EQT Corporation (NYSE: EQT) announced its Q2 earnings, which was highlighted by a massive jump in both net cash provided by operating activities and in adjusted operating cash flow. EQT also recapped major sales of assets made in Q2, along with plans for further stock buyback initiatives.

Highlights:

- Increase of 116% in net cash provided by operating activities

- Increase of 128% in adjusted operating cash flow

- Decrease of 20% in Production’s per unit cash operating costs

- Approved a 19.9% retention of SpinCo stock

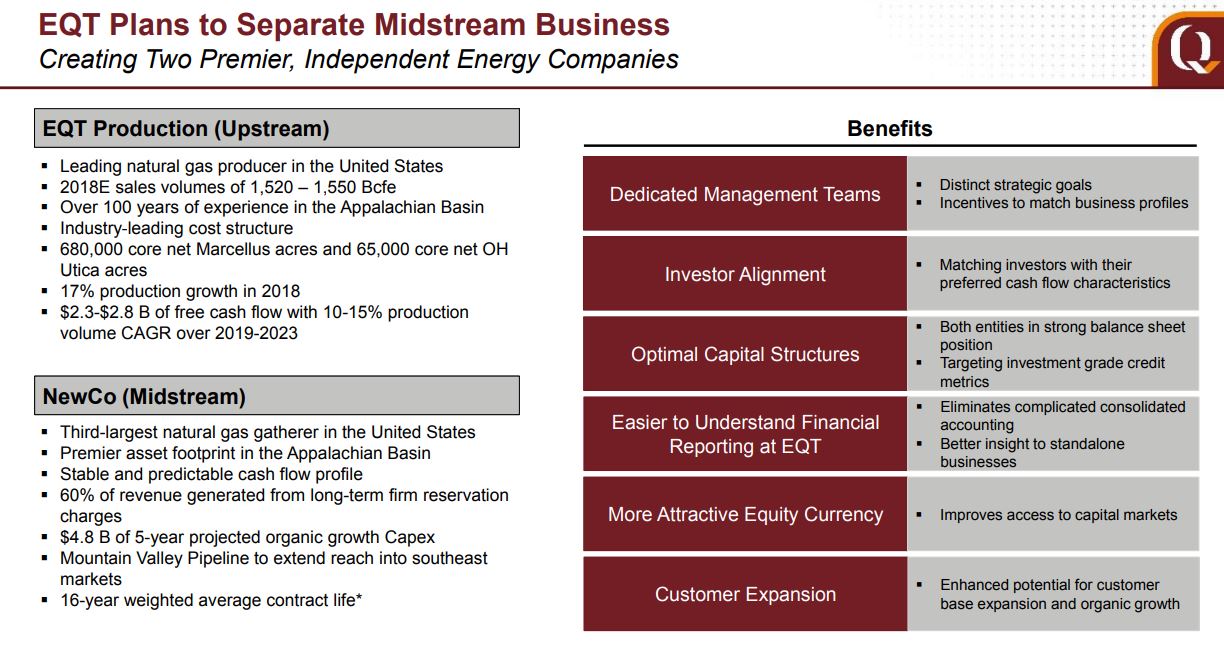

- Announced plan to separate midstream business

- Authorized a $500 million stock buyback program

- Completed midstream streamlining transactions

- Completed the sale of Huron and Permian assets

Net income attributable to EQT Q2 2018 decreased due to higher operating costs, including impairments of long-lived assets and leases, transaction-related expenses, higher interest expense, and losses on derivatives not designated as hedges despite higher revenue that resulted from an 83% sales volume increase, lower corporate income taxes, and higher pipeline, water, and net marketing services revenue.

Adjusted net income increased $104.9 million in Q2 and adjusted operating cash flow including transaction-related expenses and excludes the non-controlling interests in EQT Midstream Partners, LP (EQM) and Rice Midstream Partners LP (RMP), increased 128%.

EQT is retaining 19.9% of its shares in the midstream company SpinCo that will be spun-off to EQT Shareholders.

The EQT board has approved $500 million stock buyback program following the repurchase of 700,000 shares of EQT common stock at an average price of $55.25 earlier on in Q2 2018.

