Saguaro Resources is realizing 46%+ IRRs in the Montney

“Stacked pay” has become one of those phrases that you see in nearly every press release regarding a new acquisition in the Permian. As operators rush to the Delaware Basin and other parts of the Permian, investors are excited about the stacked pay potential of the acreage, and operators are willing to pay a premium for to add those assets to their inventory.

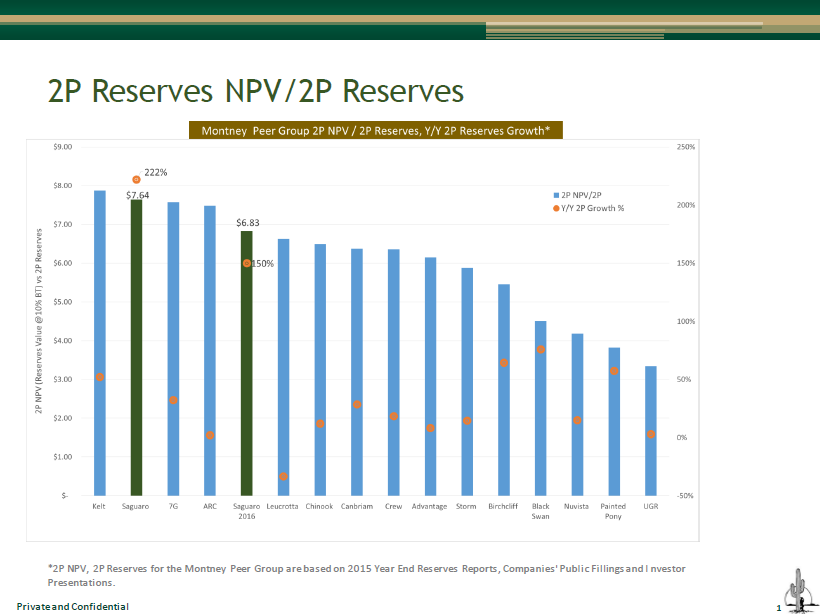

North of the Permian, North of the United States, in fact, lies another play with stacked pay and great potential for E&P companies. Canada’s Montney resource play is proving to be another high-quality basin in which companies can realize strong rates of return, even at today’s prices.

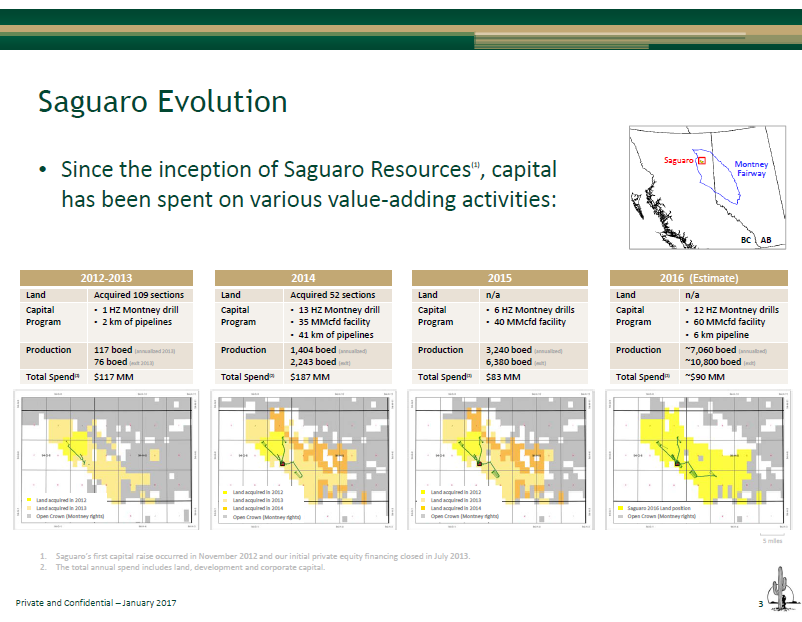

One such company is private operator Saguaro Resources, which holds acreage in the northeast portion of the Montney Fairway, in British Columbia. At year-end 2016, the company had 32 wells on production. As of February 1, 2017, Saguaro was producing approximately 12 MBOEPD (~50% of Q3 and Q4 revenue was generated from liquid production), according to information from the company.

