All parties seem to agree, but holdup remains

The state of Alaska plans to buy out TransCanada’s (ticker: TRP) share of the Alaska LNG project. Both Alaska Governor Bill Walker and TransCanada have agreed to the deal, according to Alaska Dispatch News, but the funds necessary to purchase TransCanada’s share in the project still need to be approved.

Alaska LNG has been described as a “gigaproject” by those involved, with an estimate price tag of $45 billion to $65 billion. The project has stayed on track despite the plummet in prices since November of last year, largely because of its size. The project is being developed by a partnership including energy majors BP (ticker: BP), ExxonMobil (ticker: XOM), ConocoPhillips (ticker: COP) and TransCanada, who represents the state of Alaska’s interest in the project.

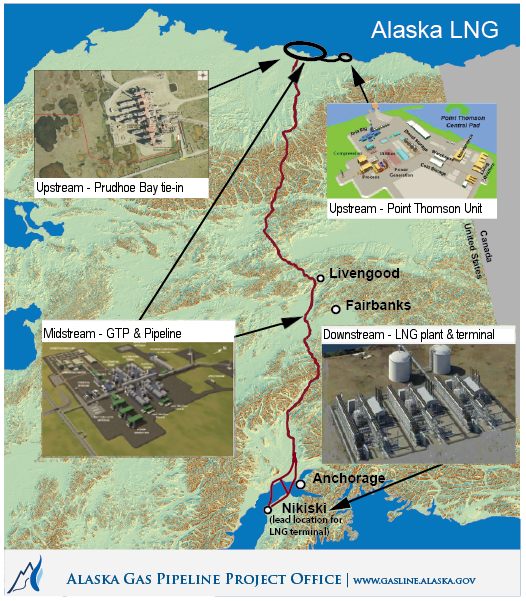

Once complete, the Alaska LNG project will include a three-train, 6 million tons per annum (approximately 246 Bcf per annum) LNG plant and a gas treatment plant with expected capacity of 3.7 Bcf/d, connected by an 800 mile, 42” pipeline with a minimum of five domestic gas off-takes along the pipeline route, according to an Alaska LNG project presentation.

The project is still in the initial phases of determining whether or not to go ahead with construction. Regardless, Alaska is obligated to pay TRP for costs it puts in on the behalf of the state, plus about 7% interest, meaning the state would owe TransCanada about $68 million if the buyout happens.

The project is still in the initial phases of determining whether or not to go ahead with construction. Regardless, Alaska is obligated to pay TRP for costs it puts in on the behalf of the state, plus about 7% interest, meaning the state would owe TransCanada about $68 million if the buyout happens.

Governor Walker is still waiting for approval from the state legislature for $158 million, but the lawmakers want to know who will be running the state’s interest if a buyout occurs.

“I’ve been asking for months now, who is coordinating the efforts of all the state departments, and I haven’t got that answer yet…there is no one person in the administration now who you can go to to get the majority of your questions answered,” said House Speaker Mike Chenault.

Walker said he is already in regular meetings with the project’s other partners and that, for the time being at least, he is in charge of representing the state’s interests, reports Alaska Public Media.

Walker’s administration believes the state would benefit to the tune of $400 million more a year if it buys out TransCanada before gas starts flowing. Walker said he will be coordinating a meeting to be held December 4 in which all parties will vote on whether or not to go ahead with the next year of work and funding.