EQT to separate from Midstream business

Streamlined Midstream

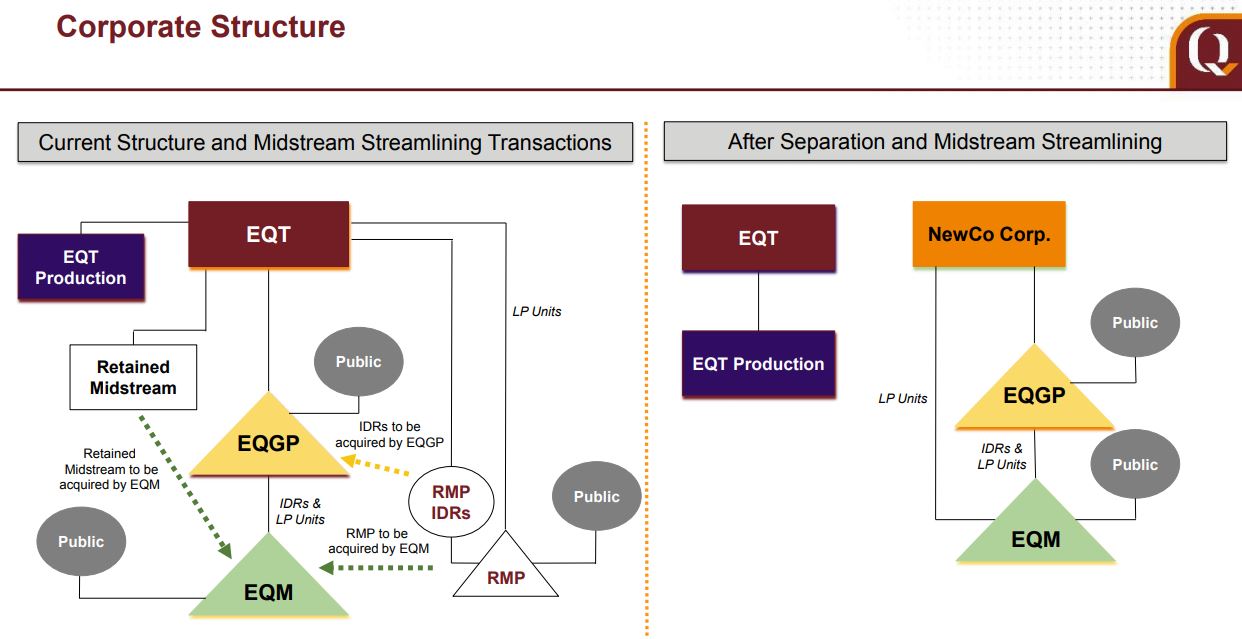

The Company completed its previously announced plan to streamline its midstream structure, including:

- On July 23, 2018, EQM acquired Rice Midstream Partners LP (RMP) in a unit-for-unit merger at an exchange ratio of 0.3319x. EQM also repaid $260 million of RMP debt bringing expected 2018 production to 1.54Tcfe

- EQT finished its acquisition of Rice Energy in Q4, finalizing the combination in November. The company estimates SG&A savings of about $110 million in 2018, and CapEx savings of $210 million.

- On June 25, 2018, EQM completed its offering of $2.5 billion in aggregate principal of three tranches of senior notes.

- On May 22, 2018, EQT sold all of its RMP incentive distribution rights to EQT GP Holdings, LP (EQGP) for 36.3 million EQGP common units.

- On May 22, 2018, EQM acquired EQT’s retained midstream assets for $1.15 billion in cash and 5.9 million EQM common units (May 2018 Acquisition).

- On May 1, 2018, EQM acquired Gulfport Energy Corporation’s 25% ownership interest in the Strike Force Gathering System for $175 million in cash.

Huron and Permian Sold

During Q2 EQT completed the sale of its Huron assets located in Southern Appalachia to Diversified Gas and Oil PLC, for $575 million cash. The transaction relieved EQT of approximately $200 million of plugging and other liabilities associated with the assets. EQT retained the deep drilling rights across the acreage.

EQT also completed the sale of its Permian Basin assets located in Texas for $64 million cash, which also relieved EQT of approximately $40 million of related plugging and other liabilities.

Q & A

Selected Q&A from EQT’s Q2 earnings call:

Q: You talked a lot about the buyback here, and it seems like there are three avenues you have to fund the buyback; asset sales, which you’ve done with the Huron sale here; the midstream SpinCo proceeds, which you’re highlighting might be an option to use for share repurchase; and the third lever might be activity levels and growth. Can you talk about the key constraints that you’re looking for, particularly on the latter two, i.e., what your target balance sheet would be as you think about how much proceeds could be used from the midstream SpinCo towards share repurchase, and then also whether you would consider slowing your growth rate and using the excess free cash flow for share repurchase?

