Statoil Plays Largest Role, Locks Up Interests in Six Blocks

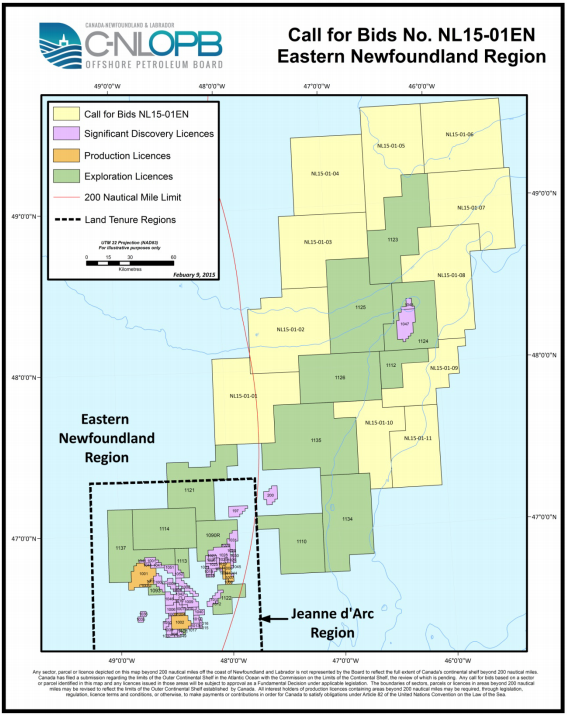

Some of the industry’s largest players spent $1.2 billion in a Canada offshore lease sale on November 12, 2015, securing a foothold in an area estimated to hold as much as 12 billion barrels of oil and 113 trillion cubic feet of gas.

Statoil (ticker: STO) was a consistent player in the action, landing interests in six of the seven blocks that were sold. The Norway-based producer is teaming up with some of the biggest names in the industry, including BG International (ticker: BG) BP Canada (ticker: BP) and ExxonMobil (ticker: XOM) in joint ventures. The highest bid for a block was about $423 million – paid exclusively by Statoil, who will own full working interest in the area. The only other company to win a block on its own was Nexen. Four of the blocks went unsold.

The previous round of lease sales, completed in December 2014, yielded nearly $600 million in high bids.

The previous round of lease sales, completed in December 2014, yielded nearly $600 million in high bids.

Statoil has been an active explorer in the area, known as Flemish Pass, since 2009 and first got its feet in Canadian waters upon its inception in 1997. The company claims three discoveries, including the Bay du Nord, Harpoon and Mizzen wells in a nearby block. The Harpoon is still being evaluated, but STO believes the Bay du Nord and Mizzen wells hold up to 600 and 200 MMBO, respectively. STO holds a 65% working interest in the blocks, while its partner, Husky Energy (ticker: HSE) has the remaining 35% interest.

United States Waiting on the Green Light

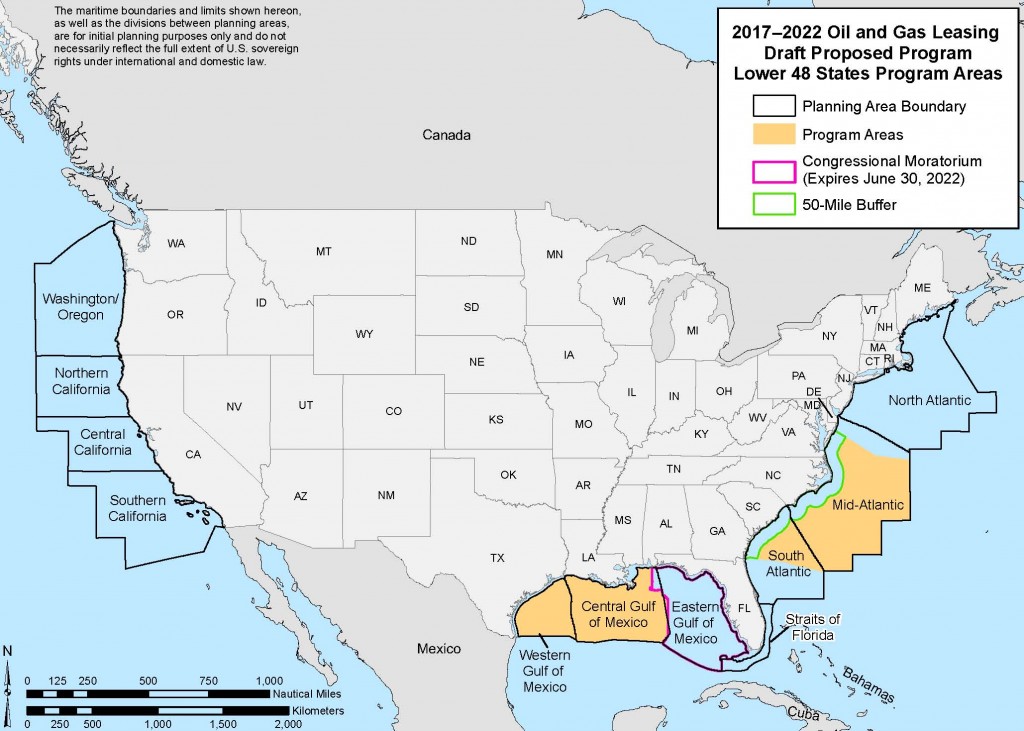

The region is currently the only place on the North American Atlantic shelf available for oil and gas development. The United States announced preliminary plans for development in the Atlantic but has yet to commence a lease sale. Based on 2-D seismic surveys from the 1980s, geologists believe the recoverable resources can be as high as 3.3 billion barrels of oil and 31.3 Tcf of natural gas. A study from an independent analyst firm believes the Atlantic could contribute 3.5 MMBOEPD of production to American output.

On a related note, the U.S. Bureau of Ocean Energy Management cancelled two offshore lease sales in the Arctic until 2017, citing the difficult commodity environment. Its two most recent lease sales in 2015, albeit in the Gulf of Mexico, generated a combined total of $561 million and BOEM officials directly blamed “market conditions and low industry interest” in its press releases.