Private E&Ps becoming dominant in San Juan

Private companies continue to increase their hold on the San Juan basin, as Encana (ticker: ECA) announced the sale of its San Juan assets today.

Encana will receive $480 million from Denver-based DJR Energy.

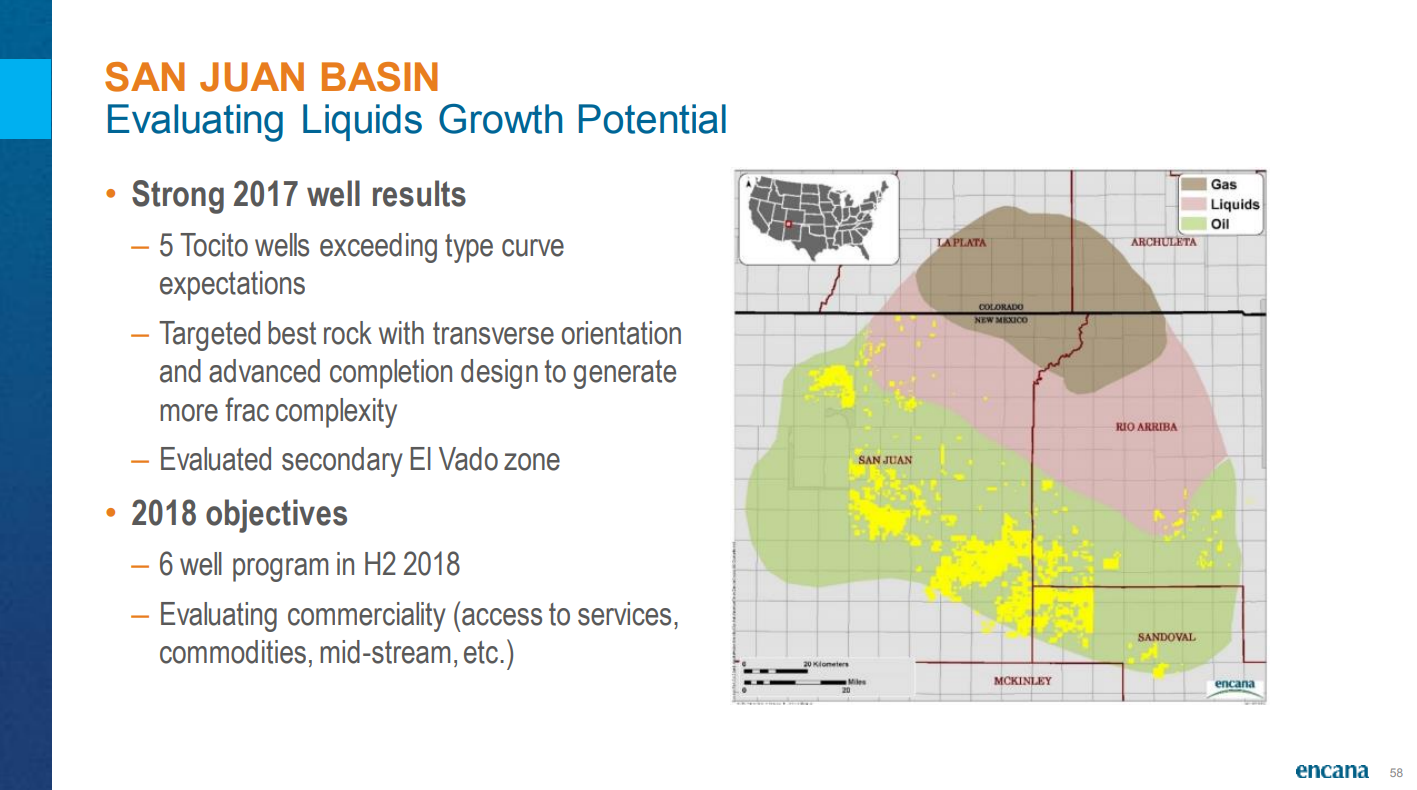

Encana held 182,000 net acres in the San Juan, assets that produced 5.4 MBOEPD in 2017. This selling price equates to $2,640 per acre or $1,600 per acre after adjusting for production, far below the acreage prices seen in many major shale basins. Encana expects the sale will close in Q4 2018.

DJR has accumulated a substantial position in the San Juan, this transaction roughly doubled the company’s holdings. DJR now owns roughly 350,000 net acres in the San Juan, focused on the oil window of the play. The pro-forma company is producing about 6 MBOEPD, with an inventory of 1,100 drilling locations. Based on this transaction’s valuations, DJR’s holdings are worth roughly $925 million, though development may increase this value significantly.

DJR President and CEO Dave Lehman commented, “Our entire management team is very excited to acquire this world class asset from Encana, who has been a fantastic operator. We are now poised to become a dominant player in the San Juan Basin as we combine their asset with our existing footprint and focus our efforts on further developing our acreage.”

Public E&P companies are exiting the San Juan, with private firms taking their place. WPX (ticker: WPX) sold its San Juan assets in early 2018 to Enduring Resources in a $700 million deal, finalizing the company’s exit from the basin. The largest San Juan transaction in recent years, though, was ConocoPhillips’ (ticker: COP) exit from the play. Conoco sold about 1.3 million acres to Hilcorp Energy in mid-2017, for a price of $2.7 billion. Conoco’s assets were significantly more developed than WPX’s or Encana, with 124 MBOEPD of production.