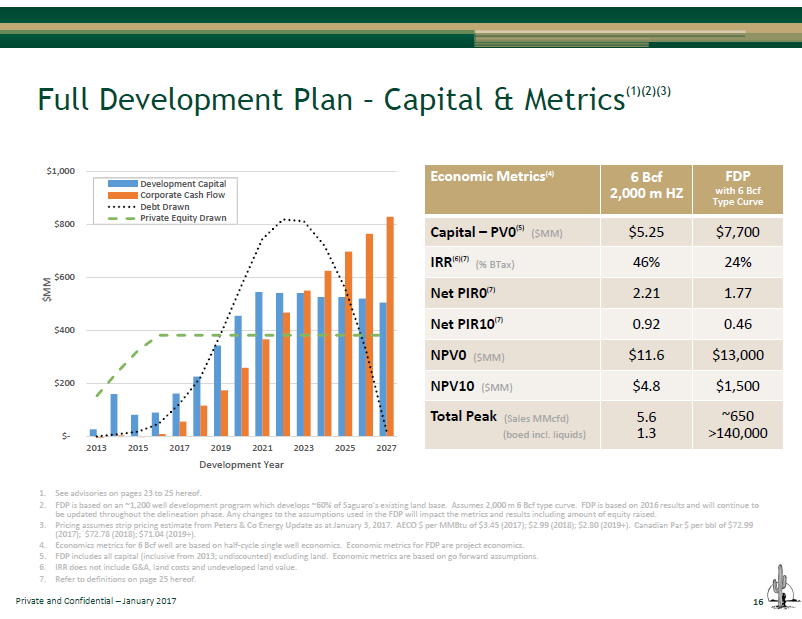

“The Montney is a world-class resource play,” Saguaro Resources Vice President, Land & Business Development Esther Troyan told Oil & Gas 360. “Our DC&E costs are at about $5 million per well, and the wells have an IRR of 46% on our conservative 6 Bcf type curve, which we are beating today.”

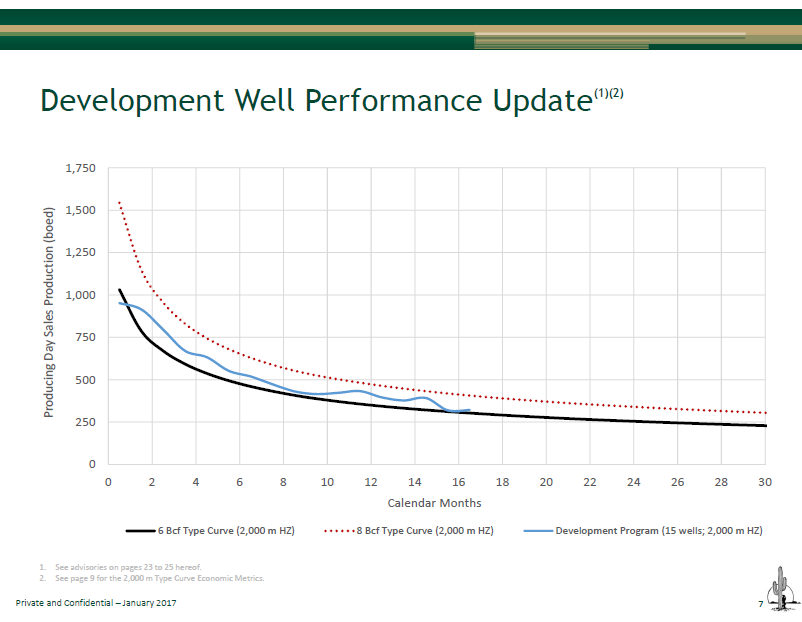

Saguaro began its commercial development program in 2015, utilizing 2,000 meter horizontal wells. Production results from these wells indicate an average type curve between 6 Bcf and 8 Bcf EUR. A 46% half cycle IRR is associated with our lower 6 Bcf type curve, and a 98% IRR is associated with the 8 Bcf type curve.

The company has already derisked approximately 86% of its land base, and believes that all three zones on its Montney assets are productive and economic, Troyan said. Saguaro averages 260 meters (853 feet) of gross pay across its three stacked zones.

Saguaro plans to drill up to 28 new wells in 2017, depending on commodity prices

Saguaro has a scalable inventory and can speed up and slow down quickly depending on commodity prices and results. Now that prices are improving, the company is looking forward to ramping up operations again. Currently, the company’s accelerated-case for 2017 is to drill 28 new wells this year, Troyan said.

Also ahead of the company in 2017 is the expansion of its compression and dehydration plant from 60 MMcf/d to 100 MMcf/d, with a footprint that has the ability to grow to 1 Bcf/d, according to the company.

Saguaro’s Q4/15 to Q4/16 production growth rate was 117%, with 1P and 2P reserves increases of 163% and 150%, respectively, from year-end 2015 to year-end 2016, according to information provided by the company.

“Saguaro is self-funding through cash flow and reserve based bank line growth at strip prices,” said Troyan.

Saguaro Resources presenting at EnerCom Dallas

Saguaro Resources will be presenting its story at the Tower Club Downtown Dallas on Wednesday, March 1, as part of EnerCom Dallas, an investor conference which is modeled after EnerCom’s The Oil & Gas Conference® in Denver.

The Dallas conference is designed to offer investment professionals a unique opportunity to listen to a wide variety of oil and gas company senior management teams update investors on their operational and financial strategies and learn how the leading independent energy companies are building value in 2017.

The event also provides energy industry professionals a venue to learn about important energy topics affecting the global oil and gas industry. The forum offers healthy dialogue and informal networking opportunities for attendees.

To sign up for EnerCom Dallas and hear Contango present, or to find out more information about presenting companies at EnerCom Dallas, click here to visit the conference website.