QEP says proceeds will fund Permian development until cash flow neutral in 2019 and a $1.25 billion share repurchase program and pay down debt

Along with its Q4/2017 results, QEP Resources (ticker: QEP) unveiled several major strategic shifts today, furthering its transition into a pure-play Permian producer.

The company has engaged advisors to help sell its Williston and Uinta assets, and data rooms on the properties are expected to open in late March or early April. In addition, QEP intends to market its remaining non-Permian assets, primarily in the Haynesville, in the second half of 2018.

Properties on the block represent nearly 80% of production, 60% of reserves

This will be a major move for the company, as QEP’s Williston, Uinta, Haynesville and other non-Permian assets account for a combined 9.5 MBOEPD, 412 MMBOE of reserves and more than 275,000 acres. The company’s current Permian properties represents 2.6 MBOEPD, 272.7 MMBOE of reserves and 50,800 acres.

QEP, therefore, is planning on selling nearly 79% of its current production, 60% of its reserves and roughly 85% of its acreage. The proceeds from these sales will, unsurprisingly, be primarily used to fund the company’s Permian development program, until QEP’s operations in the basin reach operating cash flow neutrality in 2019. In addition, QEP will use the proceeds to fund a $1.25 billion share repurchase program and reduce debt.

The company plans to spend just under $1.1 billion in 2018 CapEx. While the intended asset sales will leave QEP with only Permian properties if completed, the company will not wholly concentrate capital in the basin until those sales close. Therefore, QEP plans to spend 45% of its 2018 CapEx on its non-Permian properties this year.

This transition was likely in part due to activist investor Elliott Management, which held a 4.4% stake in QEP at the end of December. Activist investors have been making their presence felt in the oil and gas industry, with companies like SandRidge and EQT making major changes in response to investors like Carl Icahn.

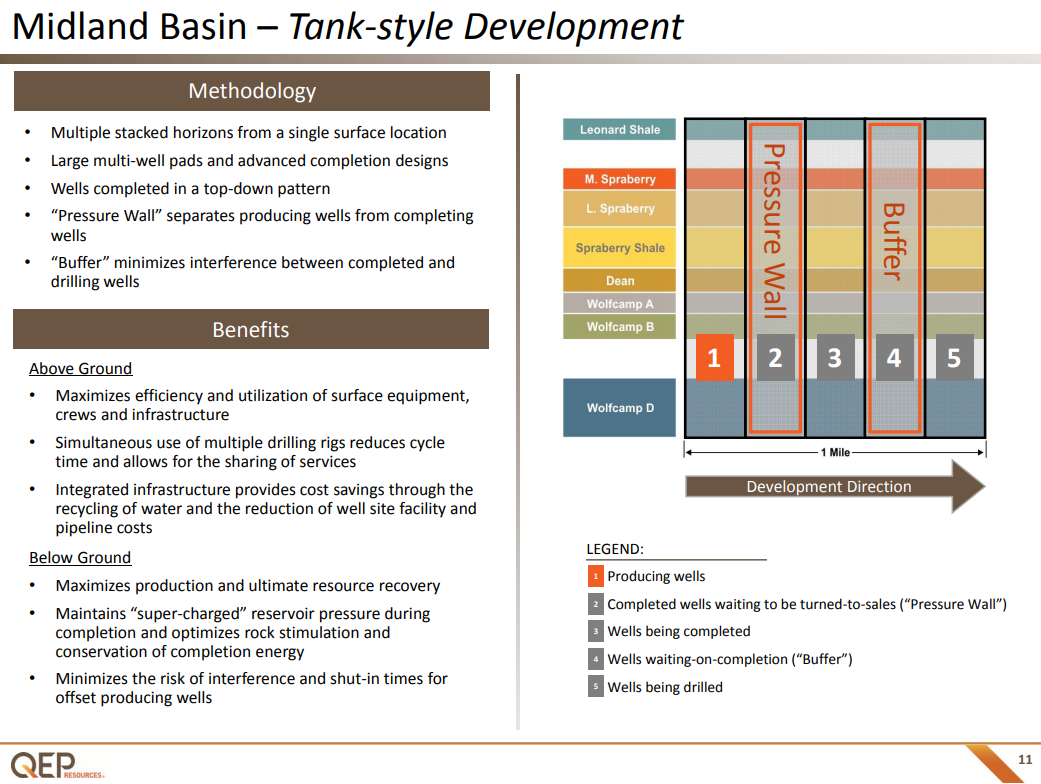

“Tank-style” development involves careful order of operations

QEP plans to grow its Permian production significantly in the coming year, with output rising about 70% at the midpoint of guidance. The company plans to put 95 wells on production, with over 35% of these wells having laterals longer than 10,000 feet.

