A new chief executive lands in the Wattenberg: the former Kodiak CEO talks about a new company culture, acquisition strategy and his go-forward road map for the ‘core Wattenberg’

Life before Synergy

Lynn Peterson was an independent oilman from 1986 to 2001. Then, as co-founder, director, president, CEO (2002-2014), and chairman (2011-2014) of Kodiak Oil & Gas, Peterson grew Kodiak into a top tier E&P in the Williston basin.

Kodiak was acquired by Whiting Petroleum (ticker: WLL) on Dec. 8, 2014 in a $6 billion deal including debt. Kodiak’s reported production in Q3 of 2014 was more than 40,000 BOEPD. The acquisition of Kodiak turned Whiting into the largest Bakken-Three Forks producer.

In an article published on May 8, 2015, the Wall Street Journal spoke with Jaime Perez, who had gotten to know Lynn Peterson while Perez was working at a hedge fund that was an investor in Kodiak: “Mr. Perez recalled that Mr. Peterson would knock on the doors of land owners, maps in hand, offering to buy their properties. ‘He was pretty much a wildcatter’.

Perez told the Journal that Peterson’s early efforts were critical in getting Kodiak off the ground: “‘At that time, most of the big land grab was over. … There were only small mom-and-pop [exploration companies] with acreage in that location of the Bakken. Lynn just went to the smaller E&P land holders and offered them a deal…. What was unknown at that time was how good his acreage was’.”

On May 28, 2015, Synergy’s founders and co-CEOs Ed Holloway and Bill Scaff announced that Lynn Peterson would become their company’s president, and on December 14 Peterson was named Synergy’s chief executive officer.

Synergy’s new chairman and CEO has already made an impression. The company has relocated its headquarters from a farmhouse in Platteville (Weld County), Colo., to downtown Denver. The company’s balance sheet is debt-free. Peterson staffed key management, technical and support positions in-house.

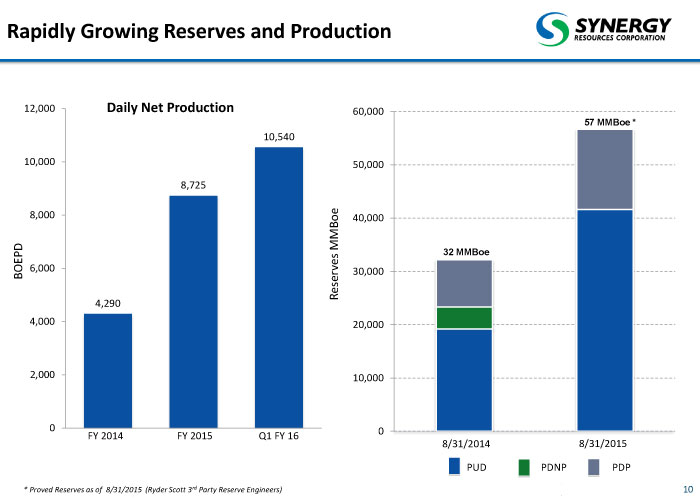

Lynn Peterson is looking to build Synergy Resources (ticker: SYRG; Syrginfo.com) into a formidable E&P company focused entirely on the Wattenberg field in Colorado.

Oil & Gas 360® had this conversation with Lynn Peterson in the company’s Denver headquarters on February 9, 2016:

Oil & Gas 360®: Lynn, why did you want to take the job at Synergy?

Lynn Peterson: I enjoy the challenges, I enjoy the people, I enjoy the investors. I had a wonderful ride at Kodiak and I just wasn’t ready to call it quits.

Oil & Gas 360®: What was it about Synergy that you liked?

Lynn Peterson: I’ve always worked the Rocky Mountains. I have watched the Wattenberg develop; it’s about five years behind North Dakota—the Bakken play. I thought the basin was crying out for consolidation—it’s too broken up. I think all these big shale plays at the end of the day end up with a handful of operators. That’s probably the most efficient way to make it work. I just thought there was an opportunity to build a company out here. I had known Ed Holloway – Ed and I went to school together and we’ve stayed in touch. When we sold Kodiak in 2014, Ed reached out to me. I thought oil would rebound a little quicker than it has, but it was the right time to get into Synergy. We’ve done some things in the last six months that will be beneficial for us going forward.

