Analysts have pegged scores of oil and gas companies as potential takeover targets in the new commodity environment, but Williams Companies (ticker: WMB) is one of the few who has remained in the acquisition spotlight ever since a failed takeover attempt was made public in June. The rejected offer of $53.1 billion from Energy Transfer Equity (ticker: ETE) was refused by Williams, with the company saying the unsolicited offer was a significant undervaluation. At the time, the proposal represented a 32.4% premium to WMB’s closing price on June 19, 2015, and did not include the value of its impending merger with its limited partnership.

Energy Transfer Still in Pursuit

Today, Reuters reported Spectra Energy (ticker: SE) pulled out of the bidding process for Williams, likely strengthening Energy Transfer’s position for another takeover bid. Comments from ETE regarding a merger have understandably been few and far between, but the management team did acknowledge its involvement in Williams’ strategic alternative process during its Q2’15 conference call. The latest published acknowledgement of its involvement with Williams was in a July 7 press release, which pledged to be “fully committed to taking the necessary steps to implement the proposed transaction.” WMB management declined to take any questions regarding a merger on their respective call.

A Williams Shareholder Dilemma

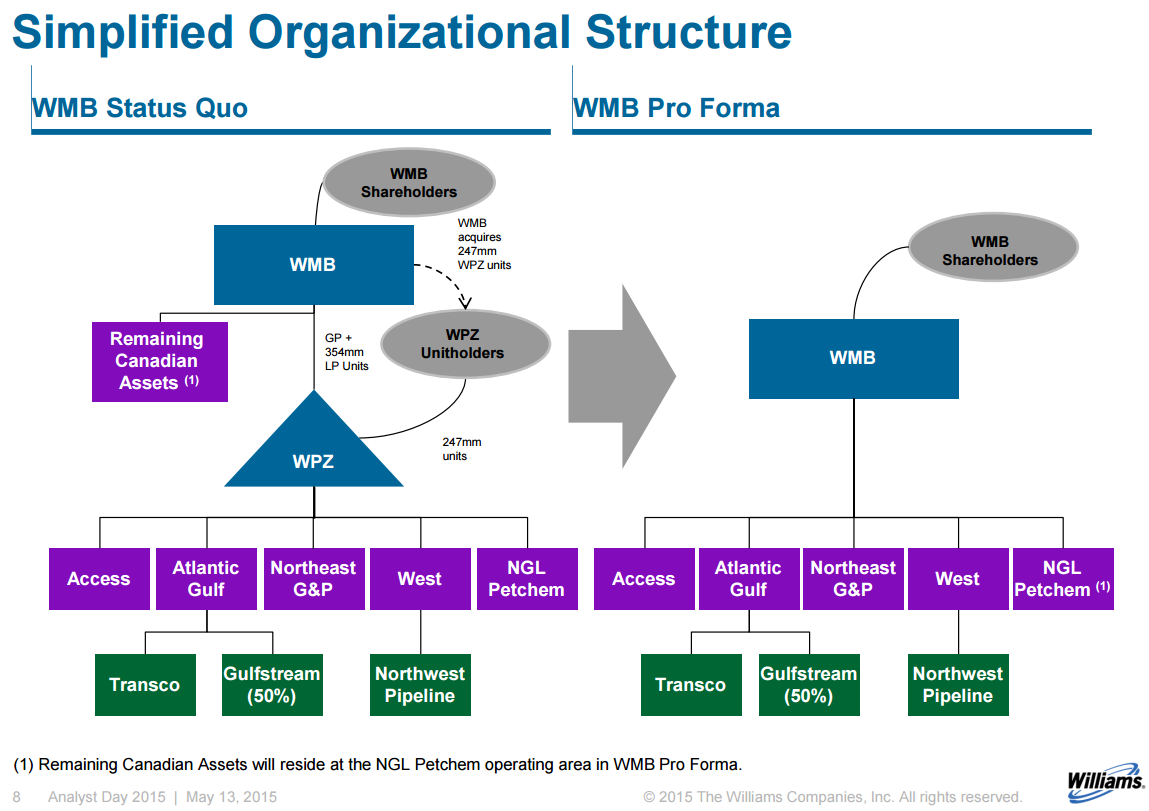

ETE’s attempt to buy Williams and break off the parent company’s pending merger with Williams Partners (ticker: WPZ) has created a unique ordeal for Williams shareholders. Statements from ETE management propose a ETE/WMB merger would create more value for Williams shareholders than a WMB/WPZ integration.

