The results are in.

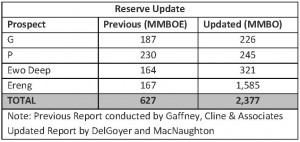

CAMAC Energy’s (ticker: CAK) updated estimate on four prospects offshore Nigeria revealed unrisked P50 recoverable resources of 2,377 MMBO – a 443% increase from the previous estimate of 537 MMBO. In a conference call following the release, Dr. Kase Lawal, Chairman and Chief Executive Officer of CAMAC Energy, said the increase will have a “monumental impact on our organization.”

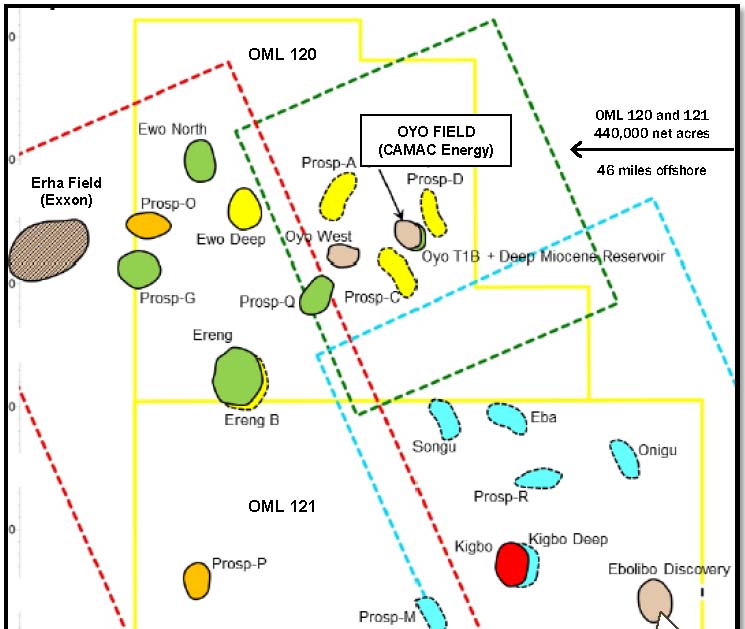

The reserve base consists of CAK’s prospects in its D, G, Ewo Deep and Ereng prospects in Oil Mining Leases (OML) 120 and 121, where the company holds 100% ownership of operations. The company identified the four prospects as the best of their seven total prospects and did not conduct estimates on its Ewo North, P and Q locations. The research report was conducted by Houston-based DeGolyer and MacNaughton. Click here for the full report.

CAMAC announced the discovery of new formations, such as the Miocene, when it first drilled the Oyo-7 well in late 2013 and then again with the Oyo-8 in August 2014. “We are entering uncharted territory, considering the Miocene was penetrated in our blocks for the first time just last year,” said Earl McNiel, Chief Financial Officer, in the call. The company’s was primarily targeting the Pliocene formation, but the Miocene has greater potential, as evidenced by Shell’s Bonga field just south of CAMAC’s properties. The Bonga produced 450 MMBO from 2006 to 2012. CAK expects both Oyo-7 and Oyo-8 to each produce 7 MBOEPD from the Pliocene alone once they are turned in line.

CAMAC announced the discovery of new formations, such as the Miocene, when it first drilled the Oyo-7 well in late 2013 and then again with the Oyo-8 in August 2014. “We are entering uncharted territory, considering the Miocene was penetrated in our blocks for the first time just last year,” said Earl McNiel, Chief Financial Officer, in the call. The company’s was primarily targeting the Pliocene formation, but the Miocene has greater potential, as evidenced by Shell’s Bonga field just south of CAMAC’s properties. The Bonga produced 450 MMBO from 2006 to 2012. CAK expects both Oyo-7 and Oyo-8 to each produce 7 MBOEPD from the Pliocene alone once they are turned in line.

Operational Guidance

CAK management said the Ereng and G prospects are its top two targets and the company is currently evaluating well designs. Three of the four prospects can be drilled with its current drillship but the fourth is too deep, so the company will evaluate options for the fourth location. The discussion of new wells has also opened the door for a possibility of a new drillship, and, in turn, a partner to join CAK’s new projects. “We are simultaneously looking for a partner, and that’s the reason we signed a contract with Stellar Energy Advisors three weeks ago, in order to attract teams,” said Dr. Lawal. Stellar is based in London and provides acquisition and divestment services to companies internationally. Its clients include Afren and Nexen.

In 2015, CAK believes it can finance the first of its high impact wells through cash on hand and incoming cash flow from its new wells. The company also has $100 million available from its credit facility, which closed on September 8, 2014. The first well for its new prospects is expected to be drilled in 1H’15 and will target the Miocene.

Meanwhile, operations have resumed at Oyo-8 following repairs to the drillship and management reinforced Oyo-7’s targeted production date of December 2014. The Oyo-8 will begin production the following month. Management said the operation is moving forward as planned and there are no delays for the time being. The company expects volumes to increase by 14 MBOEPD once both wells are online and add another 7 MBOEPD once the Oyo-9 is completed within 2015.

The company was cautious with questions regarding valuation and potential flow rates in the call, but McNiel expressed optimism in future operations: “We have been very successful in terms of the Miocene, and we are confident in our team’s ability moving forward,” he said.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.