Parsley has full borrowing capacity available for Permian development

Permian driller Parsley Energy (ticker: PE) said it has amended its revolving credit agreement, increasing the borrowing base by 60% to $1.4 billion, with a company-elected commitment amount of $1.0 billion.

The amendment also adds five new lenders under the credit agreement:

- Canadian Imperial Bank of Commerce, New York Branch;

- Capital One, National Association;

- Citibank, N.A.;

- PNC Bank, National Association;

- UBS AG, Stamford Branch.

Parsley said it currently has no outstanding borrowings under its credit facility.

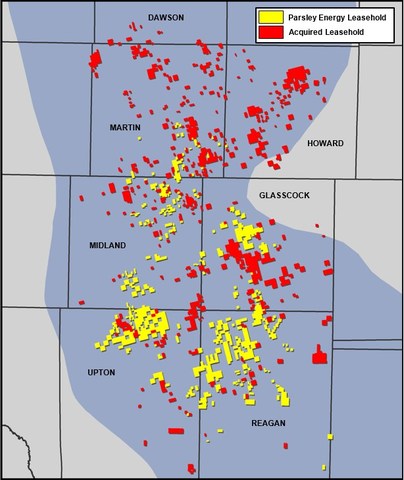

Parsley recently closed its $2.8 billion acquisition of Double Eagle Energy, bringing its Midland basin acreage total to 179,000 and its total Permian position to 227,000 acres.