Acquisition makes Parsley second largest publicly traded E&P in the Midland basin

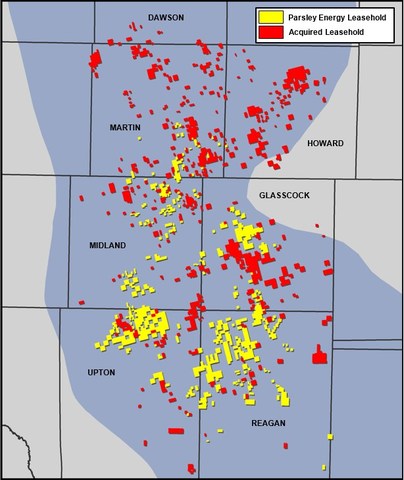

Parsley Energy (ticker: PE) announced the acquisition of 71,000 net acres in the Midland basin for $2.8 billion today, increasing its Permian acreage by 45%. The acreage will be purchased from Double Eagle Energy, a private land-centered E&P company. Including this acquisition Parsley’s total Midland basin acreage is 179,000 net acres, and Permian acreage is 227,000 acres.

Parsley will fund the acquisition with $1.4 billion in cash and 39.4 million units of Parsley Energy valued at $1.4 billion. The cash portion of the purchase will be financed with equity and debt offerings. With a per-are cost of approximately $37,400, this deal is far from the highest acreage valuation seen in the Midland basin. The acquisition gives Parsley the second largest Midland basin net acreage among publicly traded E&P companies.

Acquisition Highlights

- Approximately 71,000 net leasehold acres

- Estimated net production of approximately 3,600 Boe per day as of January 1, 2017

- 23 drilled uncompleted wells, variously targeting the Lower Spraberry, Middle Spraberry, Wolfcamp A, and Wolfcamp B formations, with an average lateral length of approximately 8,400 feet, valued at approximately $75-100 MM in aggregate

- Approximately 3,300 net horizontal drilling locations, including approximately 1,800 net locations in high priority target intervals (Lower Spraberry, Wolfcamp A, Wolfcamp B)

- Average lateral length of approximately 6,600 feet on acquired horizontal drilling locations; more than 40% of acquired horizontal drilling locations have lateral lengths of 7,500 feet or more

- Operating control on 80% of net horizontal drilling locations

- Incremental value potential through ongoing acreage trades, bolt-on acquisitions, and working interest buyouts; Double Eagle to assist with asset operation and handoff, as well as acreage trades and purchases after closing

- Scheduled to close on or before April 20, 2017, subject to the satisfaction of customary closing conditions

Acquisition increases 2017 rigs

Parsley also released updated 2017 capital guidance, as the purchase adds more opportunity for development. The acquisition will increase CapEx substantially to $1 to $1.15 billion, from $750 million to $950 million before the purchase. Parsley expects to complete 130 to 150 wells in 2017. Previous guidance indicated 10 rigs active through 2017, but the purchase has allowed 11 rigs in Q2, 12 in Q3 and 14 in Q4. The company believes that this acquisition gives it an acreage footprint large enough to support a 20 rig drilling program.

Parsley also released reserve estimates for 2016, showing a strong increase over 2015. Proved reserves increased 80% to 222.3 MMBOE from 123.8 MMBOE last year. Notably, the company removed all reserves associated with potential vertical well activity, decreasing reserves by 18.4 MMBOE in the move.

Permian basin feeding frenzy

The Permian has become a hot spot for acquisitions in recent months, as several big players have bought acreage in the basin. ExxonMobil (ticker: XOM) made a massive $6.6 billion purchase last month, buying 275,000 acres from the Bass family. Noble Energy (ticker: NBL) purchased Clayton Williams Energy for $3.2 billion in January, and WPX (ticker: WPX) acquired Panther Energy and Carrier Energy for $775 million. Parsley Energy already joined in the feeding frenzy in early January, purchasing 23,000 acres for $607 million.

Analyst Commentary

From Wells Fargo:

PE - Neutral. Huge acquisition for PE increasing total Permian acreage position by 45%. Adds substantially to inventory bringing total net locations to 7,850 with footprint now big enough to support a 20 rig drilling program. Company well on the way to big growth numbers, but it comes with a price – wider 2017E spending gap (most of the associated production and cash flow won’t hit until 2018), equity dilution, and more debt. 4Q update indicated volumes light and spending high relative to consensus, but both were within guidance.

