PM Medvedev says government needs to act now to head off a decades-long economic depression

Russia is facing a slowing economy as the oil export-dependent country battles both slumping oil prices and Western sanctions. Russian Economy Minister Alexei Ulyukayev said Russia would have to adjust to a “new normal” of low prices for crude, which will last for a “very lengthy” period, reports The Wall Street Journal.

The Russian government is considering a number of options in order to bridge the gap in the budget for the coming year. Finance Minister Anton Siluanov said the government would propose a 10% cut to spending from a budget that was based on oil prices of $50 per barrel, a price that President Vladimir Putin has since described as “unrealistic.”

Russia would need to reduce spending by about $6.5 billion in order to meet the 10% cuts. Despite the deep cuts, pensions and pay for government workers will be protected, as both are politically sensitive areas of the budget.

“We need to prepare for the worst scenario,” Prime Minister Dmitry Medvedev said in a speech at an economic conference in Moscow. “We need to live according to our means, including by reducing budget expenditures, decreasing spending on the state apparatus, [and] the privatization of part of state assets.”

The idea of selling state assets has been floated before, but not executed. Ulyukayev suggested that the government could sell stakes in the two largest state banks, Sberbank and VTB, in order to inject new funds into Russia’s banking system, which has been cut off by sanctions. Talks of selling a larger stake of state-owned giants like Rosneft have also been brought up, but the Russian government has been sensitive to selling stocks in politically important companies to foreign interests in the past.

Medvedev described the country’s economic situation as “difficult, but manageable.” He warned that a return to growth wasn’t assured and that the government needed to act to stimulate investment and head off an “economic depression (that) could last for decades.”

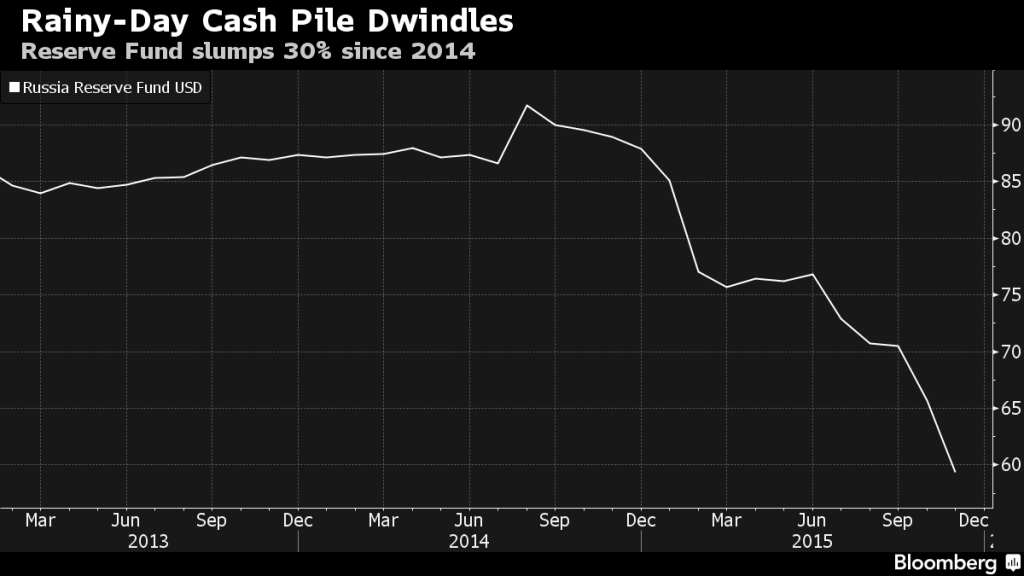

Russia’s $59 billion cushion could be gone before the end of the year

Russia’s sovereign fund, which the government uses to make up fiscal deficits, stood at $59.35 billion at the end of November, reports Bloomberg. Siluanov warned during the conference that the fund could be depleted entirely in 2016 if spending cuts were not enacted. The fund stood at a five-year high of $91.72 billion in August 2014.

Siluanov said it would require oil at $82 per barrel to balance the Russian budget as it stands. “Our task is to adapt our budget to the new realities,” he said.