Brazil now third-largest oil producer in Americas

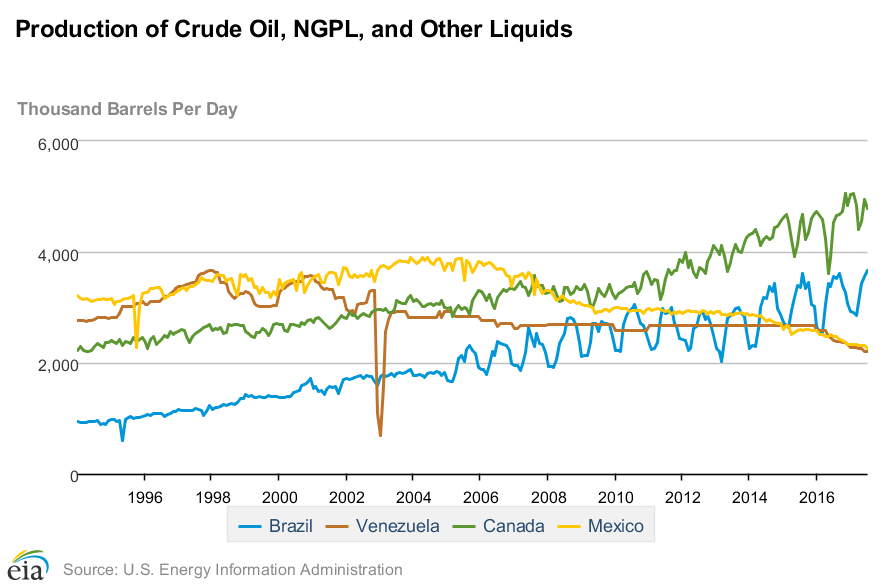

Brazil is now the third-largest oil producer in the Americas, behind only Canada and the U.S., according to the EIA. The EIA reports Brazil produced Brazilian oil output has been rising since the mid-1990s, growing from less than 1 MMBOPD to nearly 3.7 MMBOPD in July this year.

While the U.S. has always been the largest oil producer in the Americas, Canada, Mexico, Venezuela and Brazil have all competed for runner up. With current production of 4.8 MMBOPD, Canada seems to have secured second place among oil producers. Mexico and Venezuela are each producing about 2.2 MMBOPD, so Brazil is the third-largest oil producer by a sizeable margin.

Recent lease sale auctioned blocks containing 12 billion barrels of oil

Domestic oil production is a major long-term goal of the Brazilian government, which hears the call of large offshore oil fields. These fields have been the target of several recent lease sales, which earned the Brazilian government a total of $1.8 billion in signing bonuses. According to Reuters, the acreage offered held more oil than the Bakken and Three Forks formations, so Brazil has the potential to continue to grow oil output. The country faces several short-term challenges, but once these are overcome it will be able to take advantage of significant growth in offshore oil production.

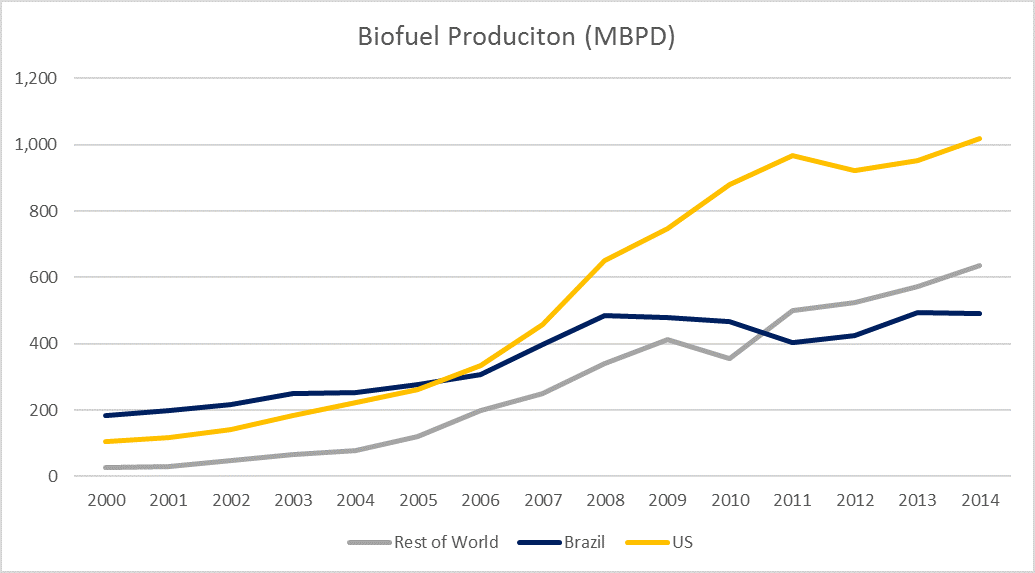

The Brazilian energy market contains a player rarely seen, biofuels (ethanol and biodiesel). According to the EIA, Brazil produced just under 500 MBPD of biofuels in 2014, making it the second-largest producer by a significant margin. Only the U.S. produces more biofuels, with about 1,020 MBPD in 2014. The next largest producer is Germany with 72 MBPD, so biofuel production is only a major industry in the U.S. and Brazil.

Venezuela in freefall, Mexico may be coming back

The rise in Brazilian output has corresponded to declines among its competition for third-largest energy producer in the Americas. Venezuela and Mexico have each held this position in past years, but different challenges have forced each country into decline.

In Venezuela, mismanagement and pressures from low commodity prices have created massive challenges for the country. Oil output in the OPEC member has been declining, falling by about 18% from the beginning of 2016. With Venezuela currently in default, a reversal is not likely in the near term.

Mexican oil and gas output has also been falling, with oil output down 21% since the beginning of 2014. Large legacy fields are in decline, forcing the country to import ever-growing volumes of crude and refined products from the U.S. Unlike Venezuela, however, Mexico may be able to halt, or at least slow, this decline. The country is in the process of reforming its energy industry, allowing foreign companies larger leeway.

This has paid off for Mexico so far, as the country’s first private offshore well in 80 years resulted in a big discovery. The Zama-1 well found the fifth-largest oil discovery in the last five years, with up to 2 billion barrels of oil in place. PEMEX has also been productive recently, and announced Mexico’s biggest onshore oil find in 15 years earlier this month. This field has an estimated 1.5 billion barrels in place.

While these fields, and others like them, could power a resurgence in Mexican production, they will take several years to reach development, while Brazilian offshore activity is already ramping up. Brazil, then, appears secure as the third largest energy producer in the Americas, at least for the near future.

Petrobras dominates oil production in Brazil, but does not hold a monopoly. The company reported production of 2.12 MMBOPD in July, 57% of the total production reported by the EIA. The company reported $266 million in net income in Q3 2017, and equal income in Q2. Both results were significantly improved from last year’s results, primarily due to commodity price improvements.