Midland Consolidation Effort. Big acquisition from Double Eagle Energy consisting of 71,000 net acres for $2.8B which equates to about $37,400 per acre or about $805,000 per drilling location. Footprint on the Midland side up 66% to 179,000 net acres bringing total net acres across the Permian to 227,000. Asset adds 3,300 net horizontal locations (6,600’ average lateral) on top of PE’s existing 4,550 locations bringing total inventory to about 7,850. Acquired acreage spans most of the Midland basin adding adjacent blocks to PE’s existing core position, but also expanding northern presence in Martin and Howard counties.

Consideration. Acquisition to be financed with a combination of $1.4B of equity from 39.4MM units of Parsley Energy, LLC and associated class B shares as well as $1.4B of cash generated from proceeds of $350MM senior unsecured notes offering (due 2025) and 41.4MM of class A shares offering (includes shoe).

Revised 2017 Guidance. 2017 guidance now assumes 8 operated rigs (average) bringing new capex range to $1,000 - $1,150MM up 30% at the midpoint from $750 - $900MM including increased spending across drilling, completing, and infrastructure. Production guidance moves 8% higher at the midpoint to 62 – 68 Mboe/d which implies 70% growth over estimated 2016 levels using midpoints. 4Q17 exit rate increased to 75 - 85 from 70 – 80 prior given increased activity which is more impactful in 2H17 setting up for a big 2018.

4Q Update. Production for the quarter estimated to be 44.8 – 45.2 Mboe/d, the high end of which is slightly lighter than consensus 45.5. 4Q spending was $158MM (estimated midpoint) coming in higher than $137MM Street estimate and our $150MM, but within full-year 2016 guidance range of $460 - $510MM. Unit costs are expected to be toward low end of guided range. Additionally the Company layered in more back-half 2017, 2018, and 2019 crude hedges including basis protection in anticipation of greater activity.

Reserves Up 80%. 2016 year-end proved reserves increased 80% to 222.3 MMboe up from 123.8 MMboe in 2015. 98.7 MMboe were added organically (7x replacement ratio) while 24.2 MMboe were added through acquisitions. Proved developed comprised 48% compared to 42% last year while crude reserves were 61% of the total up slightly from 60% a year ago. SEC pricing was $39.36, $15.03, and $2.23 for crude, NGL, and gas, respectively after adjustments.

From KLR:

PE ($33.33, B, $56, Nicholson) – Transformational Midland Basin Acquisition, Equity & Debt Offering, '17 Guidance Update (Minor Positive Value Impact) - PE announced it agreed to acquire ~71,000 net acres in Midland Basin for ~$2.8 billion from Double Eagle Energy Permian, LLC (~$1.4 billion in cash and ~$1.4 billion in stock, equating to ~39.4 mm shares). Estimated current net production is ~3,600 Boepd and the transaction includes ~23 DUC's (~8,400' avg lateral). Assuming ~$40k per flowing Boe on production and ascribing ~$75 million (low end of $75-$100 million guide) of value for the DUC's, the transaction equates to ~$36.4k per acre or an incremental ~$1.4 mm per high priority horizontal drilling location. PE estimates there are ~3,300 net horizontal drilling locations (~6,600' avg lateral) with ~1,800 high priority locations targeting the Lower Spraberry, Wolfcamp A and Wolfcamp B. To fund the cash portion of the acquisition, PE announced it priced an offering of 41.4 million shares (including overallotment), at ~$31.00 for total gross proceeds of ~$1,283 million. The company also announced a private placement of $350 million senior unsecured notes due 2025. Including the shares issued to Double Eagle, PE shares outstanding increased ~35%. The transaction is expected to close on or before April 20, 2017. The company also announced 4Q/16 production guide of 44.8-45.2 Mboepd in line with our expectation of ~44.9 Mboepd. PE announced YE ’16 proved reserves of ~222.3 MMboe (~61% oil) a ~80% increase y/y (includes M&A activity). To reflect the newly acquired acreage, PE revised ’17 guide and now plans to spend ~$1,000-$1,150 mm (~$160-$190 mm on Infrastructure) to complete ~130-150 gross horizontal wells (~95-105 Midland;~35-45 Delaware; ~8,000' lateral) and 5-10 vertical completions. PE now expects '17 volumes of 62-68 Mboepd (68%-73% oil), up from 57-63 MBoepd (68%-73% oil) previously. Preliminarily we are forecasting production towards the high end of the company’s newly revised guide. Assuming PE accelerates its rig activity to a 20+ program by ’19 (up from our previous assumption of ~15) this transaction should have a minor positive value impact as the incremental drilling activity more than offsets the significant equity dilution.