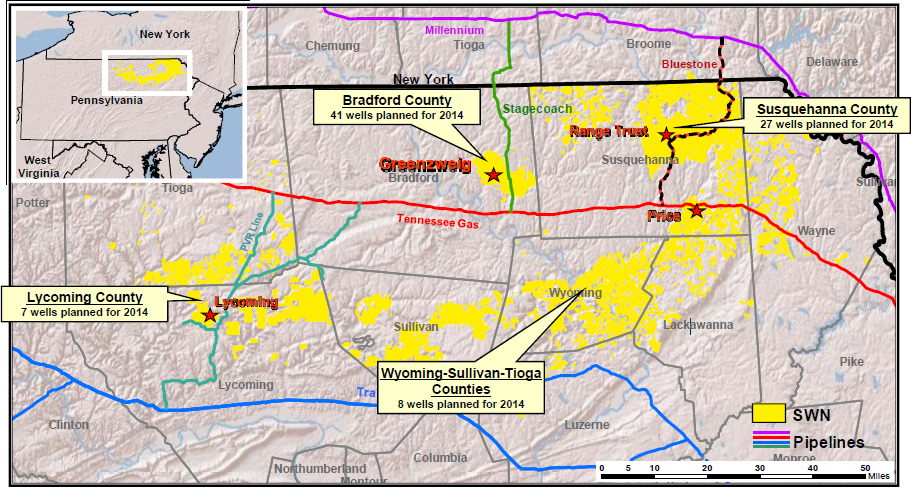

Southwestern announced yesterday the addition of 46,700 net acres to its expanding Marcellus play.

Southwestern Energy Company (ticker: SWN) released a statement yesterday saying that it has signed an agreement to purchase oil and gas assets, including approximately 46,700 net acres in northeast Pennsylvania, from WPX Energy, Inc. (ticker: WPX) for approximately $300 million.

The acreage is currently producing approximately 50 million net cubic feet of gas per day (MMcf/d) from 63 operated horizontal wells.

Also as part of the deal, SWN will assume firm transportation capacity of 260 MMcf/d, predominantly on the Millennium pipeline, effective upon closing. The transaction is conditional upon receiving a waiver from the Federal Energy Regulatory Commission regarding transfer of the firm transportation capacity and is currently expected to close in the first quarter of 2015.

Southwestern intends to use its revolving credit facility to finance the acquisition.

Steve Mueller, President and Chief Executive Officer of SWN, said in the release: “We are very excited about the addition of this asset and firm transportation capacity to our portfolio. This acreage position complements our existing Marcellus acreage in northern Susquehanna County where we have recently seen very good results.”

“Further, the additional firm transportation capacity adds to our existing firm transportation portfolio to provide 1.3 Bcf per day of firm transport capacity upon closing and growing to 1.4 Bcf per day by the end of 2016. The immediate availability of this firm transportation provides the pathway for ongoing growth in production over the next three years and the added acreage solidifies future value through a growing well inventory.”

Source: Southwestern Energy

http://www.swn.com/investors/Press_Releases/2014/SWN-NewsRelease120214.pdf

$300 million deal second Marcellus acquisition for SWN this year

Southwestern’s purchase of WPX’s Marcellus assets comes after the company announced a $5.375 billion deal with energy giant Chesapeake Energy (ticker: CHK), in October of this year.

The deal with Chesapeake resulted in Southwestern receiving 413,000 net acres located in northern West Virginia and southern Pennsylvania (more than 50% held by production), approximately 1,500 wells, including 435 gross horizontal wells in the Marcellus/Utica with an average working interest of 67.5%, average net production of 56 MBOEPD (45% liquids) during September 2014, and net proved reserves of 221 MMBOE.

The company planned to finance the transaction through a $5.0 billion commitment from Bank of America and its existing credit facility.

The transaction equates to $6,424 per acre and $6,000 per flowing Mcfe/d, including the pipeline access. By comparison, SWN paid $13,014 per acre and $15,997 per flowing Mcfe/d in the Chesapeake deal earlier this year. Many analysts agreed the transaction was above their estimates, but SWN’s bold move rewarded it with a third core position. Its latest bolt-on acquisition was purchased below the company’s current enterprise value to trailing twelve months production value of $6,451 per Mcfe/d, according to EnerCom’s E&P Weekly database.

WPX refocusing as it moves into the New Year

In the company’s note about the $300 million sale, WPX President and CEO, Rick Muncrief, said the company saw the deal as a continuation of the company’s strategy to “reshape and refocus” as it moves into 2015.

“We’re heading into 2015 … ready to grow margins, develop our highest returning assets and build the long-term value of the company,” Muncrief said.

WPX’s first transaction involving its Marcellus Shale operations marks the company’s sixth significant agreement it has entered into since May to narrow the company’s business focus, increase scalability of core assets, bring value forward and further strengthen its balance sheet.

WPX’s remaining operations in the Marcellus Shale primarily consist of its physical operations in Westmoreland County in southwestern Pennsylvania and additional firm transport capacity on Transco’s Northeast Supply Link line, which are also target for divestiture, according to WPX.

The company expects that the transfer of firm capacity to SWN in yesterday’s deal will release WPX from approximately $24 million per year in annual demand obligations associated with the transport.

Two years ago, WPX’s portfolio consisted of assets in eight areas – seven domestic plays along with South American interests through ownership in Apco Oil and Gas International (ticker: APAGF). The company has since narrowed its interest on three plays – the Williston Basin in North Dakota, the Piceance Basin in Colorado and the San Juan Basin in both Colorado and New Mexico – in order to develop assets with the highest rate of return, according to the company. The company has an estimated 16,000 remaining gross drillable locations, more than 14 trillion cubic feet of proved, probable and possible reserves at year-end 2013 and approximately 480,000 net acres among the three plays.

“We’re confident we have the right building blocks in the Williston, San Juan and Piceance basins. We have upside in all three. Our strategy accelerates our oil development and capitalizes on what we can gain from technical excellence, new technology and greater economics of scale,” said Muncrief.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.