A look at where the industry believes energy development capital will be sourced

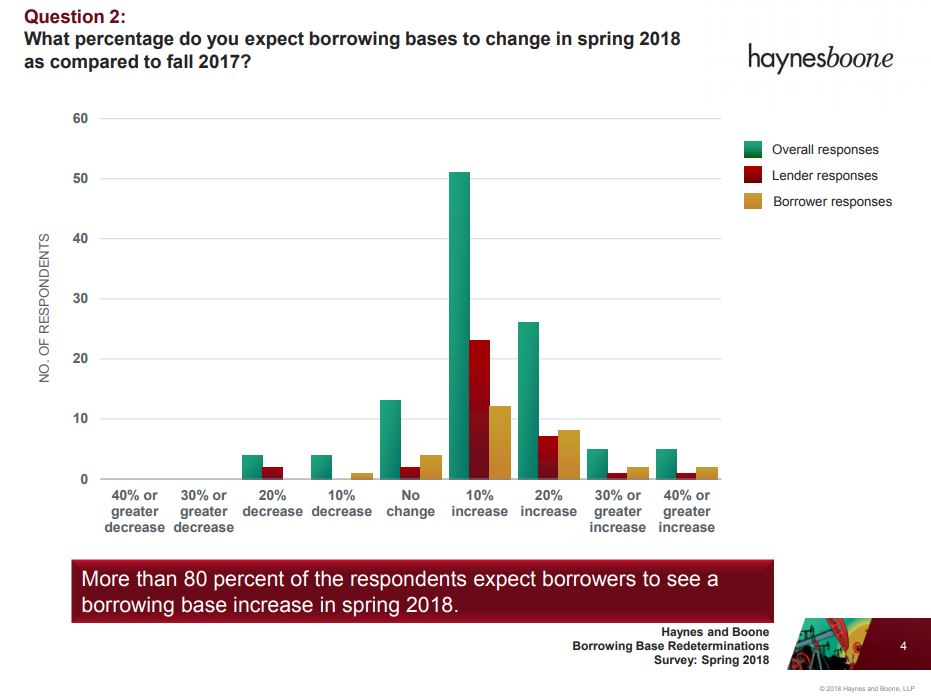

More than 80% of Haynes and Boone’s respondents in its newest borrowing base survey expect borrowing bases to increase, with most expecting 10 to 20 percent increases, the firm said today.

The energy group at Haynes and Boone said that results of its Spring 2018 Borrowing Base Redeterminations Survey shows borrowers are locking in increased oil prices. Respondents estimate that producers have a significant percentage – 50 to 60 percent – of their 2018 production hedged.

Public filings of E&P companies indicate this trend started at the end of 2017 and has held strong through 2018, Haynes and Boone said.