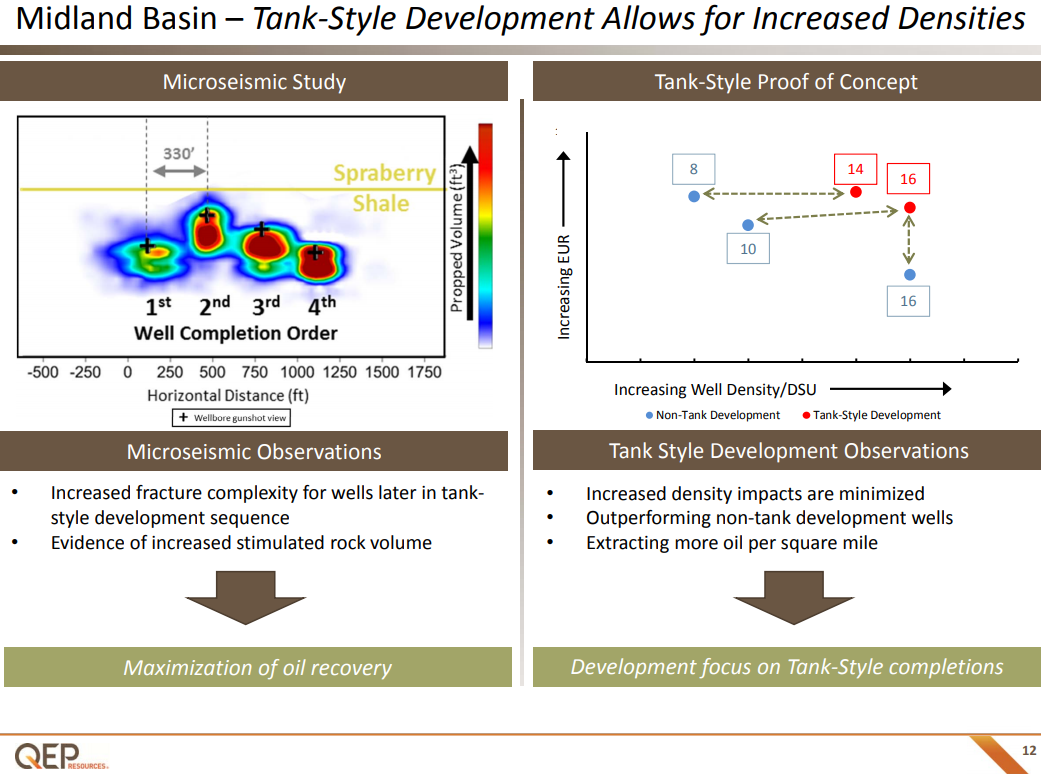

QEP continues to focus on “tank-style” development of its Permian assets, which it claims yield major benefits to operations. Tank-style development involves drilling multiple horizons from a single location, then completing wells in a specific order. According to the company, this minimizes interference and shut-in times for producing wells, and increases the fracture density of wells being completed.

Financials: new U.S. tax law provides $308 million boost

QEP also announced fourth quarter earnings and reserves today, showing net quarterly income of $150.3 million, or $0.62 per share. The company received a significant boost from the recent tax legislation, which gave QEP a $307.9 million benefit due from lower deferred tax liabilities.

QEP reserves fell by about 6% this year, to 684.7 MMBOE. This is primarily due to QEP’s sale of its Pinedale assets, which accounted for nearly 1 Tcf of reserves in 2016.

Not counting divestments, below are QEP full year 2017 highlights:

- Net Income of $269.3 million, or $1.12 per fully-diluted share

- Total oil equivalent production of 53.1 MMboe, of which 37% was crude oil

- Record Permian Basin oil production of 6.1 MMbbl, a 52% increase

- Natural gas production of 168.9 Bcf, including 72.9 Bcf in the Haynesville

- Year-end total proved reserves of 684.7 MMboe, including record proved oil reserves of 320.5 MMbbl

- Divested Pinedale Anticline natural gas asset for net cash proceeds of $718.2 million, after purchase price adjustments (the Pinedale Divestiture)

- Acquired approximately 15,100 net acres in the core of the northern Midland Basin (2017 Permian Basin Acquisition)

“Our accomplishments in 2017 were significant, including the divestiture of our Pinedale Anticline natural gas asset and expansion of our tier one acreage position in the Permian Basin,” said QEP Chairman, President and CEO Chuck Stanley.

