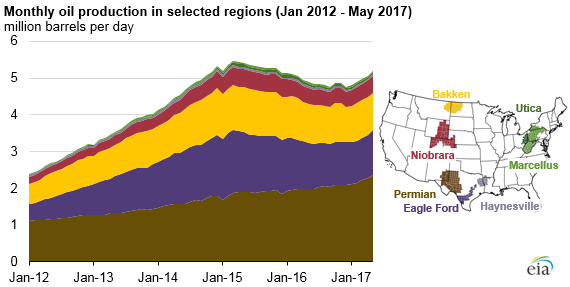

Permian produces 45% of lower 48 onshore oil – half of all rigs are in the Permian

Crude oil production from the Permian Basin is expected to grow to 2.4 MMBOPD in May, according to a note released by the EIA today. Since January 2016, production in the Permian has increased all but three months, despite low crude prices.

Oil production from most other regions of the U.S. fell in 2015 and 2016, increasing the Permian’s share of U.S. production. In January 2015, the Permian area produced about 32% of U.S. lower 48 onshore oil production. This value has grown steadily through the downturn, rising to 45% at present.

Half of all oil rigs are in Permian

This production growth will almost certainly continue, as the Permian is by far the most popular destination for rigs. According to the Baker Hughes rig count, half of all oil rigs active in the U.S. are in the Permian.

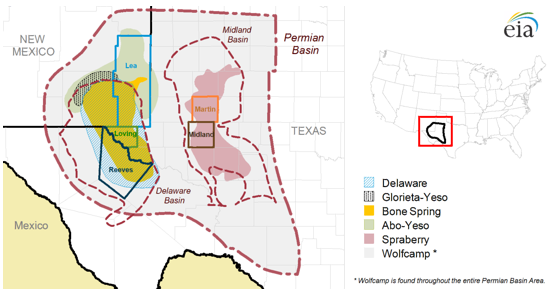

The decline in oil prices has served to concentrate activity in the heart of the Permian, as producers seek to stay economic. In defining the Permian, the EIA considers 43 counties in western Texas and southeastern New Mexico. However five counties, Martin, Loving, Midland, and Reeves in Texas and Lea in New Mexico, are the primary focus of activity. In November 2016, the most recent data that the EIA has available, these five counties produced 882 MBOPD, more than 40% of total Permian region oil production in that month. More than half of the rigs that have been added in the Permian since prices began to recover have gone to these five counties, meaning that this dominance will only continue.

Companies flock to buy acreage

Many companies have responded to the Permian resurgence by buying up acreage in the region. WPX (ticker: NBL) was one of the first major deals in 2017, purchasing 120,000 net acres in the Delaware for $775 million on January 12. Noble (ticker: NBL) purchased Clayton Williams Energy for $3.2 billion five days later, adding about 120,000 net acres in the Permian. The same day, ExxonMobil (ticker: XOM) purchased 250,000 acres in the Permian from the Bass family for $6.6 billion. Many other companies have also bought in, driving acreage valuations to greater than $30,000/acre.

Midland Wolfcamp largest tight oil resource: USGS

The estimated oil in the Permian has increased along with the activity. In November, USGS estimated that the Wolfcamp formation in the Midland basin, only part of the greater Permian basin, could contain over 20 billion barrels of oil, 16 Tcf of gas and 1.6 billion barrels of NGL. While this estimate outlines the technically recoverable oil, not necessarily what is economically available, it is the largest USGS assessment of tight oil resources in any domestic basin. The Permian basin has been producing oil since 1921, and will continue to do so for many years to come.