Ethane’s domino effect in Pennsylvania

The shale energy revolution is famous for jump-starting natural gas production in Appalachia, with Pennsylvania and Ohio at the center of a drilling boom during the past decade from which thousands of people flourished from good jobs related to natural gas extraction.

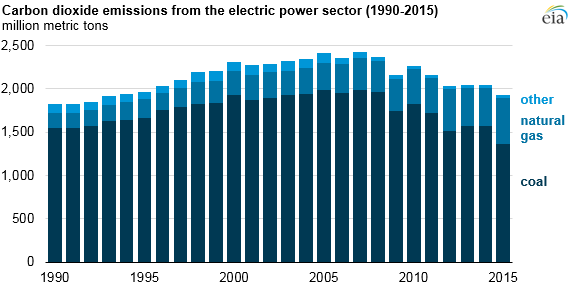

But putting people to work drilling and producing natural gas and building pipelines to transport it isn’t the only positive result from their work. The natural gas that is being produced in the U.S. is having a country-wide positive impact by creating more efficient power generation, lower electricity prices, and plummeting carbon dioxide output. By using natural gas for power, utilities have cut GHGs in half compared to emissions from the coal-fired plants which the new combined cycle natural gas plants are replacing. In fact, the U.S. energy-related CO2 emissions are at the lowest levels since 1991.

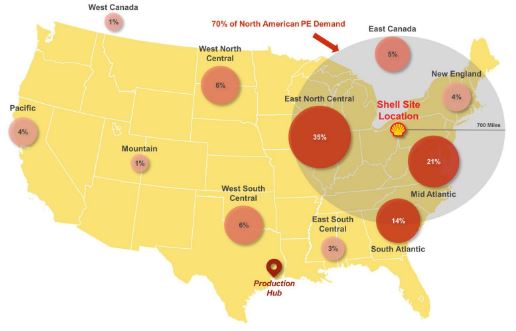

But there is more good news coming from the natural gas that is being produced from the Marcellus and Utica formations in Appalachia. Last summer, when global supermajor Royal Dutch Shell (ticker: RDS.A) made a commitment to build a large petrochemical plant in the heart of the Marcellus/Utica region, suddenly the region is looking at a tremendous gift horse: the birth of a new industrial sector and all the jobs, related industries and prosperity for thousands that will come along with it.

