NSAI report puts estimate of lifetime EUR for the Wattenberg at nearly $180 billion

Northern Colorado’s Wattenberg field has been a prolific producer of oil and natural gas for decades. Like other basins, the area’s production accelerated significantly when hydraulic fracturing and horizontal drilling came to the DJ Basin a dozen or so years ago.

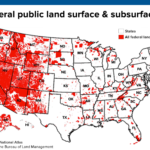

But there are proposed ballot initiative petitions being circulated this summer and a court case awaiting final outcome in Colorado that could result in shutting out large areas of the state for oil and gas development.

Initiative 97, would grant local towns and counties the power to regulate or deny oil and gas development and would impose a 2,500-foot drilling and development setback for new oil and gas activity. Likewise, if the Martinez appeals court decision, now in front of the Colorado Supreme Court, is upheld, the Colorado Oil & Gas Conservation Commission would be mandated to revamp criteria for how it either approves or denies drilling permits to account for the effects on climate change. Either outcome will result in a denial of royalty payments to oil and gas mineral rights owners for new oil and gas wells.

According to CAMRO, the Colorado Alliance of Mineral and Royalty Owners, government entities that essentially stop oil and gas development could then be on the hook for more than $26 billion from successful takings claims, or just compensation paid for the public use of private property.

$180 billion in EUR in the Wattenberg

CAMRO released a report today that was prepared by worldwide petroleum consultants Netherland, Sewell, & Associates showing that untapped minerals in Colorado’s Wattenberg Field could have an expected ultimate recovery of nearly $180 billion over the life of the field.

Just the royalties for mineral owners would come to $26 billion dollars, CAMRO said in its statement.

“If the seizure of private property rights in Colorado is codified through the local control initiatives or statewide ballot measures, all property rights throughout the state are under attack,” said Neil Ray, president of CAMRO.

“Not only do these estimates represent a staggering value that could be taken without compensation from mineral owners by proposed ballot initiatives, but they represent funds taken from tax coffers that fund schools, roads, and other community services that we all value,” Ray said.

According to a 2015 University of Colorado Leeds School of Business report detailing the economic impact on Colorado from the oil and gas industry, in 2014 property, income, and severance taxes and public land leases and royalties paid by oil and gas companies operating in Colorado totaled nearly $1.2 billion.

Groups behind local control and 2,500-foot setbacks could trigger compensation to property owners if ballot initiatives pass

“Even a section with low-producing wells still would generate over $200 million in royalties alone. Our cities, counties, and state simply cannot afford to compensate mineral owners for their property,” Ray said in today’s statement.

Local control measures and ballot initiatives, such as Initiative 97, would severely restrict mineral development and, thus, represents a reverse takings claim, which would require compensation to property owners.

Besides infringing on the property rights of mineral owners who depend on their minerals for financial support, these measures prevent future development that could bring millions of dollars to the Colorado economy and local governments, CAMRO said. “Such restrictions on mineral development threaten the economic wellbeing of our communities and the sanctity of property rights for mineral owners.”

“If governments prevent mineral owners from developing our minerals, we will be forced to seek just compensation for their value,” said Kathy Allen, a mineral owner who owns minerals in Weld, Yuma, and Montezuma Counties.