PDC Energy expects gross proceeds of $675 million to help fund a portion of its Delaware Basin acquisition

PDC Energy (ticker: PDCE) announced Thursday that it upsized its public offering to 7.9 million shares of common stock for total gross proceeds of approximately $500 million and $175 million of its convertible senior notes due 2021. Originally, the company had planned to offer 6.5 million shares and $100 million in senior notes. PDC has also granted an option for an additional 1.2 million shares of stock up to $25 million principal amount of additional notes to cover over-allotments.

The senior notes will be carry an interest rate of 1.125% per annum, payable semi-annually. The notes will be convertible at the option of holders in certain circumstances and during certain periods into cash, shares of common stock or a combination thereof at an initial conversion rate of 11.7113 shares per $1,000 principal amount of notes, which is equal to an initial conversion price of approximately $85.39 per share. The conversion rate represents a premium of approximately 35% relative to the public offering price in the concurrent common stock offering.

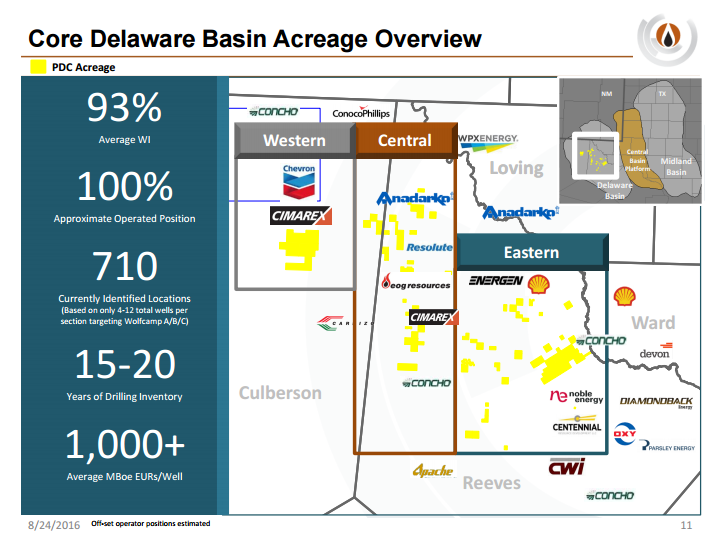

The company said it intends to use the net proceeds from the offerings to fund a portion of the cash consideration payable for its recent acquisition of two privately held companies with acreage in the core of the Delaware Basin. The transaction includes approximately 57,000 net acres in Reeves and Culberson Counties, Texas, with an average working interest of approximately 93%, according to the company’s press release. Current net production is approximately 7,000 BOEPD from 21 wells, with two additional wells in the completion and flowback phase. The company believes that the acquisition will add 15 to 20 years of gross inventory life to its U.S. assets.

PDC said that if the acquisition is not completed for any reason, the company intends to use the net proceeds from its upsized offering for general corporate purposes. The offerings are expected to close on or around September 14, 2016, the company said in its press release.