Low oil prices bring SEC price deck down to $50.13

With the end of 2015 quickly approaching, and companies preparing for a lower Securities Exchange Commission (SEC) price deck for reserves reporting, proved reserves for oil and gas companies are likely to diminish significantly in the near future.

The dramatic decrease in oil prices since November of last year has pulled the SEC’s price deck down to about $50.13, based off the average of the price for WTI on the first day of every month this year, falling within 1% of EnerCom Analytic’s estimate, made in September. That represents a 48% decline from $94.99 in 2014.

In order for a company to book reserves with the SEC, its reserves must meet three key stipulations:

- The reserves must be reasonably certain of recovery, meaning a company has a good idea of what producing from a position will entail and what they will see in terms of production;

- The reserves must be economic to produce at SEC prices; and

- A development plan must be adopted indicating that they are scheduled to be drilled within the next five years.

With the SEC looking at oil prices near $50 per barrel in 2016, the amount of hydrocarbons in place a company can produce economically is likely to come down substantially.

“Reserve replacements have not been as big of a deal over the past ten years, because companies were drilling wells with very high rates of return,” Scott Rees, chairman and CEO of Netherland, Sewell & Associates, Inc. (NSAI) told to Oil & Gas 360®. “Companies could make a few mistakes, and spend 10% to 20% of their budget on wells that didn’t make any money, because the returns on their other wells were so good they were still seeing good reserve replacements and F&D costs.”

Now that oil prices are less than half of their value from this time last year, companies have right sized their capital expenditures to match their expected cash flows and well economics. To what degree companies decided to make those cuts, and what outlooks those companies chose to use could have a substantial effect on the companies’ five-year development plans.

Where do the reserves go?

Speaking to an audience of energy and finance professionals in Denver today, Dr. John Seidle looked to answer the question of what happens to the hydrocarbons that are no longer commercially viable under the SEC’s new price deck. In his presentation, titled “Falling Reserves Numbers, Where Did the Molecules Go?” Seidle said they are simply reclassified, and the hydrocarbons remain in the ground.

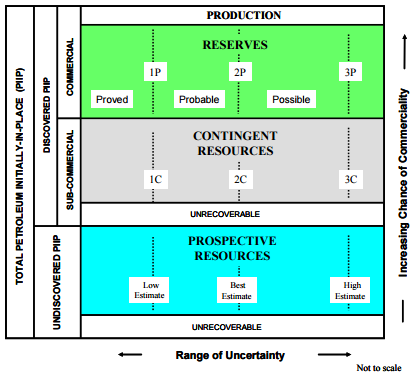

Gesturing to the Society of Petroleum Engineers’ Petroleum Resource Management System (PRMS) framework, Seidle said the molecules simply slide down into contingent reserves as they become uncommercial due to the low commody price.

“If you look at it year-to-year,” he said the group in Denver, “you will see contingent resources increasing as reserves fall, and returning to reserves as the price for oil and gas increases.”

While the normal maturation of assets is to move up and to the left of the PRMS’ classification framework as technology improves, making more reserves recoverable, the low oil price environment has turned the process around. Previously commercial reserves will become resources in SEC filings, but the hydrocarbons themselves will remain in place. Future technology advances could bring them back into play: the shale boom comes to mind.

Positively disruptive technologies

Not ones to simply watch as reserves decline, many oil and gas companies are looking for positively disruptive technologies to help them continue lowering their cost of production. Using technologies that improve efficiencies, there are cost benefits that also result in improved rates of return on capital – even with a lower commodity deck.

At EnerCom’s The Oil & Gas Conference, management teams made the case that a well drilled today can generate a company-targeted return. President and CEO of Whiting Petroleum (ticker: WLL) Jim Volker stressed that even in the current price environment, companies can be successful.

“We rigged the company to run at $30, $40 and $50 oil,” said Volker at EnerCom’s The Oil & Gas Conference 20®. “The plan is to continue to explore and develop inside discretionary cash flow… We can still grow.” Whiting is seeing 3-to-1 returns on its wells in the Williston by improving completions and lowering well costs, Volker said during his presentation.

One of the positively disruptive technologies being employed by Whiting is the company’s scanning electron microscope (SEM), which WLL uses to understand how to get the most from its fracs. The SEM has allowed Whiting’s geologist to gain knowledge from “detailed mineralogy down to two nanometers,” allowing for “a true 3D representation of [its] reservoirs,” Whiting SVP Mark Williams said at AAPG in Denver.

Whiting Special Report: measuring the oil in the Williston Bason

Oil & Gas 360® spoke with Williams at Whiting’s Denver headquarters about the company’s hi-tech approach to understanding its reservoirs. Williams said multi-stage completions opened up the Bakken, but it also raised questions. “One of the fundamental differences was that the pore space (in the minerals) was much, much smaller than in conventional plays … we knew it was in the same size range as the oil molecules were asking to pass through this network of pores. It proved to be quite frustrating for us,” said Williams.

To alleviate their frustration, Whiting’s geoscience team is using two scanning electron microscopes (SEMs) to gain an understanding of the flow of oil in the Bakken and Three Forks formations. The goal of the research is to understand and measure the total resources in place throughout the Williston basin—and how best to recover them.

On that topic, EnerCom / Oil & Gas 360® has produced an exclusive video special report entitled “Whiting’s Wildcatters: Micro Scale, Macro Vision” – sponsored by FEI Company (ticker: FEIC).

In this 10-minute, behind-the-scenes look at the inner workings and accomplishments at Whiting’s in-house geoscience lab, Williams and the Whiting scientists demonstrate how their use of the SEM technologies is not only providing an understanding of the movement of oil through the rock, but it is improving drilling efficiencies for the company. The Oil & Gas 360® Special Report is scheduled for release in January 2016.