Don’t Expect a Rebound: Warm Winter Expected to Keep Prices in Check

Henry Hub prices in 2015 averaged $2.61/MMBtu, marking the lowest level of the millennium to date and are roughly 70% below the average price level in 2008, according to data from the Energy Information Administration (EIA). Prices dipped below $2.00/MMBtu for the first time in three years near the tail end of 2015, pressured by record inventory levels and unseasonably warm temperatures keeping the energy source in storage.

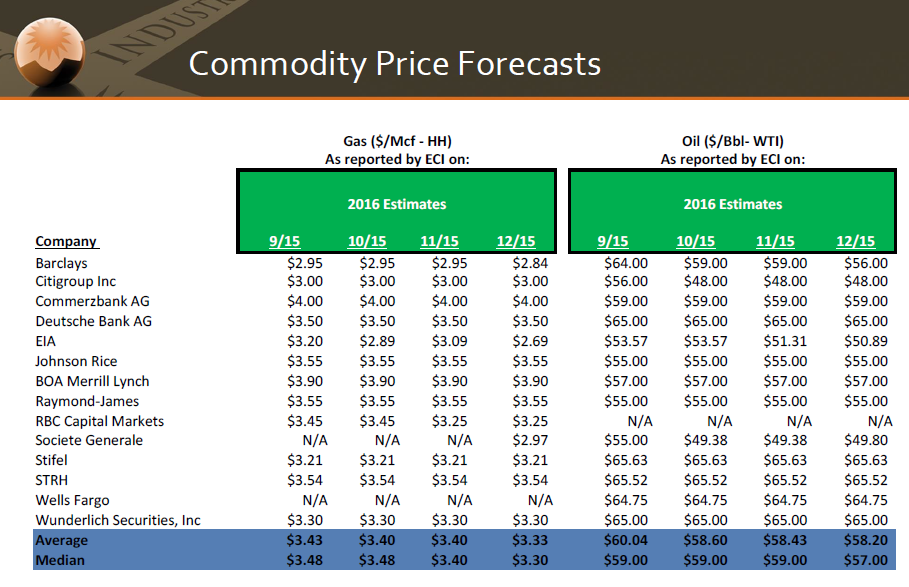

The closing price of $2.33 today was, at first glance, a welcome sight for traders and producers, considering Henry Hub was hovering in the $1.80/MMBtu range in late November. Many analyst firms have not adjusted 2016 estimates for prices, although the EIA expects current year prices to average $2.69/MMBtu. That estimate may be revised further downward: the EIA expects average Henry Hub prices for the winter (October 2015 to March 2016) will average $2.47/MMBtu – down more than 25% from last year.

The closing price of $2.33 today was, at first glance, a welcome sight for traders and producers, considering Henry Hub was hovering in the $1.80/MMBtu range in late November. Many analyst firms have not adjusted 2016 estimates for prices, although the EIA expects current year prices to average $2.69/MMBtu. That estimate may be revised further downward: the EIA expects average Henry Hub prices for the winter (October 2015 to March 2016) will average $2.47/MMBtu – down more than 25% from last year.

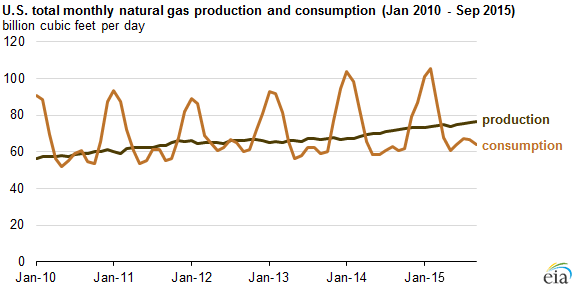

In the Marcellus/Utica, incoming pipeline projects will balance a region that has been vulnerable to sharp prices spikes due to a shortage in infrastructure. A note from Raymond James Equity Research says pipeline capacity in the northeast could triple by 2019 if all projects materialize on schedule. The firms says that incoming takeaway availability, combined with drilling efficiencies and the ever-growing resource estimates of the Appalachia, provide a bearish outlook for Henry Hub and its associated spot prices. “The bottom line,” Raymond James says, “is that we think readily available Marcellus and Utica gas supply will keep a lid on overall U.S. natural gas prices for the next several years.”