On November 7, 2017 Carrizo Oil and Gas, Inc. (ticker: CRZO) announced the company’s financial results for Q3 and provided an update on current operations. Carrizo reported third quarter of 2017 net income attributable to common shareholders of $5.6 million, or $0.07 per basic and diluted share, compared to a net loss attributable to common shareholders of $101.2 million, or $1.72 per basic and diluted share in the third quarter of 2016.

For the third quarter of 2017, Adjusted EBITDA was $132.8 million, an increase of 46% from the prior-year quarter due to higher production volumes and commodity prices.

According to the company’s press release, production volumes during the third quarter of 2017 were 5,080 MBoe, or 55,224 Boe per day, an increase of 35% versus the third quarter of 2016.

Operations

Delaware Basin

Carrizo closed their most recent Delaware acquisition in the third quarter of 2017. Carrizo paid Exl Petroleum Management $648 million to acquire 16500 net acres in Reeves and Ward counties. When the deal was made the acreage was producing about 8,000 BOEPD from 11 wells, and an additional seven wells were either being drilled, completed, or flowed back. Carrizo purchased the acreage with plans to target Wolfcamp A, and the Upper and Lower Wolfcamp B.

In the third quarter in the Delaware Basin, Carrizo drilled 5 gross (3.8 net) operated wells during the third quarter and completed 3 gross (2.4 net) operated wells.

Since taking over operations on the Delaware Basin properties acquired from ExL during August, Carrizo has successfully upgraded the drilling rigs on the acreage with more modern equipment. Carrizo is currently operating four horizontal rigs on the acreage, and expects to temporarily add a fifth rig later this quarter in order to build an inventory of locations.

To further ensure a smooth development on the properties, Carrizo has also elected to accelerate the build-out of its water handling system in the area, shifting activity originally planned for 2018 into 2017. As a result of these schedule changes, as well as an increase in non-operated activity on its acreage in the Delaware Basin and DJ Basin, Carrizo is increasing its 2017 drilling and completion capital expenditure guidance to $600-$620 million from $590-$610 million.

Carrizo is currently running four horizontal rigs in the basin, and recently secured another Generation 5 rig, which should arrive later this week.

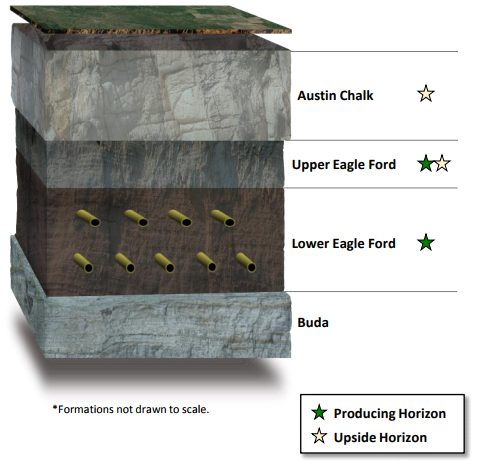

Eagle Ford Shale

In the Eagle Ford Shale, Carrizo drilled 24 gross (19.8 net) operated wells during the third quarter and completed 19 gross (17.7 net) operated wells. Crude oil production from the play was more than 30,000 barrels per day for the quarter, nearly flat with the prior quarter despite the impact of Hurricane Harvey. The Company is currently operating two rigs in the Eagle Ford Shale, and expects to drill approximately 90 gross (77 net) operated wells and complete 88 gross (82 net) operated wells in the play during 2017.

Source: Carrizo Oil and Gas, Inc.

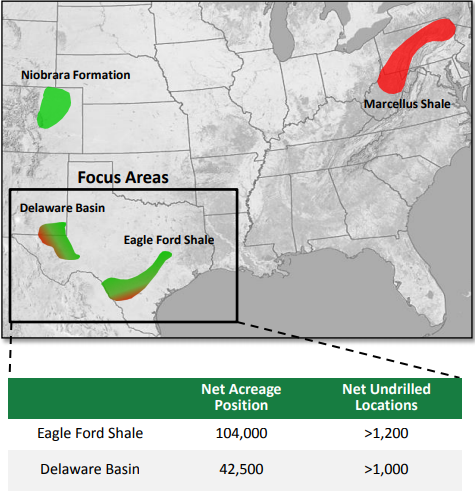

Niobrara Shale

In the Niobrara, Carrizo is producing from 132 gross or 59 net wells. Throughout the third quarter 9 gross or 5.2 net operated wells were completed, with new completion designs. Two of the wells were completed with tighter stage spacing, higher proppant concentration, and a different fluid design. Early results are positive as production from the wells is at or above our type curve for the area.

Utica and Marcellus

Over the past several months, Carrizo entered into agreements to sell its assets in the Utica Shale and Marcellus Shale. Both divestitures are currently expected to close during November. According to the companies press release, the Marcellus Shale Assets were sold to a subsidiary of Kalnin Ventures LLC for $84 million. Net production from the sold assets averaged more than 40 MMcf/d of natural gas.

Source: Carrizo Oil and Gas, Inc.

Q&A from CRZO Q3 conference call

Q: I’m wondering if you could quantify the stagger-stack potential on the SN properties. And then you mentioned some optimization projects, were you referring to maybe re-completes there? Or just any color that you can provide on that as well.