“We had success with our refrac programs in both the Haynesville and the Williston Basin and we successfully completed our first long-lateral horizontal well utilizing state-of-the-art completion techniques in the Haynesville. As we begin 2018, the Company is undertaking a number of strategic initiatives that will result in QEP becoming a pure-play Permian Basin company.”

For the year ended December 31, 2017, QEP reported net income of $269.3 million, or $1.12 per diluted share, compared with a net loss of $1,245.0 million, or $(5.62) per diluted share, for the comparable 2016 period.

Q&A from QEP conference call

Q: For the 2018 guide, can you maybe just give us the sense of what kind of type curve you’re using for the Permian, and what’s flowing through the budget, either on like an IP 30, IP 90 or even just like an EUR basis, like how should we think about that?

Charles B. Stanley: Well, I think as we get more production data on these tank-style wells, we’ll start to share more information in that. A couple of quick observations. One, with tank-style development, we’re seeing a dramatic increase in pressure in the reservoir as we pump a lot of fluid volume into these wells. So, they flow naturally, but they also flow a high percentage of water and exhibit a longer cleanup than a single well would, if you just drilled a single well in any of these reservoirs – or even a handful, two or three wells, in these reservoirs.

So, I think a lot of folks’ models need to be calibrated on, not reaching peak production within the first 30 days. In some instances, especially in shallower horizons, we see peak production after 90 days. So, it’s important, I think, as you’re calibrating your models to take that into account.

Q: On the 95 Permian completions in 2018, how many frac crews do you need to operate that plan, and what does that imply for efficiency compared to last year?

Charles B. Stanley: We’ll average two. We may pick up an occasional third crew, but our frac efficiency is quite good. And I think, again, it’s a testament to the efficiency of tank-style development and the contiguous nature of our acreage, because we all spend a lot of time rigging up and rigging down and moving that frac crews sit in one place and we work on multiple wells, then they rig down and move to the next half section basically. So, our tank-style development, coupled with just our contiguous acreage position, mean that our crews are pumping rather than rigging up and rigging down, and driving up and down the road.

Q: You used the phrase stake in the ground in a prior response. A lot of people might say that $1.25 billion share price authorization is a very big stake in the ground. Can you talk about why the board felt such confidence in putting such a big kind of number out there, especially amid concerns that some people have, that you all will need to buy more inventory over the next one or two years?

Charles B. Stanley: First, that’s a $1.25 billion authorization, and the caveat that we gave in the release yesterday, and I think Richard’s already said it, is it’s subject to market conditions, available liquidity, and the ultimate proceeds from asset sales.

Now, that being said, we have a 44,000 net acreage position in the core of the Permian, the northern part of the Midland Basin. And we think we’ve got more than adequate running room currently to prosecute a multi-year development program on those assets to drive peer-leading production growth and peer-leading returns. When we look at acquisition opportunities, we think the most attractive acquisition today is buying back our own stock, as we become a pure-play Permian company.

Q: Timing wise, if data rooms open up late March or April, should we be thinking about the kind of July plus or minus timeframe, or how should we be thinking about these updates?

Charles B. Stanley: If you use the Pinedale Divestiture from last year’s kind of model, that was a sort of five-month – start to finish. I think advisers were engaged end of April. We announced the transaction in the July and closed in the September. So, if you think five months from where we are today, that puts you some time in the August to early September timeframe.

Q: Transition over to the tank-style development program. As you think about what’s right for balancing, what’s right for the reservoir with the execution risk and facility costs associated with that style of development, what does that suggest as optimal in terms of how many wells each vertical tank should contemplate?

Charles B. Stanley: Well, when we think about it, there’s a couple of things, Derrick. One is, as we’ve described in our previous calls, and I think it’s really – there’s a great picture in our slide deck on slide 11. We have two – there are three, actually, distinct activities. We have two barriers. One, which we call a pressure wall, which we developed between the frac crew and the existing producing wells; and then we have another barrier, which we call a buffer between the frac crew and the drilling rigs that are drilling new wells.

And the idea is to minimize or eliminate frac interference, either with producing wells or fracing into actual drilling wells. And the width of those buffers is an ongoing exercise in trying to minimize the number of wells in each one. I mean, at a minimum, there’d be four well stacked, vertically one in each of the reservoirs between the family of producing wells and the frac crew and a minimum of one well in each of the producing reservoirs between the frac crew and the drilling rigs.

And as we evolve the technique, that’s our goal, is to minimize the number of wells that are in those two barrier areas. Right now, we have between two and three wells in each of them in various parts of the development. And our desire is to shrink that down.