A New Culture: Bringing in Top Caliber People

Oil & Gas 360®: What are the main things that you brought over from Kodiak that will help take Synergy to the next level?

Lynn Peterson: I think the one thing you realize is that it’s about the people. Our industry is built on people. If you don’t have people you’re probably not going to be successful, especially if you are going to do acquisition work. You don’t want to play catch-up; you want to be ahead of the game. That’s one of the things that was certainly important to me was to change the culture of the company—to go from using third party consultants to bringing aboard in-house expertise. Having employees that have skin in the game, you make better decisions: you live it. So I think that was probably my biggest push. One good thing for us about the downturn is that people are available. If you look around our staff and you look at our key management guys, most of our guys have 30-35 years’ experience in the Wattenberg.

Oil & Gas 360®: Which positions have you added at Synergy?

Lynn Peterson: Brian Macke [director of government affairs] was one of our first hires. Brian was with the Colorado Oil and Gas Conservation Commission for a little over 15 years, the last four or five as director. Because of the environment we’re living in here in Colorado, with so many governmental regulatory agencies, Brian has been invaluable to us. He has an impeccable reputation.

When we look at the technical side, I think that is where the company was really kind of lacking. We had a lot of people come to us; we didn’t really go out and approach a lot of people, they came to us.

The first guy I brought on was Mike Eberhard [VP of completions]. Mike was head of completions for Anadarko for the last five years. For 25 or 30 years prior to that he was involved in the technical management side for Halliburton. He has literally fracture stimulated thousands of wells in the Wattenberg.

Nick Spence [VP of drilling] heads up our drilling operations now. Nick was an Anadarko guy. He has 25-30 years of experience, a little more varied; the last five or six years he’s been here in the Wattenberg. And as you know Anadarko is kind of on the leading edge of this new conventional horizontal well, low maintenance, intermediate string. I wanted to build on that group quickly if we are going to go that direction; I didn’t think we had the experience I was comfortable with going into municipalities. We can’t afford to have a mistake, so Nick is very important to us.

Tom Birmingham [VP of exploration] was with HS Resources, Kerr-McGee and Anadarko. He spent 35 years with them, and he’s heading up our geological team. Tom has forgotten more than most people know, just a wonderful addition to the team here.

Jimmy Henderson is our CFO; he was with me at Kodiak. I couldn’t ask for a more professional person on the support team.

Cathleen Osborn [general counsel] – we have never had in-house counsel. She was with us at Kodiak, went to Whiting, and now she’s here.

There’s been a lot of support staff. I’m thinking through the accounting team, financial reporting guys we’ve brought in. We’re still working on our land team. We’re 95%-98% of the way there.

Again, we’re front and center here in Colorado; we’re drilling in 13 different municipalities. We want visibility. We want people to know the people that we have, their experience. We were delighted that Dan Kelly joined our board of directors. Dan comes from Noble; he was part of the governor’s task force. He brings an incredible amount of knowledge and connections.

[EDITOR’S NOTE: Jon Kruljac, Synergy’s vice president of capital markets & investor relations, joined the interview.]

Jon Kruljac: The corporate culture that Lynn is imbuing here has spread. And this is what has brought in some of these top caliber people: to be part of a dynamic team where their voice is heard. When we have a staff meeting, there are ten or twelve of us around the table, and you’ve got the key elements of the whole business, the whole corporation—from the technical to the financial and the strategic as well as the marketing piece. You can reach a decision and feel like you’re really part of the process as opposed to being a cog in a wheel.

Lynn Peterson: We don’t have a lot of red tape to go through. We don’t have to call Houston.

Enlarging the Footprint in Today’s Price Environment

Oil & Gas 360®: If we have two years of $30-$40 oil ahead of us, what is Synergy’s plan of attack?

