2014 closed the largest capital program in the history of Bellatrix Exploration (ticker: BXE), and the results were evident on its latest reserves report issued on March 9, 2015. The totals, determined by an independent evaluation, showed proved reserves of 161 MMBOE and proved developed producing reserves of 74 MMBOE – respective increases of 30% and 37% compared to 2013.

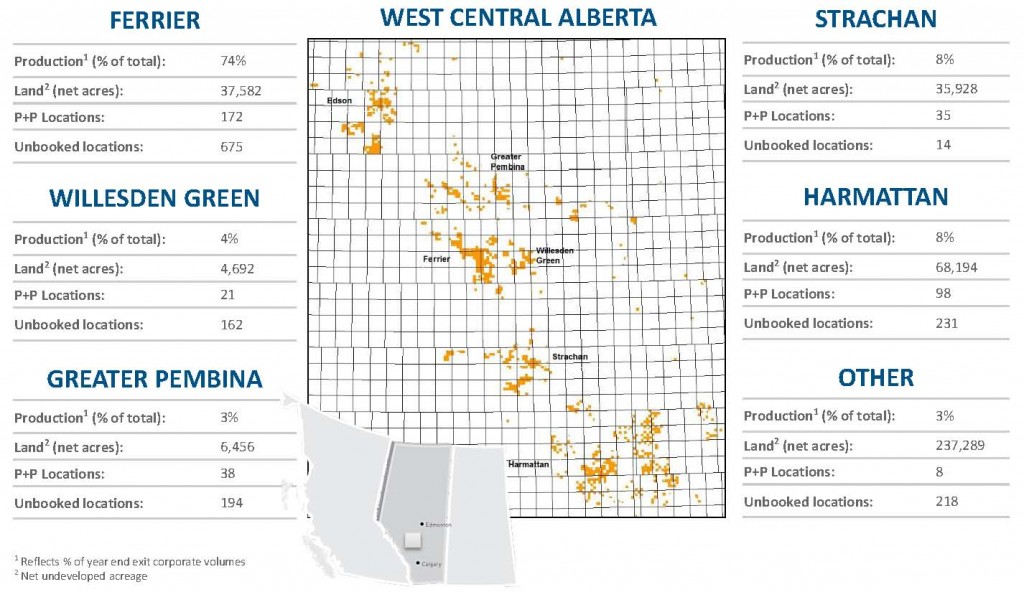

The company estimates its current reserves provide more than ten years of drilling inventory with 466 gross drilling locations (301.8 net) throughout its Cardium and Mannville properties. Its properties span 683,647 net acres across Alberta, Saskatchewan and British Columbia, with the approximately 90% (613,313 acres) residing in Alberta. More than 365,685 net acres are currently undeveloped.

Bellatrix is scheduled to discuss its Q4’14 results via conference call on March 12, 2015.

How Bellatrix Stacks Up

BXE has established its position as a low-cost producer, as evidenced by EnerCom’s International E&P Weekly Report. Based on its Q3’14 results, BXE’s asset intensity (defined as the percentage of every EBITDA dollar required to maintain production) is only 23%, ranking sixth overall out of its 50 Canadian peers. On a trailing three-year basis, its finding and development costs are just $5.48/BOE – the third lowest in the group, while its production replacement of 643% ranks fifth overall.

In the release, the company showed its effective execution on its 2014 drilling plan is paving the way for even more future growth. Total production for fiscal 2014 was 13.9 MMBOE (about 38 MBOEPD), representing a 74% increase compared to 2013’s total of 8.0 MMBOE (roughly 22 MBOEPD). BXE said production replacement for 2014 was 369% despite the sharp increase in production volumes. The net present value of its proved assets is more than $1.4 billion.

2014 Financials

Bellatrix released “select operating results” in the press release, and announced its unaudited expenditures for 2014 totaled $770.9 million. Funds flow from operations nearly doubled year-over-year, reaching $270.7 million from 2013’s total of $143.5 million. BXE says the increase is attributable to the increase in production along with higher realized natural gas prices. Approximately two-thirds of the company’s producing and proved assets consist of natural gas.