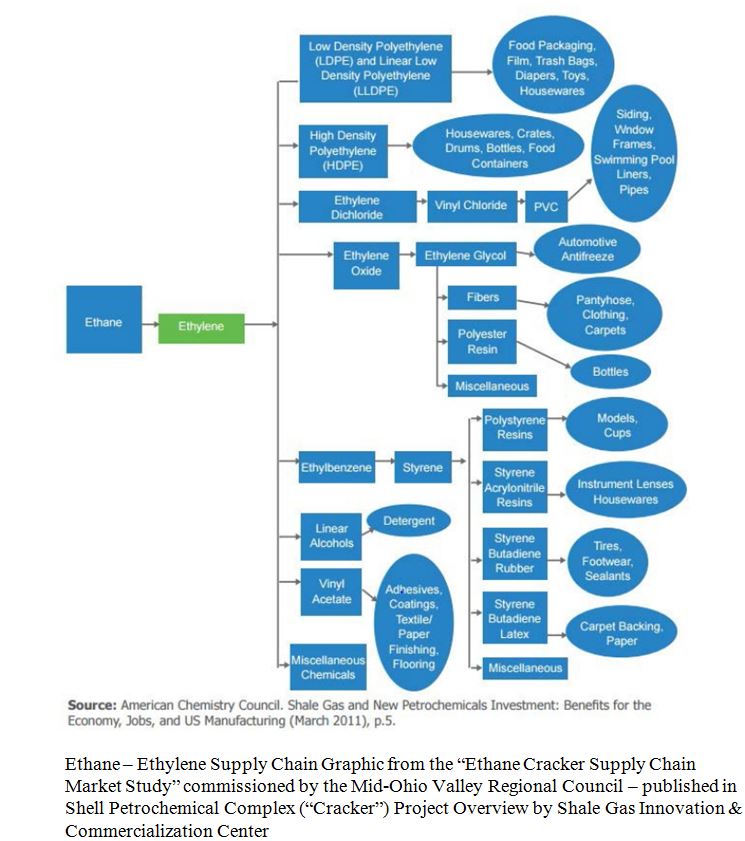

Natural Gas Liquids, or NGLs, are a byproduct of natural gas production. One component of the liquids portion of natural gas is ethane. Ethane is the feedstock for ethylene, which is the key building block of polyethylene, the plastic used in thousands of products that are abundant throughout global economies.

How many products spring from ethane-ethylene?

Clothing, bottles, tires, toys, housewares, packaging, pipe, diapers: this ethane cracker is a big deal for Pennsylvania, the gas producers in the region and manufacturing entrepreneurs. This graphic from the Ben Franklin report shows what’s coming:

Shell said the complex will use low-cost ethane from shale gas producers in the Marcellus and Utica basins to produce 1.6 million tonnes of polyethylene per year, once the plant is completed and operating, which Shell anticipates in the 2020-2021 time frame.

Construction will commence on the plant in about a year, and that is expected to spark the local economy with the creation of approximately 6,000 construction jobs. Once completed, the plant is expected to employ 600 full-time workers at the facility. Shell says the expected cost of the plant is between $2 billion and $3 billion.

The Ben Franklin Shale Gas Innovation and Commercialization Center has published an economic analysis of the proposed Shell ethane cracker and its projected effects on the region’s economic development and the Pennsylvania economy.

“Just as the discovery, extraction, and use of the natural gas from the Marcellus and Utica formations has fundamentally and positively changed the energy landscape of the entire region, so will the use of the NGLs. The Shell Cracker is in essence the first step in the buildout of an entire petrochemical industry in the region surrounding where the NGLs are being produced from the Marcellus and Utica basins,” the report says.

The report calls the Shell cracker “a first step forward towards the buildout of a regional petrochemical hub and manufacturing renaissance in the plastics and chemicals sector in the Commonwealth that will lead to new business creation and expansions not just in this sector, but in many sectors that provide support products and services to it.”

The report says the plant will use approximately 100,000 barrels equivalent/day of ethane. Numerous fractionation plants (plants used to process and separate the NGLs in to its various components – ethane, propane, butane, etc.) have been built already in Pennsylvania, West Virginia, and Ohio and more are expected to be built as the volume of NGLs extracted grows.

Shell has signed contracts with 10 producers to provide the ethane, according to the report.

The players

The report says that Shell’s cracker will most likely use steam-cracking technology offered by Linde Engineering North America, Inc., headquartered in Houston, Texas.

The engineering, procurement, and construction contractor (EPC) on the Shell project is Bechtel Oil, Gas, and Chemicals.

Jacobs Field Service North America, Inc. (Houston, Texas) has been chosen to handle all permitting aspects for the project. There will be as many as six additional EPC contracts for specific projects (such as the wastewater treatment plant) that will be undertaken as part of the overall project.

The investment

Shell has already invested $500 million to get the project to the FID stage. The Ben Franklin Center puts projected budget for building the entire cracker plant and polyethylene (PE) units, plus all supporting units (power plant, wastewater treatment facility, etc.) at $6 billion.

The schedule

- Continued site preparation – Through 4Q 2017

- Letting of contracts and beginning building of ancillary support units – Beginning in late 2016 and continuing throughout construction period

- Initiating main construction of cracker and polyethylene units and other facilities – Estimated to begin in 18 months

- Anticipated project completion – 2020/2021 timeframe

The pipelines

In order to deliver the ethane to the complex, Shell Pipeline Company LP is developing a 94-mile ethane transport system—the Falcon Ethane Pipeline System— scheduled to begin construction in late 2018. It will be located in southwestern Pennsylvania and extend into West Virginia and Ohio. Ethane will be collected from MarkWest Energy Partners LP’s Houston Processing and Fractionation facility in Washington County, PA, and from MarkWest’s Cadiz Complex in Harrison County, OH.