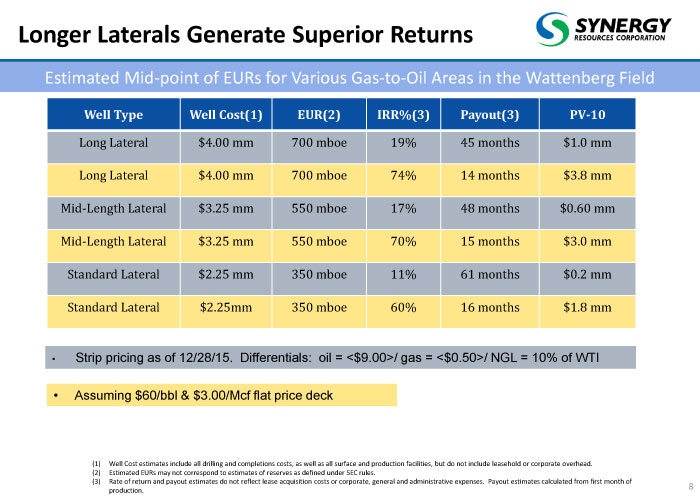

Lynn Peterson: I think we’ve been very clear. We’re really looking to enlarge our footprint. And if you look at that capital raise we did a few weeks ago, we brought that to the forefront. We are one of the few oil companies, maybe the only oil company, that doesn’t have any debt at all on the books and cash in the bank. We’re looking for opportunity. Growing organically is very difficult at these prices. You can look at the margins, and with that breeds opportunity. All players are not going to live through this. One thing we’re really trying to do is build contiguous blocks of acreage. If you look at our footprint, it’s a little bit scattered. The team has really worked on that, before I came on too, but we are moving forward in that direction—swapping, trading, whatever we have to do to get a more contiguous acreage position. When you look at the economics of $30 oil, I’ll be the first to say they’re not glowing, but I think if we can drill mid- or extended-reach laterals—get away from 4,000 foot laterals and drill 7,000 or 9,000 feet—it improves your economics. Today we’re looking for small steps as opposed to big steps.

Oil & Gas 360®: At today’s commodity prices – $28 -$30 oil – what percent of your acreage can work at these prices?

Lynn Peterson: The word “work” is the real question mark. If you think about it, today oil is $28, and we’ve got transportation differentials; we’re getting probably about $20 at the wellhead. It gets pretty skinny. What are you talking about when you calculate a rate of return? Is it just drilling and completion, is it your acreage, is it G&A—you have to account for all the things that build into it. You know the following comment is often made, and I think it’s true: “the U.S. just doesn’t work at these prices.” I think it’s fair to say that maybe a quarter of our acreage is really probably in the tier one category, with a little bit of tier two.

We’re only running one rig, so we continue to move our rig around to different areas, working on density and working on completion methods. Our focus has not been to drill our best acreage during this time period. Why do you want to complete all your best wells at the lowest commodity prices?

Oil & Gas 360®: What’s the story with the rig you’ve got working in the Wattenberg?

Lynn Peterson: We had an existing contract with a rig that was expiring Dec. 31, 2015. We laid it down for two reasons because the landscape changed: the price of oil is dropping and we wanted to conserve our balance sheet. We also saw an opportunity to bring better equipment into the field. Anadarko, the previous operator of a particular rig, was laying it down; so we jumped on the opportunity. It is a built-for-purpose rig for this basin. We stood the rig up the third week in January, and we’re drilling a 10-well pad with it right now. We’ll drill six wells to add to the four we drilled with the previous rig. We’re seeing some real efficiency gains on that. It’s a compliment to not only the equipment but to our staff. We’ve brought in a head of drilling who spent time with Anadarko who is very familiar with this horizontal-conventional well type where we eliminate the intermediate casing. We’ve got two wells under our belt, we’re on our third one right now. I’m pretty encouraged with what I’m seeing.

