Goodrich Petroleum (ticker: GDP) is an independent oil and gas exploration and production company with operations in the Eagle Ford Shale, Haynesville Shale and Tuscaloosa Marine Shale (TMS). As of late, Goodrich has been a pioneer of an emerging oil play, the TMS, in Louisiana and Mississippi. Eight of GDP’s last 10 wells have returned peak 24-hour rates greater than 900 BOEPD.

OAG interviewed Robert Turnham, President and Chief Operating Officer of Goodrich Petroleum, after completion of the Blades 33H-1 well (66.7% working interest) in April 2014. The Blades well achieved a 24-hour production rate of 1,270 BOEPD (98% oil) from 20 frac stages. In the interview, Turnham said two other wells, the C.H. Lewis 30-19H-1 (81.4% WI) and the Nunnery 12-1H-1 (93.3% WI), both located in Amite County, Mississippi, were being completed using the same technique as the Blades, including shorter frac intervals (250 feet per stage) and greater amounts of proppant (550,000 lbs. per stage). Another well, the CMR 8-5H-1, was completed using the same method and produced a 24-hour rate of 950 BOEPD.

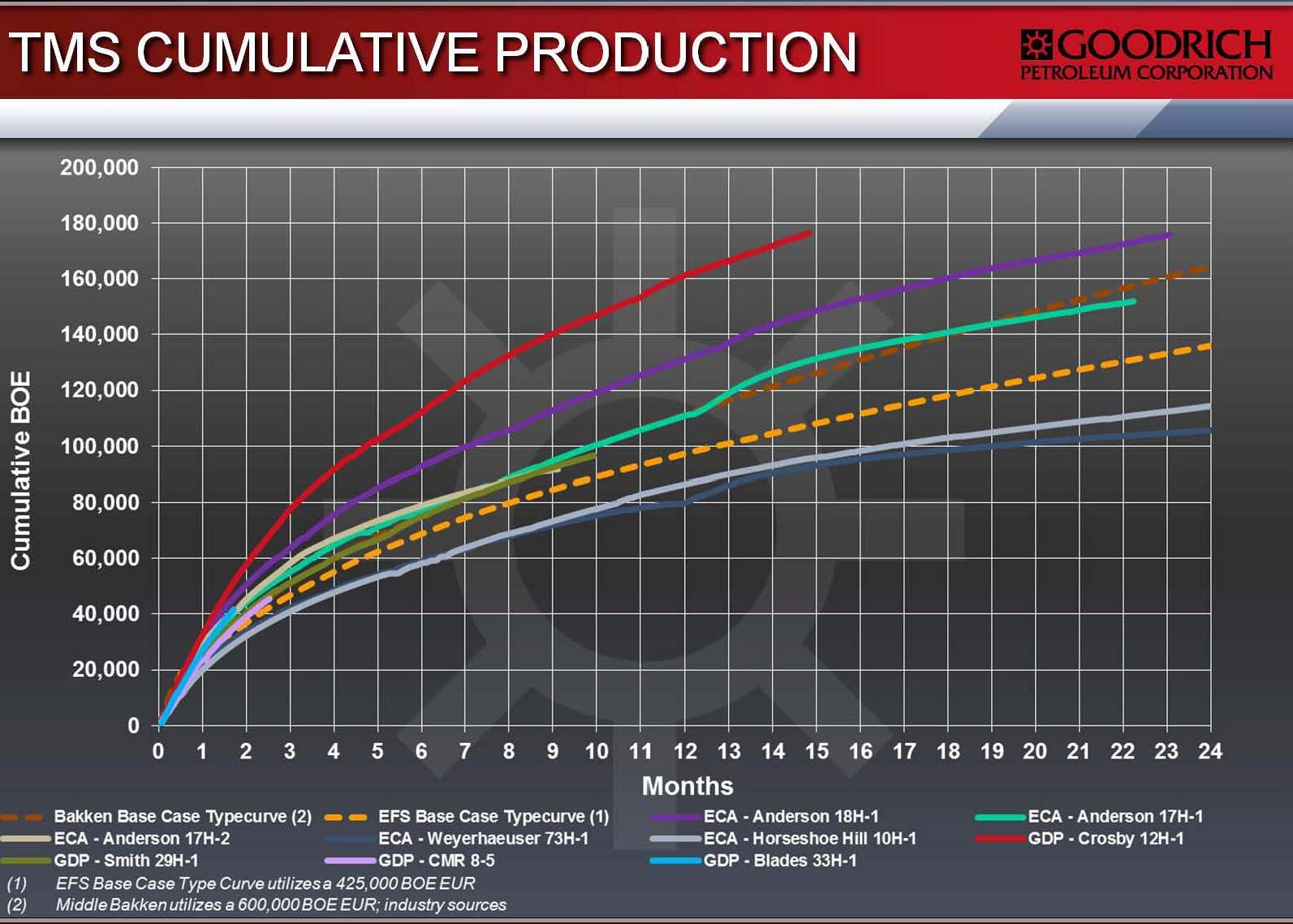

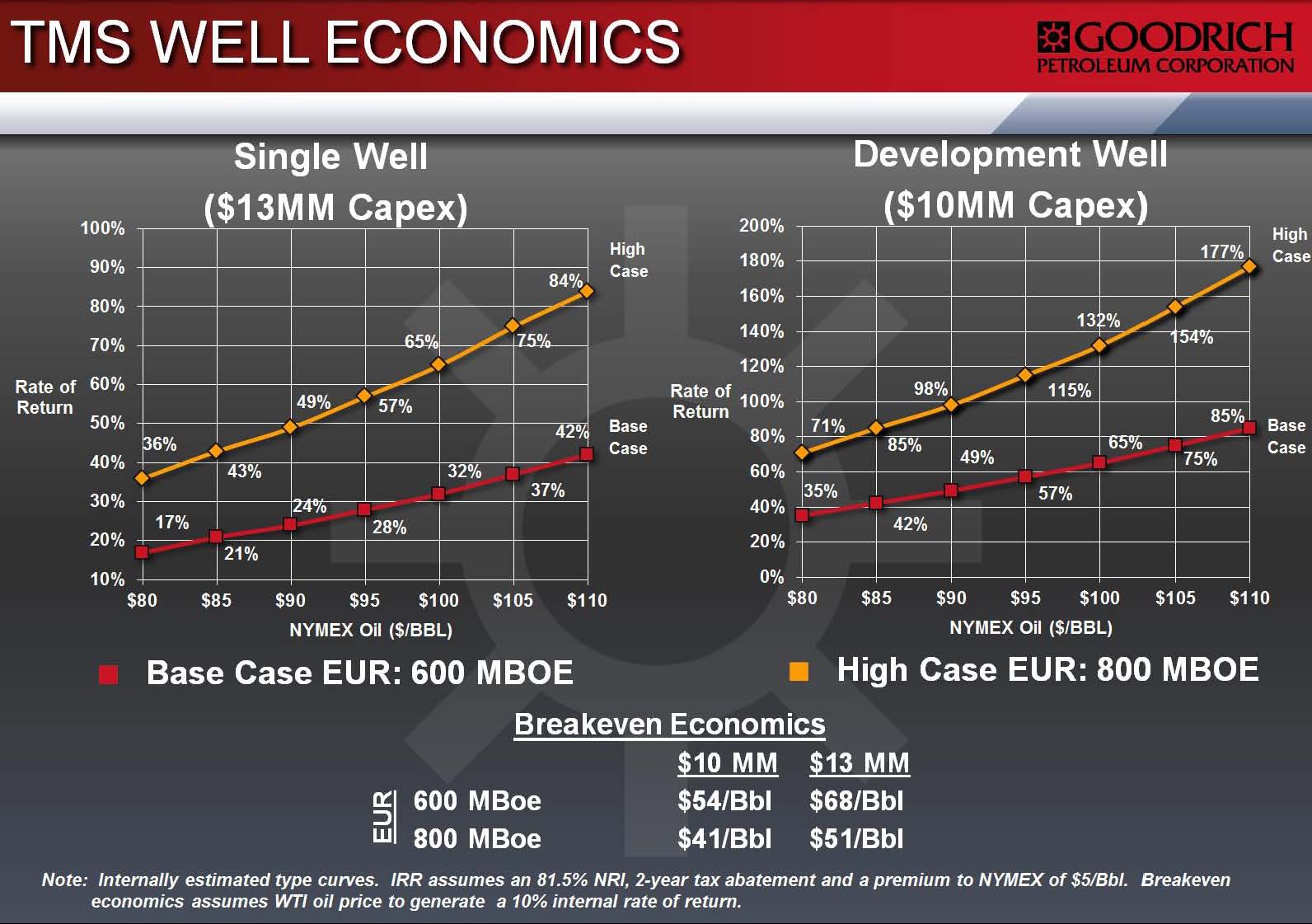

Turnham said: “When you see our wells, where we have sufficient lateral lengths and a similar frac recipe, whether it’s our wells or other operators, we’re seeing anywhere from 600 MBOE to north of 800 MBOE in EURs. We’re pleased with not only the initial rates but the decline curves are holding up very well as expected.”

High Well Rates Continue

On June 2, 2014, Goodrich announced results from the C.H. Lewis 30-19H-1. The well was completed with 26 frac stages and reached a peak 24-hour rate of 1,450 BOEPD (96% oil). According to Luke Lemoine of Capital One Securities, the C.H. Lewis rate is the second-highest of any well drilled in the TMS, trailing only Encana Corporation’s (ticker: ECA) Anderson well that produced a peak 24-hour rate of 1,540 BOEPD.