The system will also receive ethane from Utica East Ohio Midstream via their Harrison Hub fractionation plant in Scio, OH. Shell has identified ten ethane suppliers, and several have signed 10-20 year agreements to provide ethane to Shell.

The Falcon system will be comparable in size to the entire existing Appalachian Basin’s current NGL infrastructure.

Currently, the Appalachiato-Texas Express (ATEX) pipeline, which carries Marcellus and Utica ethane to Mont Belvieu, TX, has an expandable capacity of 125,000 b/d. The Mariner East 1 pipeline, which carries ethane and propane from Western Pennsylvania to the Marcus Hook Industrial Complex near Philadelphia for domestic and international distribution, has a capacity of 70,000 b/d. And the Mariner West pipeline carries 50,000 b/d of ethane from the basin to Michigan and Canada. The proposed Mariner East 2 pipeline(s) that are in the permitting process, and that are to be built adjacent to the Mariner East 1 pipeline seeks to increase the total capacity of the Mariner East pipelines up to 675,000 barrels per day of NGLs, the report says.

The beginning of a renaissance

The Ben Franklin Shale Gas Commercialization and Innovation Center considers Shell’s decision to build its large ethane cracker in Pennsylvania to be the catalyst for a coming manufacturing renaissance for the entire region. “This is the time for both small and large companies to begin gaining an understanding of all of the various opportunities that are likely to be presented as both cracker facilities, midstream pipeline buildouts and NGL processing facilities, and additional downstream petrochemical projects are announced to utilize the abundant NGLs. Now is the time for regional planners to be identifying their prime locations for prospective companies to build facilities, to be determining necessary infrastructure upgrades, and to develop appropriate incentives to attract investors and prospects,” the report recommends.

New industrial development activity has already begun in the region. According to Plastics News a plastics packaging producer based in Cyprus announced plans to establish a U.S. base in Donora, Pa. Retal PA LLC intends to invest up to $24 million in a plant to injection mold PET preforms and high density polyethylene caps for the beverage industry, Retal PA CEO Admir Dobraca told the magazine.

New industrial development activity has already begun in the region. According to Plastics News a plastics packaging producer based in Cyprus announced plans to establish a U.S. base in Donora, Pa. Retal PA LLC intends to invest up to $24 million in a plant to injection mold PET preforms and high density polyethylene caps for the beverage industry, Retal PA CEO Admir Dobraca told the magazine.

“The firm plans to be production-ready by the beginning of November with shipments to start in early 2017. … The facility and budget for the new operation include plans to blow mold PET bottles at some time in 2017,” the report said of Retal’s plans.

The Ben Franklin Shale Gas Innovation and Commercialization Center believes many additional projects like this plant that will come to the region to create products out of the Marcellus/Utica ethane. That’s the domino effect, as Shell’s ethane cracker moves closer to startup and more companies move to the area to take advantage of the region’s skilled labor force and the abundant ethane and natural gas supplies coming out of the Marcellus and Utica basins.

Meantime, natural gas producers and midstream companies have been busy in the Marcellus and Utica in 2016. Below are some recent headlines:

Antero Resources Snags 55,000 Core Marcellus Acres

Even at “The Most Punitive Pricing,” Cabot is Seeing 100% IRR in the Marcellus

EQT Snaps Up $407 Million of Statoil’s Marcellus Core Acreage

TransCanada Pays $13 Billion for 15,000 Miles of Marcellus/Utica Pipeline Assets

Trending in the Utica and Marcellus: Superlaterals