Lynn Peterson: We had an existing contract with a rig that was expiring Dec. 31, 2015. We laid it down for two reasons because the landscape changed: the price of oil is dropping and we wanted to conserve our balance sheet. We also saw an opportunity to bring better equipment into the field. Anadarko, the previous operator of a particular rig, was laying it down; so we jumped on the opportunity. It is a built-for-purpose rig for this basin. We stood the rig up the third week in January, and we’re drilling a 10-well pad with it right now. We’ll drill six wells to add to the four we drilled with the previous rig. We’re seeing some real efficiency gains on that. It’s a compliment to not only the equipment but to our staff. We’ve brought in a head of drilling who spent time with Anadarko who is very familiar with this horizontal-conventional well type where we eliminate the intermediate casing. We’ve got two wells under our belt, we’re on our third one right now. I’m pretty encouraged with what I’m seeing.

How do we go forward? We monitor oil prices. Here is our game plan right now: we feel comfortable drilling a few wells. We don’t believe we have to be in a hurry to complete them. We’ll see where oil prices go. Having a handful of wells uncompleted I don’t think is a bad thing right now. We’ve seen a lot of efficiencies coming out of the drilling side. I’m not sure that the drilling opportunity is going to get a lot cheaper than where we are today. If you look at days of drilling, it’s been incredible throughout the U.S. what the industry has done. We used to think the day rate was a big issue on a well; but today you’re on so few days. It’s still important, but it’s not the driving force on all the well costs. I remember when we used to spend 60-75 days on a well, day rates were what it was all about. Today, we’ve done our first few wells in a little over 6 days, and I think we’ll get better as we go. But bringing a new rig, and new people and new crews working together, I’m very pleased with our first few wells.

Oil & Gas 360®: What do oil prices need to be for Synergy to open the throttle, add rigs, start to ramp things up in the Wattenberg?

Lynn Peterson: I don’t think it’s a price so much as the duration of a price. We need to see some quarters—a time frame where prices stabilize. If we look at it realistically I think we’re at a $45-plus number. If we get past that, I think the completion side’s going to increase once you see prices increase. That’s two thirds of our well costs, more or less. Everybody’s trying to get these numbers down by changing the completion a little bit here or there. I think you’ll see a bit of inflation on that side, but I don’t think it’s as predominant on the drilling side where our efficiencies will be maintained. I think realistically to show a good rate of return, you’ve got to be in that $45 price range.

Lynn Peterson: I don’t think it’s a price so much as the duration of a price. We need to see some quarters—a time frame where prices stabilize. If we look at it realistically I think we’re at a $45-plus number. If we get past that, I think the completion side’s going to increase once you see prices increase. That’s two thirds of our well costs, more or less. Everybody’s trying to get these numbers down by changing the completion a little bit here or there. I think you’ll see a bit of inflation on that side, but I don’t think it’s as predominant on the drilling side where our efficiencies will be maintained. I think realistically to show a good rate of return, you’ve got to be in that $45 price range.

Making Acquisitions with Stock

Oil & Gas 360®: Lynn, the company recently completed an equity raise of $89 million. You mentioned that raise and your objective of growing the footprint. Can you talk about what the ideal acquisition looks like – where are the assets, where would you put the capital, what’s the target, how big is the acquisition, is it an M&A deal or an A&D transaction?

Lynn Peterson: It’s probably “yes” to all of those. Our emphasis is up in the Greeley area. We’re trying to find acreage that’s contiguous to our existing leasehold, again, where we can drill longer laterals. That’s a real push for us as we go to the second half of 2016 and beyond. Size-wise I’m not too concerned. I think we’ve got the team here to not only evaluate deals, but to integrate and complete a transaction. I don’t worry about size too much; it’s something you look at from the financing side—how do you handle this? Nobody wants to sell properties at $30 oil. But being able to say, “Okay guys, come join us. You’ve got our currency, and if you believe in the play, and if you believe in what we’re doing, you’ll see your appreciation through the currency.”

I think all the transactions we do will utilize stock. We did a transaction mid-2015 that was about 60% stock, 40% cash – that was a nice fit for us. Typically the sellers want to hold our stock; they’re not anxious to get out of the door right away. It also allows us to access the markets and bring in some more institutional holders and broaden our base. Those are some of the things we’re looking for. But it’s really all about the location of the acreage. That’s what it all comes down to.