In addition, the Nunnery has commenced flowback after being completed with 22 frac stages. The Beech Grove 94H-1 (66.7% WI) in East Feliciana Parish, Louisiana, is being completed with 21 frac stages. Results from both wells are expected within June 2014. Four other wells, including two in Amite County, are currently being drilled.

In the OAG360 interview, Turnham said GDP has overcome the initial learning curve and the company is consistently reducing drill times and well costs. Goodrich is the largest operator in the TMS and holds approximately 320,000 net acres. Five rigs are expected to be running at the end of 2014. Only two rigs were running at the end of 2013.

Only two other operators, Encana and Halcon Resources (ticker: HK), have significant activity in the TMS. Encana plans on drilling nine to 12 wells in 2014. HK anticipates drilling 10 to 12 operated wells by running two rigs, and its first well of the year was being completed at the time of its Q1’14 earnings release on May 7, 2014.

Next Step: Joint Venture?

In its Q1’14 conference call on May 8, 2014, Gil Goodrich, Vice Chairman and Chief Executive Officer of Goodrich Petroleum, said, “With the play’s inflection point upon us, our current plans include the initiation of a joint venture process in the TMS in the second half this year, which would include bringing in a new JV partner or expanding our existing relationship.”

Goodrich Petroleum is certainly becoming more attractive to potential partners as its operations in the play have improved. The company formally set expenditure estimates of $13 million with 45 drilling days per TMS well. Recent wells, including both the C.H. Lewis and the Blades, have been drilled and completed in 36 days. Turnham told OAG360 that GDP saves about $100,000 for each drilling day it is able to cut off the drilling cycle. Once it switches to pad drilling next year, drilling days will likely continue to decrease and costs will likely drop even further.

“In the case of the success scenario where we’re running seven, eight, nine rigs next year, is certainly going to be very capital intensive,” said Goodrich in the call. “We will need to be bringing in some incremental capital to help us do that. And therefore, we’re going to have to go through a very detailed rationalization of all of our assets to make sure that we were optimizing those and bringing the capital in the most efficiently, with the least dilution for our shareholders.”

Goodrich said GDP still plans to operate the vast majority, if not all, of its acreage. Capital One Securities placed a value of $1.40 billion for GDP’s 320,000 net acres ($4,400 per acre) in the play. GDP’s enterprise value was $1.78 billion according to EnerCom’s E&P Weekly on May 30, 2014. The cash from a joint venture would certainly pad GDP’s liquidity, which was roughly $241 million for the quarter ended March 31, 2014. The company lists 2014 expenditures at $325 million to $375 million, with $225 million to $300 million directed at TMS development.

Goodrich Petroleum will make a 30-minute presentation in London during EnerCom’s London Oil & Gas Conference™ 6. The webcast of the presentation starts at 10:00 AM British Summer Time, or 5:00 AM U.S. Eastern Daylight Time, and can be accessed by clicking on this link.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom has a long-only position in Halcon Resources.