Enbridge plans $22 billion in projects through 2020

Enbridge (ticker: ENB) announced several developments today, with the Canadian midstream company issuing several press releases.

Enbridge announced its strategic plan and outlook, the first since the merger with Spectra Energy closed earlier this year. Enbridge expects significant growth in the next three years, with annual growth of ACCFO/share and dividends of 10%. Enbridge also announced a 10% increase in its 2018 quarterly dividend, so it is already on schedule for dividend growth.

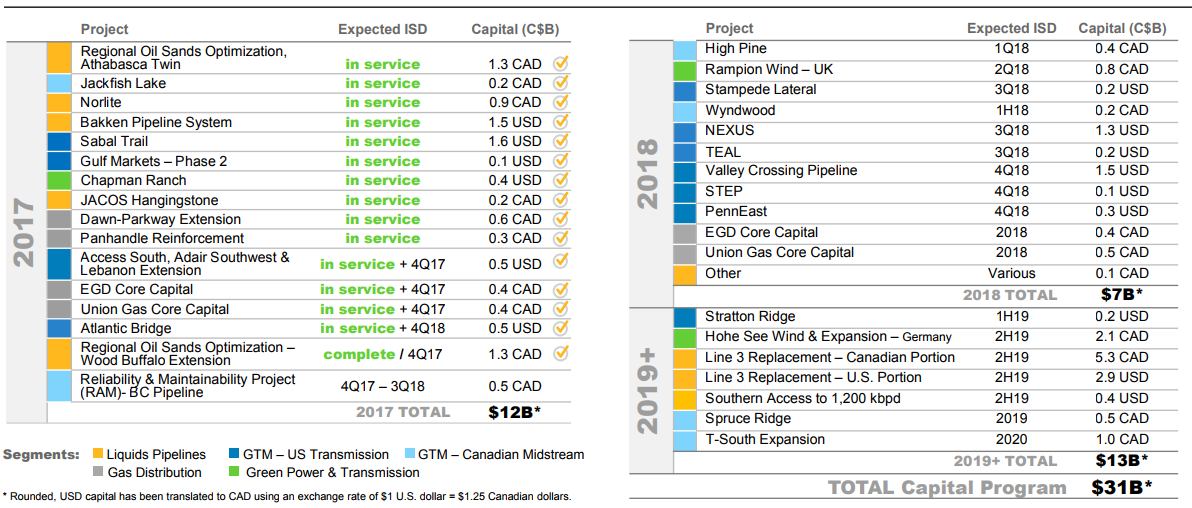

The company expects to drive this growth by spending $22 billion in the next three years. Enbridge will only generate $14 billion in cash flow, net of dividends, so it will need to raise $8 billion to complete its plan. The company today announced the private placement of $1.5 billion in Enbridge and $0.5 billion in Enbridge Income Fund Holdings. Enbridge has also identified $10 billion in non-core assets, and intends to monetize at least $3 billion of these in the next year. Finally, the company will issue $4 billion in hybrid securities in 2018, which will give it the capital it needs.

Enbridge will focus on three core businesses: Liquids Pipelines and Terminals, Gas Transmission and Storage and Gas Utilities. In the company’s Q3 presentation, Enbridge mentioned nearly 20 projects that it will be completing in the next two years, so these three business lines will certainly be enough to keep the company busy.

Enbridge President and CEO Al Monaco commented “With the Spectra Energy assets now in the fold, we will focus our attention on what we do best and the value proposition that has served shareholders well over the years. We will rationalize our asset mix to a pure regulated pipeline and utility business model, which emphasizes low risk businesses and strong growth in our three crown jewel businesses: liquids pipelines and terminals, natural gas transmission and storage and natural gas utilities. These franchises represent critical energy infrastructure with un-paralleled competitive positions, highly predictable cash flows and embedded growth. Through this review, we’ve identified a total of $10 billion of assets that are non-core to Enbridge. In 2018, at least $3 billion of certain unregulated gas midstream and onshore renewables businesses will be sold or monetized.”