Oil & Gas 360®: When you look at it it’s is a pretty competitive landscape in the DJ basin. When Wattenberg assets come up for sale, how is Synergy going to win bids?

Lynn Peterson: There are some companies that can transact in the basin and there are a lot of companies that can’t transact in the basin today. I think some competition has been eliminated just through all the financial changes we’re seeing. I think it’s about knowing people. I have always believed that. Trying to find two winners on a deal—you don’t have to have a winner and a loser on a transaction. Also, having our currency is a big value for us. Yeah, we’ve dropped a little bit in the last four months, but oil prices are half what they used to be too. I think today when people look at our stock they see there’s a lot of upside. I think that’s a big plus for us, as opposed to just trying to do all cash transactions.

Oil & Gas 360®: When you think about stock and liquidity, what do you think is the right balance between maintaining liquidity while continuing on a growth path and making acquisitions going forward?

Lynn Peterson: Not having debt is going to continue to be our mode of operation. When we went out and did our equity raise, the quality of our shareholder base really stood out. I was extremely pleased who stepped up. We’ve had calls subsequent to that saying, “we want to do more.”

We have a shareholder base, they put their money up and they trust in us; if we go back and do another deal, they’re still there. At some point do you take on debt? In today’s environment I can’t see that window yet, but down the road things will change and you have to adapt to the times.

But you’re going to see us keep a pretty strong balance sheet. I think we’re in a unique position and let’s not give that up right now. I think it’s going to get worse. I don’t think we’re there yet. You’re going to see the next bank redeterminations. We’ve gone through ours and even as clean as we were we took about an 11% hit.

Oil & Gas 360®: What percent of your acreage do you have to drill to hold the acreage?

Lynn Peterson: We are in extremely good shape. I think we have one lease in 2016 that we need to drill on. We could extend it, but we’ll probably drill on that particular one. We don’t have a gun to our head in any form or fashion when it comes to expiring leases. The big part of this was the vertical wells that were drilled to hold acreage. It’s a vertical play transformed to a horizontal play. We’re in great shape in that regard.

Jon Kruljac: That was also something that was attractive on the K.P. Kauffman Company acquisition. That was all held by production. We didn’t have capital commitments with it, so we could take that asset in and put in a placeholder for a period of time. And it also gave us some more baseball trading cards on our lease aggregation plan to get to more extended reaches over time.

Lynn Peterson: When we look at acquisitions, that is one thing we look hard at. We don’t want to get into a big drilling commitment or a lease expiration issue. These are all factors at play as far as how aggressive we go.

Jon Kruljac: I think when we went out raising money, Lynn’s predominant theme was capital preservation, balance sheet preservation, and so as we look at acquisitions that’s really high on the list. It’s the asset first, where is it located and what is around the asset?

You look at the other sub-criteria, but right at the top is ‘what’s the capital commitment? Can we continue to preserve the balance sheet?’ And then of course, ‘how are you paying for it?’ – stock, cash, assumption of debt, those kinds of things.

Weld County and Colorado Geopolitics

Oil & Gas 360®: There are some proposed ballot initiatives for 2016 that would hand over permitting decisions to local governments, impose setbacks of 2,500 feet to 4,000 feet. Last month the city of Greeley denied a permit to Extraction Resources. What’s going on up there?

Lynn Peterson: Again, this is what has built this company. A lot of us are Colorado natives. The people we’ve hired, a lot of them are Colorado natives. Being able to work with municipalities, being able to work with residents—we take a lot of pride in that. When you talk about setbacks, a lot of that we’re already doing. If we have a location that is close to a school or some type of facility like that, we’re glad to move around; we’re more than willing to do that. You can’t really have a 2,500 foot setback. It would shut down the whole industry.

When you look at the tax dollars that are going out to these districts, the counties, the schools, the oil and gas industry is an invaluable part of Colorado’s economy. I think it’s a shame being a native here, how this state’s changed. We’re trying to train our staff that when people go to a soccer game, a church function or whatever it might be, they can talk to the constituents about what we’re doing, how we’re doing it, how we’re siting [wells]. That’s a big push that we’re trying to do internally here.

