Salt-facilities offer more flexibility than other types of storage

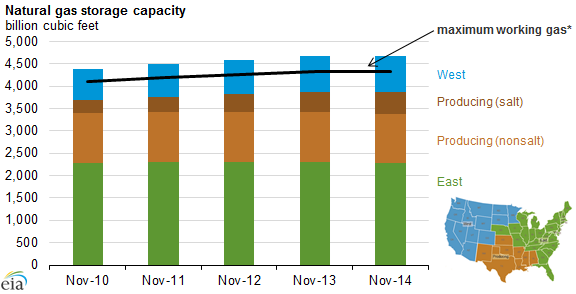

The available working capacity of salt-cavern natural gas storage facilities in the Gulf Coast gas-producing region has doubled since 2008, according to information from the Energy Information Administration (EIA). New capacity in salt-facilities has accounted for about half of the storage capacity built in the producing region, with salt-facility capacity increasing by 4.4% in 2014.

Natural gas stored in salt-facilities only accounts for 10% of total storage capacity in the Lower 48 states, but provides 28% of daily deliverability. Salt facilities operate under high storage pressure and can provide much higher deliverability than other natural gas storage options such as depleted fields or aquifers. Natural gas storage in salt-facilities can also be drawn down and refilled, or cycled, as many as a dozen times a year, while other storage facilities typically cycle only once a year.

This combination of higher pressure and more annual cycles makes natural gas storage in salt-facilities a much more flexible option when compared with other types of storage. Higher pressure storage makes it possible for holders of salt-facility gas can get their product to market much more quickly, meaning they can take advantage of short-term price fluctuations. The greater number of cycles also makes selling gas to take advantage of short-term price changes less risky. Holders in other types of storage might be less likely to sell for short-term gains if it means they will have less gas to sell during the winter withdraw season.

Salt-facilities are more expensive to construct and use on a per-unit-of-capacity basis, but the EIA believes that the increased flexibility offered by this form of storage has driven its increase in the total share of storage capacity while other types of storage have decreased.

Typically, natural gas is pulled out of storage in winter months as demand for heating increases, but consumption patterns have been changing, according to the EIA, and salt-facilities are more able to meet growing power generation demand in summer months for air conditional, lighting and industrial use. Salt-facilities are also better at meeting demand from sudden changes in weather.