In its Q3’14 report, Bellatrix expected to exit fiscal 2014 with net debt of $455 million. The company has approximately $577.4 million available on its $750 million shelf prospectus and was in ordinance with its covenants, which are listed below:

| Position at September 30, 2014 | |||||||||

| Total debt must not exceed 3.5 times EBITDA for the last four fiscal quarters | 1.78x | ||||||||

| Senior debt must not exceed 3.0 times EBITDA for the last four fiscal quarters | 1.78x | ||||||||

| EBITDA must not be less than 3.5 times interest expense for the last four fiscal quarters | 12.07x | ||||||||

2015 Forecast

The company successfully reached its year-end 2014 volume guidance of 47 to 49 MBOEPD and expects to the rates to dip slightly in 2015 to 43 to 44 MBOEPD. The projected volumes are still a 15% increase compared to 2014 and will come entirely through its organic projects.

The continuous flow is expected to be achieved despite a modest capital program of $200 million, which is less than half of the $450 million budget that was forecasted in Q3’14. Management said the updated budget will be revisited on a continuous basis and can be adjusted if prices recover. An additional $85 million of gross capital may be accessed for its joint venture opportunities.

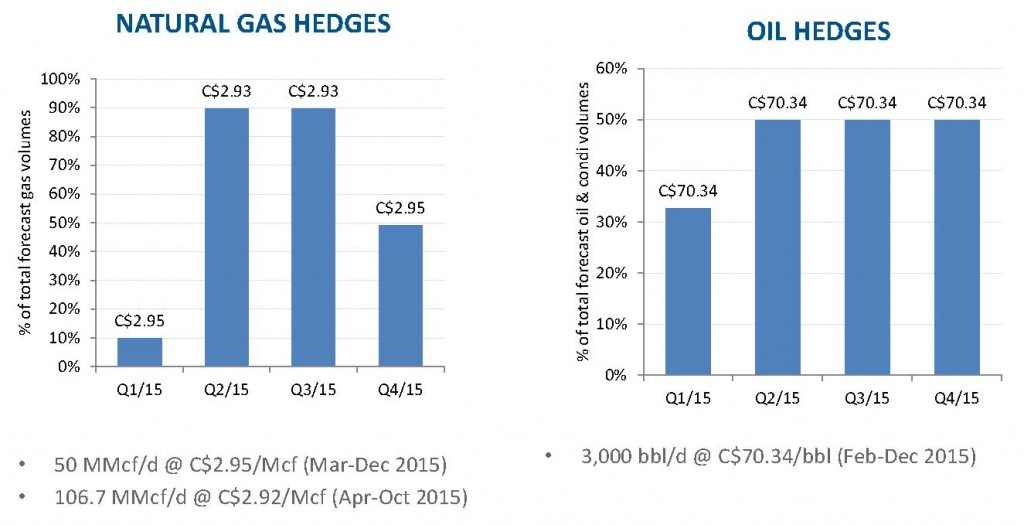

The company has commodity contracts in place for approximately 90% of its gas volumes at prices of C$2.93/MMcf through October, and the Calgary-based E&P believes it is well-suited for the current market. Brent Eshleman, Executive Vice-President and COO of Bellatrix Exploration, told Oil & Gas 360® in December that: “We have seen these downturns in the past, and have positioned the company accordingly to manage through these times. Good management teams position their companies in the good times, to handle these volatile times.”

Focus points for 2015 include the continued construction of the O’Chiese Nees-Ohpawganu’ck deep-cut gas plant, which is scheduled to come online in July 2015. The plant is designed to process up to 110 MMcf/d, increasing BXE’s net production capacity to 65 MBOEPD in regards to its current access to processing. Phase 2 of the plant has been temporarily deferred due to the market, but the company will not accrue any additional costs. Once completed, the second phase will increase BXE’s capacity to 80 MBOEPD.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.