Mexico’s rapidly changing oil and gas industry took another step forward last month, reaching an agreement with the United States Bureau of Industry and Security to swap crude oil depending on its respective grades. U.S. refineries, particularly on the Gulf Coast, are more equipped to handle heavy and sour grade crudes like Mexico’s Mayan crude oil.

U.S. refineries best suited for light crude grades, as those from shale plays including the Eagle Ford, are not as prominent.

The opposite holds true in Mexico, where refineries south of the U.S. border are more adept at handling the lighter grades. According to the Energy Information Administration (EIA), Mexico’s combined refinery capacity is 1,540 MBOPD and only 42% (about 646 MBOPD) of the refinery capacity is able to process heavy crude. The nation is home to only six refineries.

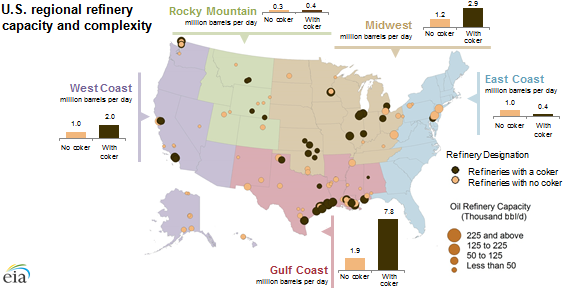

The United States, on the other hand, has 137 operating refineries with capacity of 17,967 MBOPD. More than half of the capacity (9,216 MBOPD) is in PAD District 3, which encompasses Louisiana, Texas and other states bordering the Gulf of Mexico. PADD 3 holds 51 refineries, of which 81% have coking capacity that allows the processing of heavy crude. The flows of light crude had become so great that the United States had virtually eliminated any light grade imports earlier this year.

A Welcome Agreement

Several critics have mentioned the possibility of crude swaps as Mexico has progressed on its energy reform. Even the EIA hinted at the benefits of a US-Mexico partnership in an April 2015 report. Preliminary agreements call for a swap of about 100 MBOPD, according to earlier filings from Petroleos Mexicanos, Mexico’s state-owned oil company. The contract has a length of one year.

Increased cooperation between the neighboring North American countries was an element of a presentation made by Ricardo Garcia-Moreno of Haynes and Boone at EnerCom’s The Oil & Gas Conference® 20. Garcia-Moreno noted that a lack of infrastructure can hamper Mexico’s advancements in the energy sector, but the country is proactively creating new opportunities to exploit its resources.

Among those is a tender for 24 projects from Mexico’s Federal Electricity Commission, including five natural gas pipelines. The tenders include $10 billion of total investment and will expand the country’s natural gas pipeline network by 75% by 2018.