President and CEO, Sylvester P. Johnson: We think that there could be stagger-stack potential on the Sanchez properties. There are not only some new areas where there is virgin drilling on the lower part of the lower Eagle Ford but then there are also some areas where lower Eagle Ford was under-stimulated in our opinion. So, we can call those either stagger-stack or infill wells, but there is potential for that. We’re also considering re-fracs. In general, we would rather just drill a new well than do a re-frac since our well costs are down to about $1 million on the drilling side right now. But that’s something we’re going to investigate.

Generally, the only wells we would want to re-frac are wells that were under-stimulated in the first place. And in those cases, maybe, it’s better to just drill wells around it, probably get a better frac job and better results.

Q: It looks you’re stepping up the infrastructure spend in the Delaware a little bit. Should we take this as a sign that you see the Delaware as a potentially growing piece of the portfolio longer term?

Sylvester P. Johnson: I think what it says is that we are drilling more wells than we planned to because we’ve seen the results come in better than even we thought on the West side of our acreage. So that’s led to more wells. And we’re also now building infrastructure even before we start drilling the well because we know what the result is going to be like and we don’t want to have 4 million to 5 million a day of wet gas shut-in or flared while we’re waiting to get a pipeline built.

Q: I appreciate all the color you guys provided on the Niobrara completion kind of overhaul. What do you think the biggest factor is in getting those production rates up was? Do you think it was the proppant loading? I mean, is there a way to tell? How would you guys characterize the improvement there and what’s really the biggest driver?

Chief Operating Officer, Brad Fisher: I’d say that the biggest driver really is conversion to a slick water system out there. I think really what we’re doing is going back to the way we used to stimulate the Austin wells back in the late 1980s. We were really just trying to create a bit more complexity with the larger volumes and then the sand, the larger sand volumes helped prop that open. I really think it’s that simple.

Q: How are you guys currently completing these Delaware wells? I guess how do we think about proppant loading there? How you guys are stimulating? And given that that’s kind of been more of a buzz around the industry, do you think that you potentially could see a similar type uplift by changing the completion technique and what you guys are doing on the Eagle Ford currently?

Brad Fisher: Yes, I mean we are transitioning how we frac these wells. I mean when we started off, we’ve kind of took our Eagle Ford frac up there, which was a hybrid, which was slick water linear gel, crosslink and we’ve been working towards as much slick water as we can get into the rock and supplementing that with linear gel. We stayed with 2,000 pounds a foot for our sand concentration out there.

Probably, the next move that we’ll make based on what we see in the Eagle Ford is take the per spacing down from 240-foot frac stage spacing – down about 200-foot frac stage spacing maybe 180-foot frac stage spacing. Once again, it’s just about creating complexity and keeping the frac near wellbore to drain the area right around the well, not breach way out into the reservoir. So that’s where we’re going to trend.

We’re watching what everybody else is doing out there as well, and that seems to be the kind of consensus. I don’t know that we’re going to go a lot higher on our proppant concentrations. Our experience in the Eagle Ford didn’t really show that going to really high concentrations was paying out. I think we will try in the Permian to go with a smaller per foot rate intervals.

Q: On the Delaware side, can you guys maybe talk a little bit about how the drill times and just your overall development has trended now that you are a few wells into your experience there? And then just maybe talk about how you guys see the economics kind of stacking up to the Eagle Ford, just kind of give us a sense for how that could potentially attract capital going forward.

Brad Fisher I’ll take the drill times and kind of drill improvement there. We got started on the Permian, we’ve been drilling single-well pads, so we’re not in the full development mode, to make that clear.

But our first wells were around 40 days. And we’re now for a section-and-a-half lateral, we’re just over 20 days, so a very substantial improvement in drill times. We’re seeing the same thing. That’s translating right over to the well cost. Our current view on well cost for a section-and-a-half lateral, 31 stages is about $2.5 million for the trial costs and about $5 million to frac it, so about $7.5 million well.

I think if we go into a full development mode out there where we’re drilling multiple wells from the same pad, I think we’re going to work that number down to more like $6.5 million. So, pretty confident with that in this kind of price environment.

Q: Just want a little bit more color on the regional capital allocation moving into 2017. Can you guys provide anything on that?

Sylvester P. Johnson: Well, right now, we’re running the model as if all the capital would go into Eagle Ford and then we start breaking it up from there based on economics of the Permian, non-op activity in the Niobrara and then potentially some testing in the Niobrara. So, it’s an easy way to start because we’re so confident of the economics and the drill size in the Eagle Ford. And then we’ll work that to optimize it.

Q: On the next set of wells that you’re going to be drilling in the Delaware Basin, where are those wells going to be located? Are they going to be testing any other areas of the acreage, and are you going to be doing any other sort of delineation or testing of different zones or anything like that?

Sylvester P. Johnson: Right now, we’re drilling another Wolfcamp A well on the West side of our acreage towards the Northern end, pretty close to the Fortress well. We’re participating through a farm-out with a Three Rivers well that sort of test our Southwestern part of our acreage. And right now, we have no plans for a B well, but we’ve started considering this.

Q: Is there a case to be made that with the improvements in productivity from tighter stage spacing that if you combine that with the stagger-stack that you could end up having a net neutral impact to your EURs moving forward?

Sylvester P. Johnson: That’s exactly right. That’s one of the benefits of shorter stage spacing is, should end up with more shorter fracs than a few rouge long fracs that interfere with the wells that are say 330 feet away or 165 feet away. So, optimizing that combination of the spacing in a layer and the stagger-stack and how to control the frac length that keep the rates in the EUR side is what we’re all trying to do.