So while we certainly are aware of it and concerned with it, we don’t believe that we will be hindered by it. The addition of the Brian Macke. And of course Craig Rasmusen [Synergy’s chief operating officer]. They are a big part of the team here and will be a big part going forward.

We are more than happy to roll up to someone’s breakfast table, have a cup of coffee and talk about what we are doing. This is what we do.

We’ve got two operating pads within a couple miles of the Extraction Resources location. One of the things that struck me when Greeley denied that permit was the fact that the company said ‘we can’t bring pipelines in here to get the commodities out – because of pricing’.

Well shame on us as an industry if that’s really the way you feel, because if you have a house in there you don’t want an oil tank truck running back and forth on a daily basis because you’ve got kids and everything—we get that. We’ve got a multi-well pad sited just east of that location and it’s already approved. We’re trying to time it so we get pipelines into the area. We understand there’s a cost of doing that, but we’ve got to be a good neighbor.

You can’t go in and tell residents you can’t do these things because it costs you money. You don’t tell the residents, ‘sorry, but you have to deal with it’. That doesn’t fly. Again, it goes back to being real people. We live in these communities. A lot of our staff lives up in the Greeley/Windsor area. We love to hire people up there because we want our people to be a part of the community. We’ve got to be good stewards of what we are doing.

Everything we’ve talked about comes back to this: do what you would like to have done in front of your own house.

It goes back to Synergy’s founding. Ed Holloway lives in the area [in Weld County] and he’s a very conscientious person. Craig Rasmusen, our COO, used to be the head basketball coach at UNC in Greeley. I went to school at UNC. We’ve got a lot of UNC grads. We know people in these communities; the leaders of these areas are our friends. We want to continue that. I’m proud to say I’m a native of Colorado. I love this state. Dan Kelly is the same—he spoke highly about that when he joined our board.

Oil & Gas 360®: Thinking about the effects that extended setbacks would have on the industry, do you think the chances of ballot initiatives getting on the ballot and passing in 2016 are likely to be slim?

Lynn Peterson: You hope so. You don’t know until the election, but I think our industry’s gotten a lot better at trying to educate voters, and get the positives out there.

When we look at extended length and mid-length laterals for example, we’re trying to do some things from our standpoint to lessen the footprint. We don’t have as many locations. You have to find a balance, and I think we’ve been pretty sensitive to that.

Testing the Greenhorn

Oil & Gas 360®: Synergy tested the Greenhorn zone last fall, how did it look to you? Can you say what are the plans going forward?

Lynn Peterson: We came out in our last quarter and tried to be pretty straightforward about it. We are making oil with the well; it’s not really commercial at $30 oil prices. We’re not going to spend additional money today trying to develop it. The team we have brought in here was very much involved with testing the Greenhorn in several areas at their previous company. We’re actually involved in a data swap right now with that company so we can see what we did right and what we did wrong, and vice versa. I think it’s a very interesting formation to test. I think that at the right oil prices it will evolve. If you go back in history these plays didn’t start over night; the first well was not always successful; they took years in some cases to figure out where to drill. We went out east; it was a thicker zone. We have to think about temperatures, did we complete it right—slickwater vs. hybrid gels. There are a lot of things we’re trying to go back and evaluate. But at some point I think it could be a real viable play in this basin.

Oil & Gas 360®: How far do you see the extension of Synergy’s operations in the DJ eventually going?