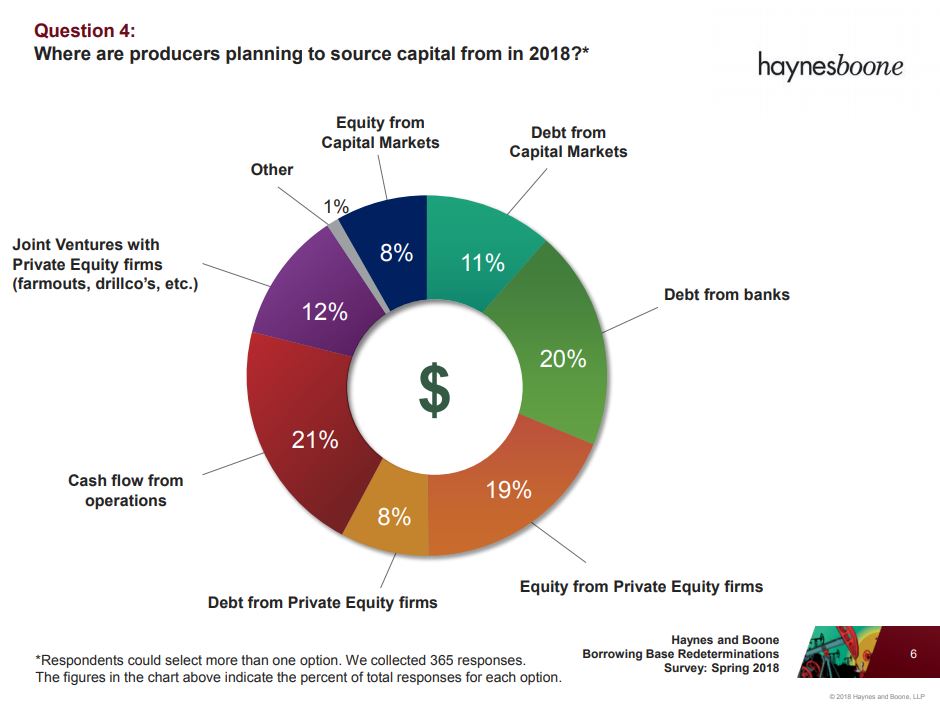

Cash flow from operations, bank debt and PE will rein – public securities issues will take a back seat

Producers will utilize cash flow from operations, bank debt and private equity as their primary sources of capital in 2018, according to industry respondents to the latest survey. Public debt and equity markets are taking a back seat to these sources.

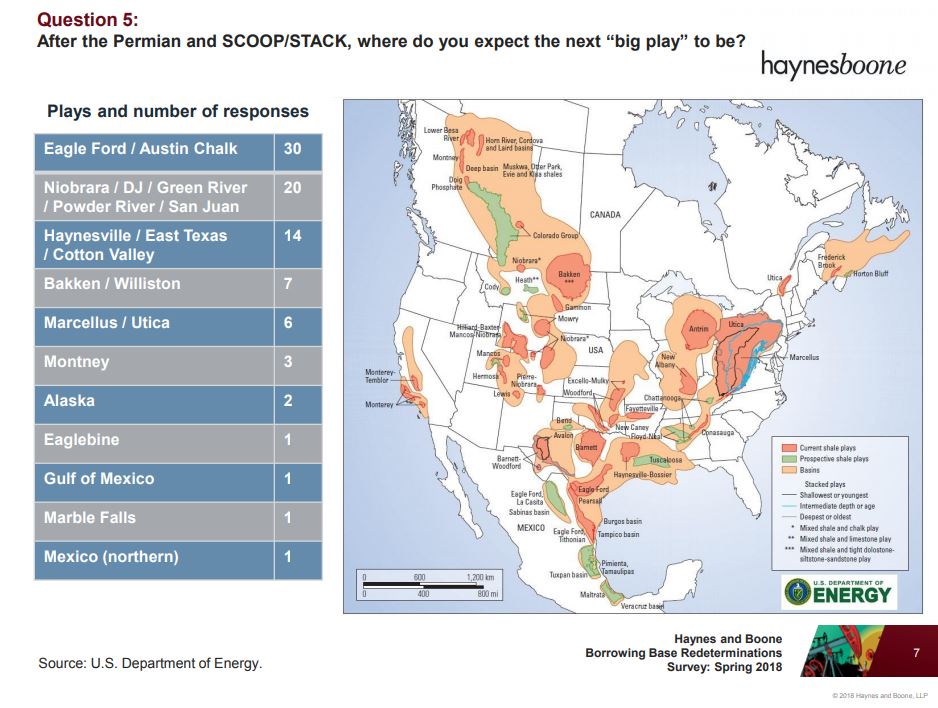

After the Permian and SCOOP/STACK, what’s next?

The firm said its respondents predict that the Eagle Ford and Austin Chalk will be the next “big play.”

The significant amount of Eagle Ford M&A activity in the first quarter of 2018 indicates that acquirers believe this to be the case as well, Haynes and Boone said. The survey also shows strong interest in the Niobrara and Powder River Basin, the law firm said.

See the complete survey results here.