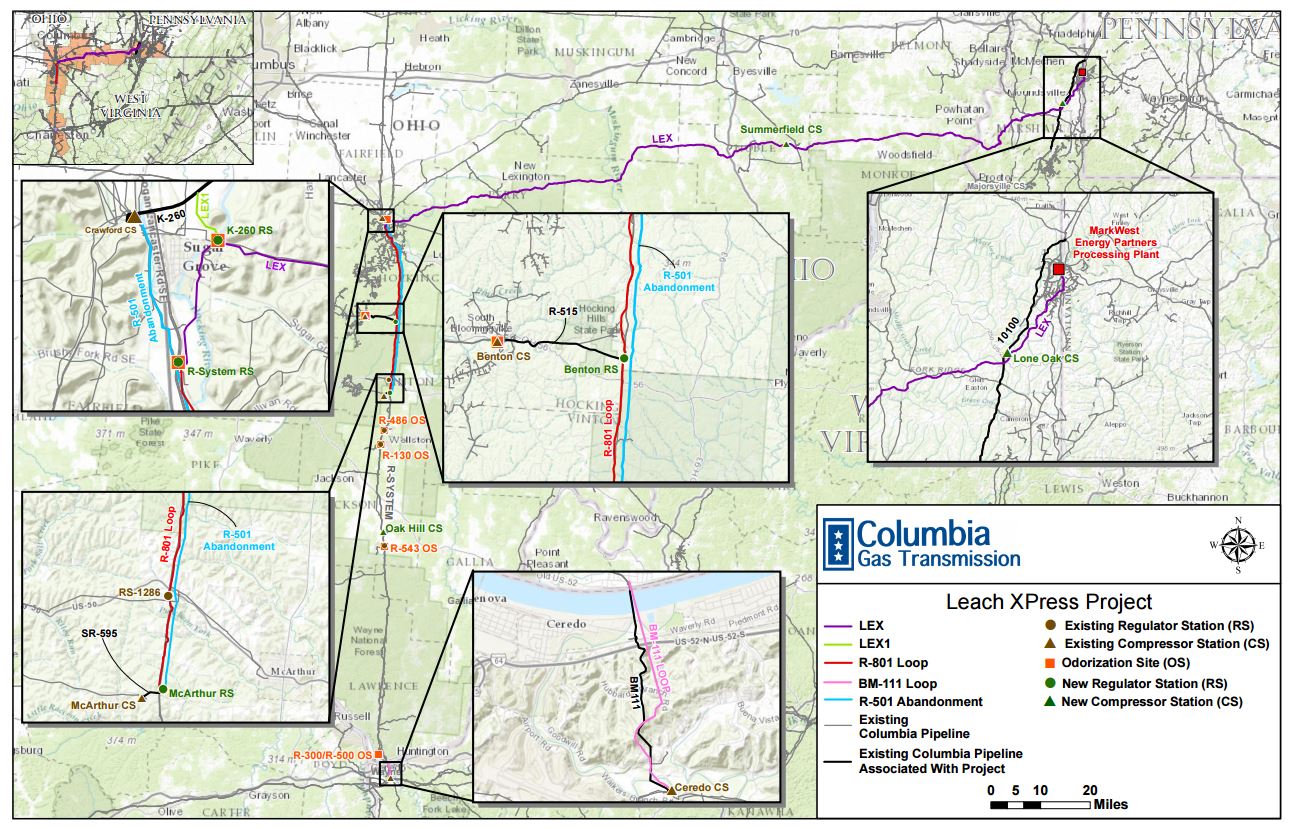

Today the company said the Federal Energy Regulatory Commission (FERC) had approved the construction of the Leach XPress and Rayne XPress projects, two of the Columbia Pipeline Group projects that were designed to transport natural gas from the Marcellus and Utica production areas to Midwest and Gulf Coast markets.

The approximately $1.4 billion investment in Leach XPress will enable the safe transport of approximately 1.5 billion cubic feet per day (Bcf/d) of natural gas from the Marcellus and Utica supply basin to homes, businesses and industries, TransCanada said. The 160-mile greenfield project crosses the northern panhandle of West Virginia and then traverses southeastern Ohio.

The two pipeline projects together represent a combined $1.8 billion investment.

The issuing of the certificates of public convenience and necessity follows the September release of FERC’s final environmental impact statement for the projects. Once remaining regulatory approvals are obtained, TransCanada plans to begin right-of-way preparation and construction activities on both projects in February, TransCanada said in a press release today.

TransCanada said its goal is to maintain the proposed November 1, 2017 in-service date.

“Approval of Leach XPress and Rayne XPress follows a very thorough review by the FERC,” said Stan Chapman, TransCanada’s senior vice-president and general manager, U.S. Natural Gas Pipelines. “These projects will create critically needed connectivity between the prolific, but constrained, Marcellus and Utica shale production areas and higher value markets. The projects will also create significant new jobs and tax revenues for communities along the projects’ routes.”

Rayne XPress primarily involves the construction of two new compressor stations along TransCanada’s existing Columbia Gulf system and is designed to create an additional 1.0 Bcf/d of capacity to efficiently transport Marcellus and Utica production to markets in the Gulf Coast region and beyond.

Both projects are underpinned by long-term, fixed-fee, firm transportation service agreements, the company said.

TransCanada earlier summarized its acquisition of Columbia Pipeline Group as:

- Creating one of North America’s largest regulated natural gas transmission companies with approximately 90,300 km (56,100 miles) of natural gas pipelines connecting the continent’s most prolific supply basins to premium markets;

- Creating the largest North American natural gas storage business with 664 billion cubic feet of capacity;

- Representing $25 billion of secured, near-term growth projects in Canada, the United States and Mexico.

FERC’s Final Environmental Impact Statement for the projects may be found here.