EQT SVP & CFO, Robert J. McNally: Yeah. So, there’s several things in that question, Brian. So, let me start and deal with them one at a time. Yeah, as we think about the appropriate growth rate for the company, we certainly see the need to balance generating free cash with a moderate growth rate. We’re currently working through that with the board and we’ll have a better guidance for you later in the year on what we think the forward growth rate will be. But we certainly do think there has to be a balance between returning cash to shareholders with growth.

In terms of the share repurchase, we have a $500 million authorization from our board, and once we have used that up, depending on what the balance sheet looks like and what the environment is like, we can certainly consider going back to the board for further authorization. In previous calls and commentary, we have said that we want to see our leverage levels at less than 2 times debt to EBITDA and preferably more like 1.5 times debt to EBITDA. And so, that’s the target range that we still believe is right for EQT going forward.

Q: Given the deficit we have in storage and some improvement that we’ve seen in local Appalachia prices, combined with some of the efficiency gains you’ve highlighted, how do you think about potentially increasing activity or what would you need to see to increase activity?

EQT SVP & CFO, Robert J. McNally: Yeah. I think clearly, Brian, in a higher gas price environment, higher realizations, the math on returns will tell us that if we’re better off to increase growth rates and production. But we haven’t seen a significant move in realized prices. While there have been some modest improvements locally in bases, that’s been partially offset by lower NYMEX pricing. So, I would say that that dynamic isn’t pushing us to increase production at this point.

Q: On retaining those SpinCo shares, can you give us some sense of what is your plan to like – how do you look to monetize that? Is it something we should expect pretty quickly? Is it going be systematic, opportunistic? And with that, what was really the driving force behind making that decision to retain that, those SpinCo shares? Was it specifically to have the access to extra liquidity or was it for more, during the spin process, to make it a little, I guess, cleaner for investors that would have been spun a little bit more shares?

EQT SVP & CFO, Robert J. McNally: Yeah. The real job right here was this was an avenue for us to right-size the EQT balance sheet and get to the liquidity levels that we want and be able to fund a share buyback prior to the spin, because we were retaining that value and it gives us confidence that we would have the available capital to fund the buyback without putting undue leverage at the SpinCo level, all right. So, we want – our goal all along was that we would have two independent companies with strong healthy balance sheets, and this was the most elegant way to accomplish that goal, as well as fund the share buyback.

Q: I was wondering if you could kind of walk us through the steps in terms of the separation. You mentioned that the Form 10 would be filed in mid-August. But walk us through kind of the timing and what kind of happens from here. And at what time would you be prepared to provide kind of standalone kind of guidance for EQT Production?

EQT SVP & CFO, Robert J. McNally: Yeah. So, from here – we’ve essentially completed all of the clean-up transactions that we announced in April and the related financing transactions. So, I would like to say that I’m extremely happy with the progress that we’ve made and the hard work that our teams have done. I’m really impressed with what we’ve gotten done. So, what’s left now is to file the Form 10, which we expect to do by mid-August, and then with that starts the process with the SEC, which – that timing then is a bit out of our control.

It depends on how many rounds of questions the SEC has, and then we’re also waiting on the PLR from the IRS. And we think that that likely pushes us into the fourth quarter now between those two gating items. I suspect that as we get closer to – as we get closer to separation, we will likely want to get out and meet with investors, and at that point, I think you’ll get standalone guidance from both EQT and SpinCo. So, I don’t know what the dates of that will be. But I think in the month leading up to the spin being finalized, you would expect to hear from us with more concrete guidance for both SpinCo and EQT.

Q: Is there some thought in your mind to target that leverage – previous leverage target you had mentioned 1.5 times or to push that lower? And how are you thinking about using the proceeds between share buybacks or return of cash to shareholders and debt reduction?

EQT SVP & CFO, Robert J. McNally: Well, I think that the – the $500 million share repurchase that we have authorized, that’s all that we have authorized at this point, and the majority of the rest of the value will likely go for debt reduction. And we do think that getting down to that 1.5 times debt to EBITDA is the right place for EQT to be. It puts us in a strong liquidity position. We don’t feel the need to get – to move it a lot lower than that. But if we’re a little lower, that’s fine too.