The EIA anticipates declines in natural gas production for the first time

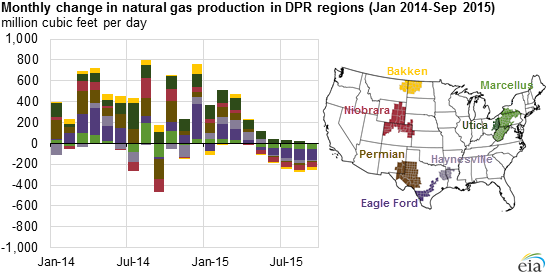

The Energy Information Administration (EIA) expects to see near-term declines in the amount of natural gas produced in the seven major shale regions for the first time in September. The number of new wells being brought on in every region will not be able to produce enough to offset the declines seen in legacy wells, according to the EIA.

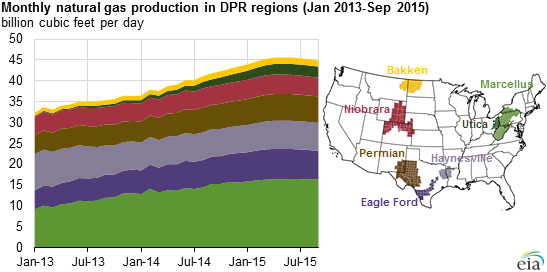

Natural gas production peaked in May of this year, with the seven major shale regions in the U.S. accounting for 45.6 billion cubic feet per day (Bcf/d) of production. The numbers were the highest on record since the EIA began tracking the information in 2001. Despite the overall increase in the production of natural gas, consumption decreased in residential commercial and industrial sectors for the third consecutive month.

The EIA’s Drilling Productivity Report (DPR) anticipates that next month will be the first month in which production in all seven shale regions show declines, as increased well efficiencies are unable to offset the low number of running rigs and typical well decline curves.

Marcellus and Utica begin to slow production

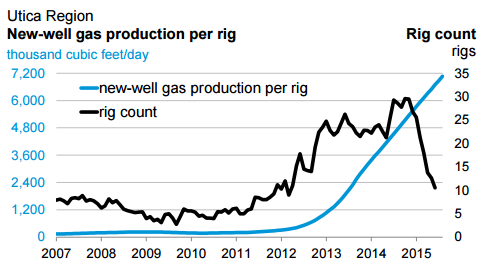

The Marcellus and Utica shale plays have been responsible for 85% of shale gas growth in the U.S. since 2012, but even they are expected to produce less natural gas in September than in August. New well production in both regions has increased substantially, with wells in the Marcellus producing 160% more in in July 2015 than in January 2012. New wells in the Utica saw an even more substantial increase, producing 6.9 MMcf/d in July 2015, compared to just 0.31 MMcf/d in January 2012, or a 2230% increase.

Despite this tremendous increase in productivity, the EIA anticipates declines from legacy wells in the Utica will total 55.6 MMcf/d in September, which will only be partially offset by new well production of 52.2 MMcf/d. With just seven rigs drilling in the Utica in July, even new-well production of 7 MMcf/d will not be able to fully compensate for legacy declines.

The EIA’s estimates could potentially be affected by factors like bad weather, shut-ins, variations in the quality and frequency of state production data, and infrastructure restraints, the Administration said. For example, the Rockies Express Pipeline started to deliver 1.8 Bcf/d of Appalachian natural gas production west on its existing mainline, which could encourage increased production from regions such as the Marcellus and Utica.