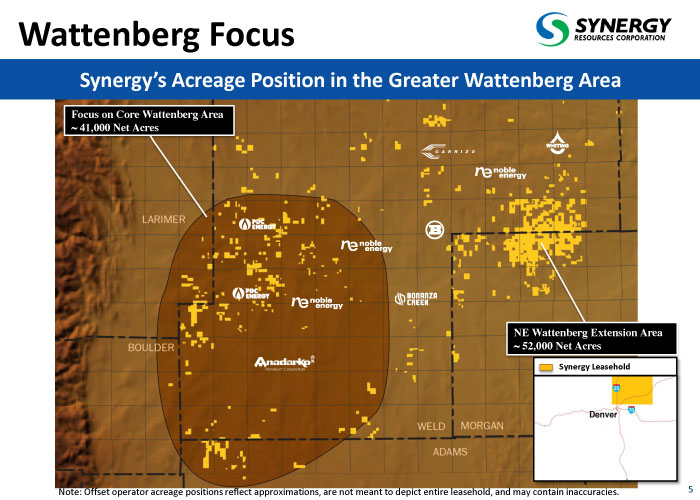

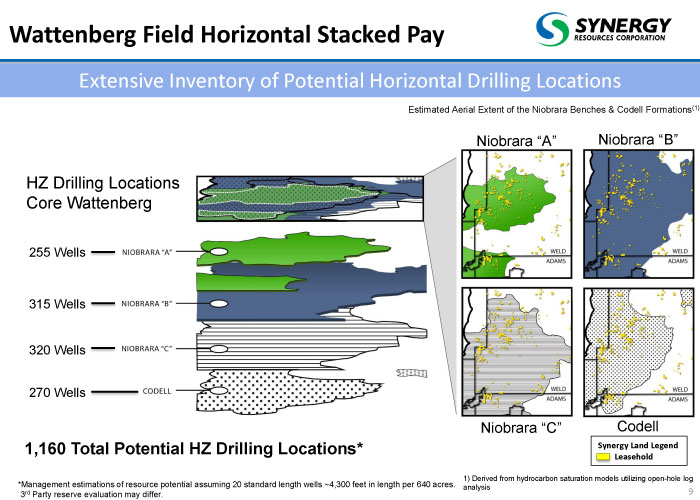

Well, let me just focus back to the Wattenberg. We really talk about 90,000 acres, and we identify that as 41,000 in what we think of as the core of the Wattenberg. And about 50,000 acres sit out east where we did the Greenhorn test. Part of that could have Niobrara in the very northwestern part of it, but it was put together for the Greenhorn test.

We have other acreage that will be a divestiture candidate at some point. The reason it was assembled was really because of the geopolitical risk. Five years ago, everybody was concerned if you got shut down, where are you going to go. So it was put together for that reason.

Jon Kruljac: Apache was putting a huge position together out there, and said this looks intriguing. The price was right—we paid a nominal amount in stock per acre, for 10 year leases, all paid up. But Synergy really is about the 93,000 acres we have in Weld and Morgan Counties, and it’s really about the core 40,000 acres.

Lynn Peterson: I have never tried to believe you have to have the most acreage in a play. What I really want to know a couple of years from now is that we’ve got the best acreage. I think we can do that in the Wattenberg; we’re starting with a nice base, and we can build up from that. We’re trying to stay focused. I want to be really good at what we do and not try to be something to everybody. There is plenty of opportunity in the Wattenberg.

Oil & Gas 360®: To sum things up, Lynn, what is your personal vision for Synergy?

You know, I think at the end of the day we’re all in this for the same reason: to build something. How fast it happens is going to be dictated by economic conditions. We were fortunate to be able to do that at Kodiak—and it made a lot of shareholders a lot of money. That’s part of the reason we’re able to go out to the Street today and do some things. A lot of people said, ‘we’re glad to have you jump back on the boat’.

You know, I think at the end of the day we’re all in this for the same reason: to build something. How fast it happens is going to be dictated by economic conditions. We were fortunate to be able to do that at Kodiak—and it made a lot of shareholders a lot of money. That’s part of the reason we’re able to go out to the Street today and do some things. A lot of people said, ‘we’re glad to have you jump back on the boat’.

Jon Kruljac: We’re seeing a change in our shareholder base. People that were on the sidelines looking at us have come in at a difficult time in the last six months and started to take positions, and it is with the backdrop of having Lynn come in to run the company. Some of the tier one names on the buyside are anteing up, and so are energy-specific hedge funds.

Lynn Peterson: We want to grow this company within the core Wattenberg area. I think we can get to No. 3 or No. 4 in the basin. One or two companies in the basin are the giants, and PDC (ticker: PDCE) would be next. I have a lot of respect for what they’ve done, and if we could put a company together that would mirror something like that, I think it would be awesome.