Qatar lifts moratorium on developing the North Field, which holds the majority of the country’s natural gas

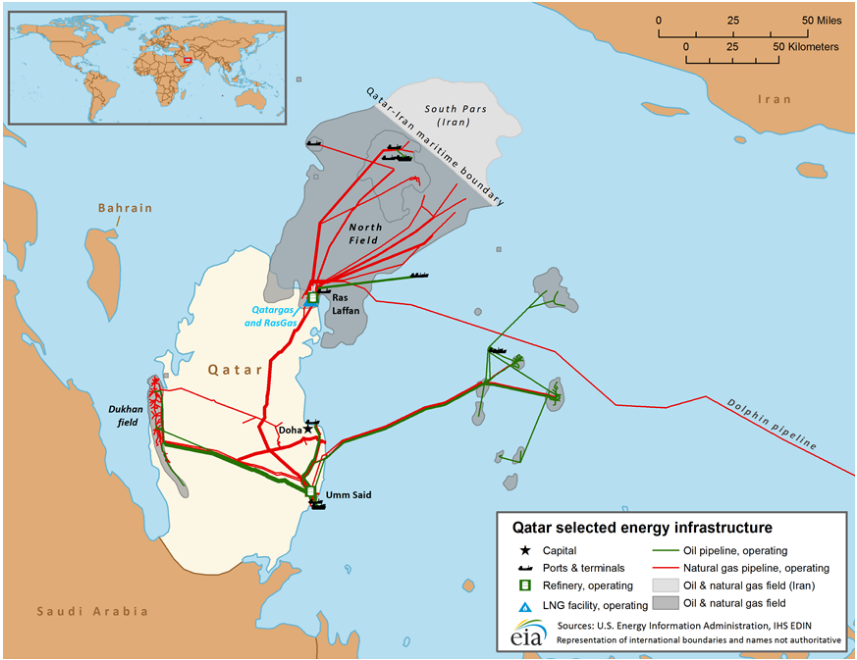

Qatar will end a self-imposed moratorium on further developing the North Field as it hopes to remain competitive and capture more market share in natural gas markets over the coming years. North Field, which is split by territorial lines with Iran and called South Pars by the Islamic Republic, is the largest natural gas deposit in the world, according to the EIA, and represents the majority of Qatar’s 872 Tcf of natural gas reserves.

Qatar declared the moratorium in 2005 to study the effects of production on the reservoir.

“We have completed most of our projects and now is a good time to lift the moratorium,” Qatar Petroleum CEO Saad al-Kaabi said. “There are no analysts who can say when demand for gas will wane. For oil, there are people who see peak demand in 2030, others in 2042, but for gas, demand is constantly growing.”

The development in the southern section of the North Field will have a capacity of 2 billion cubic feet per day, or 400,000 barrels of oil equivalent, and increase production of the field by about 10 percent, when it starts production in five to seven years, he said.

Staying competitive in LNG markets

Qatar Petroleum’s decision is a sign that it wants to increase its LNG market share, Giles Farrer, research director, global LNG, at Wood Mackenzie, said. It’s “also a threat to other developers of new capacity worldwide, as Qatar can add new capacity at a lower cost than anybody else.”

Qatar is expected to lose its top exporter position this year to Australia where new production is due to come on line. While current commodity prices do not offer the most attractive returns on new LNG projects, Qatar Petroleum expects that markets will tighten by the time its new developments come on line.

An energy advisor to the Qatar government told Reuters he saw it as a preemptive step to warn competitors who are considering LNG investments that Qatar remains an aggressive seller.

“It will certainly give rivals something to chew on,” he said, declining to be named as he was not authorized to speak publicly.

Several other countries are looking for ways to increase their LNG output as well, however. Both the U.S. and Australia have been adding new projects, and Russian President Vladimir Putin said Thursday Russia aims to become the world’s largest LNG producer.

All of the upcoming projects in global installed LNG capacity of over 300 million tons per annum, while only around 268 million tons of LNG were traded over the course of last year, according to Thomson Reuters data.

Iran also increasing production from South Pars

Last week, Iranian Oil Minister Bijan Zangeneh said Iran will also ramp up natural gas production from its portion of the field. “Iran’s gas production in South Pars can exceed Qatar’s before the end of new Iranian year (ending March 20, 2018),” Zanganeh was quoted as saying by Tasnim news agency on Thursday.

Iran has made increasing natural gas production a top priority to meet domestic shortages. The country signed a preliminary deal with France’s Total (ticker: TOT) in November to develop its South Pars II project.

Total was the first Western energy company to sign a major deal with Tehran since the lifting of international sanctions.

Kaabi said the decision to lift the moratorium was not prompted by Iran’s plan to develop its part of the shared field.

“What we are doing today is something completely new and we will in future of course … share information on this with them (Iran).”