President Obama addressed the nation on Wednesday night, urging Congress to increase funding, assistance and conduct “a series of strategic airstrikes” against the Islamic State, or ISIL, the group marching across Iraq that recently beheaded two American journalists on Internet broadcasts. The President vowed to support the Iraqi government by providing military training and supplies, but stopped short of placing any American fighters on Syrian or Iraqi soil for combat purposes.

West Texas Intermediate closed today at $92.83 and Brent Crude closed at $98.08, staying in line with recent prices and generally ignoring the possibility of war-related supply interruptions.

Obama said: “This is not our fight alone. American power can make a decisive difference, but we cannot do for Iraqis what they must do for themselves, nor can we take the place of Arab partners in securing their region. That’s why I’ve insisted that additional U.S. action depended upon Iraqis forming an inclusive government, which they have now done in recent days. So tonight, with a new Iraqi government in place, and following consultations with allies abroad and Congress at home, I can announce that America will lead a broad coalition to roll back this terrorist threat.”

The President said more than 150 successful airstrikes have been conducted in Iraq within the last month, but additional steps must be taken. “In two weeks, I will chair a meeting of the UN Security Council to further mobilize the international community around this effort,” he said, adding that the U.S. has already reached out to its European allies for additional support.

The President said more than 150 successful airstrikes have been conducted in Iraq within the last month, but additional steps must be taken. “In two weeks, I will chair a meeting of the UN Security Council to further mobilize the international community around this effort,” he said, adding that the U.S. has already reached out to its European allies for additional support.

The two top Republicans in the House voiced their approval for Obama’s recommendations following the address.

More Sanctions Forthcoming for Russia

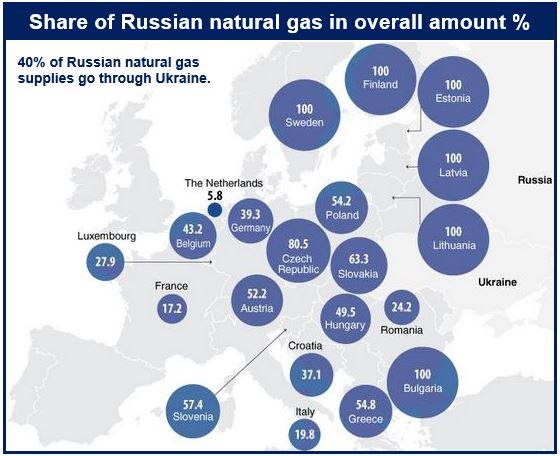

Some critics were encouraged by a potential cease-fire between Ukraine and Russia, but the progress was not enough to stop the European Union for enforcing more sanctions against the hydrocarbon giant, effective at the end of the month. “The measures will reinforce steps taken in July restricting trade, commerce and financial links with Russia,” reports The Wall Street Journal. Russian oil companies, including Transeft, Gazprom and Rosneft will be forbidden from raising funds of longer than 30 days maturity, effectively preventing the funding of large-scale projects like shale and offshore development.

Oil Prices Continue Decline

Escalations in conflict typically lead to higher oil prices, but the shockwave has been virtually nonexistent. The International Energy Agency reported “A pronounced slowdown in demand growth in the second quarter of this year and a weaker outlook for Europe and China” in its September Oil Market Report on September 11, 2014.

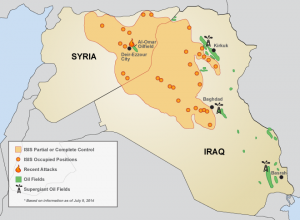

The European Union is attempting to avoid purchasing oil from fields captured by ISIL, meaning any additional actions taken against the terrorist group should have no effect on European spot prices. The U.S. is in the same fold, keeping a disputed Kurdistan oil tanker in limbo for more than a month. About 80% of all Iraqi oil production is located in the south, where ISIL has yet to make progress. Intelligence still estimates ISIL brings in roughly $2 million per day in the selling of black market crude to fund its barbarism. Obama, obviously, was not specific in his targets when mentioning airstrikes, but Representative Adam Schiff (Democrat, California) said oil infrastructure may be a “worthwhile target.”

Prices for Brent are already trading at a 16-month low and dropped below $97 for a brief period on Thursday morning. The IEA has cut its projected oil demand growth for 2014 by 25% since July. In an interview with The Wall Street Journal, Myrto Sokou, senior analyst at Sucden Research, said, “The recent disappointing oil fundamentals weigh heavily on market sentiment, offsetting any geopolitical risks in Middle East.”

In his speech, the President said, “Energy independence is closer than it’s been in decades.” Oil prices in the United States reflect the mass production, which is at its highest level since 1986 – the West Texas Intermediate spot price is hovering around $92 while Midland spot prices in the heart of the Permian are trading at roughly $84.

The EIA, like the IEA, also reduced projected 2015 prices in its Short Term Energy Outlook for the month of September. WTI prices were cut by 1.47% to $94.67 per barrel and Brent prices were trimmed by 1.90% to $103.00 per barrel. Projected gasoline prices dropped by five cents to an average of $3.41 per gallon in 2015.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.