The pending merger between the two Williams entities was announced in May, with the intent of streamlining the corporate structure. Energy Transfer closed on a similar deal in April, merging with its Regency Energy Partners subsidiary for a total transaction value of $18 billion.

WMB owns 60% of WPZ and said a successful merger would be beneficial to dividends. WMB increased its annual dividend to $2.56/share on September 11 and forecasts compounded dividend growth of 10% to 15% through 2020 if the WPZ merger is completed. If successful, WMB shareholders are in line for dividend payouts of $4.57/share by the end of the decade.

In a June 22 news release from Energy Transfer confirming their bid for Williams, the company tried to sway WMB shareholders in their favor by saying a ETE/WMB merger would create an even better dividend payout scenario and would be better positioned for long-term growth with ETE’s balance sheet. For reference, ETE’s dividend coverage ratio of 0.9x (on a compounded quarterly basis dating back to Q1’14) is more than double than that of WPZ’s mark of 0.4x, according to EnerCom’s MLP Weekly Benchmarking Report. Its distributable cash flow ratio of 1.20x, year to date is also higher than WPZ’s ratio of 0.93x.

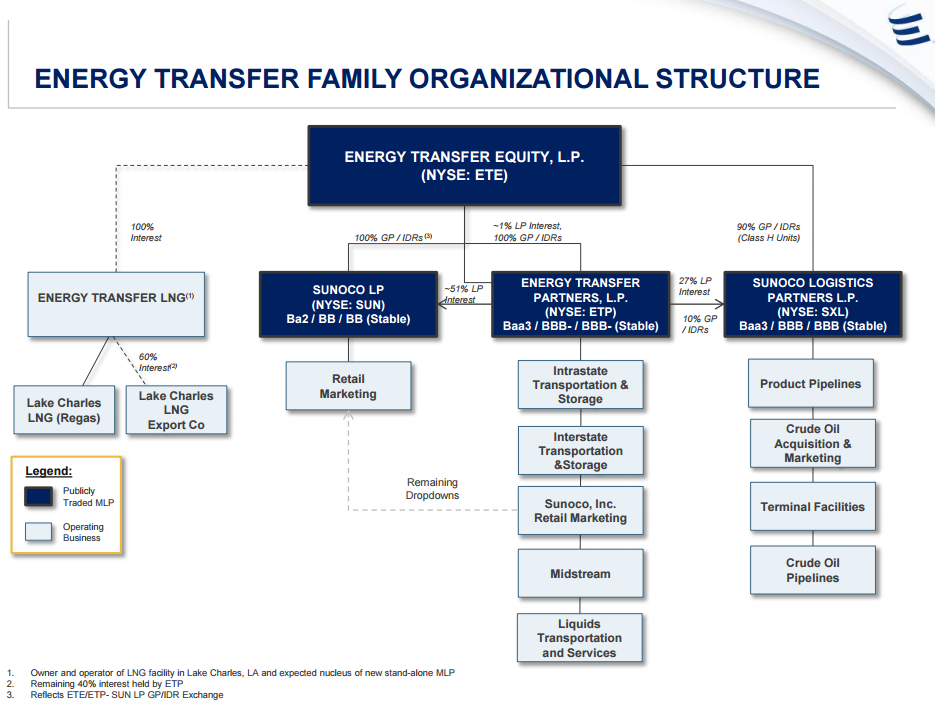

Energy Transfer recommended the merger to its own shareholders, saying a WMB acquisition would create a vast growth platform (the world’s largest energy infrastructure group and third largest energy franchise in North America) as well as be immediately accretive to earnings. Benefits realized by WPZ stakeholders, according to ETE, include being involved with a larger general partner that could create new commercial opportunities.

What Happens Next?

According to ETE statements, the two sides have likely been engaged in discussions since the beginning of the year and have remained in touch even after talks fell through in late June. Williams first disclosed the proposal without identifying the offering company, to which Energy Transfer quickly admitted to the role of the purchasing company. ETE management expressed disappointment in a company release and even hinted at frustration, saying WMB “inexplicably ignored” discussion requests from ETE for five weeks before publicizing the takeover bid. Reuters says many of its industry sources believe ETE could launch a hostile takeover attempt by appealing directly to WMB shareholders if discussions go awry once again.

When the offer was first made in June, analysts interviewed by Reuters said the ETE proposal may be WMB’s “best offer,” which holds even more weight now that Spectra is reportedly out of the picture. Kinder Morgan (ticker: KMI) was also rumored to show interest, but KMI is currently the largest energy infrastructure company in North America and meeting anti-trust issues would likely be a significant hurdle.

Williams executives say there is no definitive timetable on when the strategic review will be complete.