Columbia Pipeline Partners (ticker: CPPL) began trading on the New York Stock Exchange today following its spin-off from NiSource Partners (ticker: NI). Under terms of the spin-off, CPPL is transferred NI’s pipeline and storage assets, while NI retains ownership of its natural gas and electric utilities. The company priced 46,811,398 common units at $23.00 per unit, above the initial estimate of $19.00 to $21.00 per unit, raising more than $1.07 billion. A note by Baird Energy says the pricing of the notes translates to annualized distribution of $0.67 for a yield of 2.9%. The general public will own a 50% stake in the partnership, with an option to increase to 53.5%. Units closed at $26.79 today, 16.4% above the opening price.

First Oil & Gas IPO of 2015 Sets the Bar High

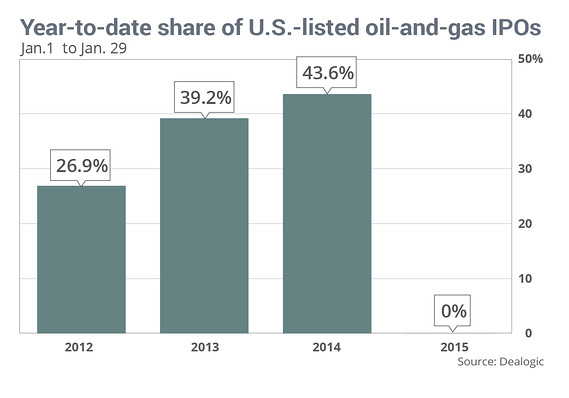

Many energy companies have shelved initial public offering (IPO) plans due to the lower commodity prices. Noble Corp. (ticker: NE), for example, announced in its Q1’15 results that its spin-off plans have been postponed indefinitely. The new market is a stark contrast from 2014, when oil and gas IPOs raised $13.3 billion in the United States, according to Ernst & Young estimates. Canada also fared well, generating $3.5 billion, according to a PricewaterhouseCoopers survey.

On the standpoint of IPOs from master limited partnerships (MLPs), E&Y reports 11 such deals ion 2014 raised more than $5.1 billion. The number is down from 2013’s total of 16 MLPs generating $7.2 billion, but proves “the result of continued market interest in the MLP product.”

Columbia Pipeline Partners reinforces E&Y’s assumption: the IPO is the largest by an oil and gas company in history, topping the IPO of Shell Midstream (ticker: SHLX) that raised nearly $1 billion in October 2014. The initial pricing happened to be the exact same of CPPL at $23.00 per unit, with 40 million units available to the public. SHLX, however, owns 71% of the partnership, whereas CPPL will own no more than 50%.

NiSource’s New Setup

Plans for the separation were first announced in September 2014. CPPL consists of assets totaling more than 15,000 mile of pipeline with nearly 300 Bcf of natural gas storage capacity and other midstream facilities. The portfolio ranges primarily along the eastern United States and Gulf Coast, including positions in the Marcellus/Utica region. NI projected potential capital investment opportunity of $12 to $15 billion over the next decade, according to the release. Management said the separation of the businesses were key to greater investment and growth.

NiSource, meanwhile, transitions to a pure-play utilities company and projects $30 billion in investment opportunities over the next 20 years.

2015 IPO Outlook

Energy MLP stocks, like many others in the oil and gas industry, have been getting hammered as oil prices have dropped in recent months. The average MLP price for E&P companies has sunk by 60% in the last six months. Midstream MLPs have fared the best of all segments of the industry, and are down by an average of only 15% in the same time frame. All other segments are down by more than 40%.

Prices have leveled off recently as West Texas Intermediate has stayed above the $50/barrel threshold this week, but that doesn’t mean the waters are calm. Mike Scialla, Managing Director for Stifel, told Oil & Gas 360® in a previous interview that near-term volatility will persist. “I don’t think we’re completely out of the woods, but I think there’s sight of a light at the end of the tunnel,” he said.

Greg Matlock, MLP Leader for Ernst & Young, explains the effect of oil prices can impact company valuations, ultimately deterring companies (such as Noble) from commencing IPO plans. “That being said, the 2015 MLP (and broader IPO) markets are expected to continue to be strong,” he said in E&Y’s report. “Suppressed oil prices may continue to inject volatility in public stock prices, which may push IPOs back in the year, but given the investors’ thirst for yield and focus on long-term growth, we still expect to see a relatively good market.”

Considering CPPL is the first to brave the oil and gas IPO market in 2015, the results will be heavily monitored by analysts, investors and industry executives alike. John Groton, a senior equity research analyst at Thrivent Asset Management, believes the results could encourage more companies to test the MLP waters once again. “If you’re the management of another company in the pipeline about to IPO, I would think you’d be watching very carefully,” he said in an interview with The Wall Street Journal. “If Columbia works, the next guy will think that could be me too. Then we’re off to the races again.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.