Brent Oil in Bear Market as China-U.S. Trade Tensions Mount

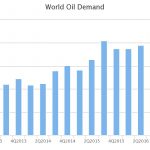

From Reuters Oil prices fell more than 1% on Tuesday, with Brent crude settling near seven-month lows below $60 a barrel as trade tensions between the U.S. and China intensified worries about weakening global demand. During the session, Brent traded at a low of $58.81 a barrel, down more than 22% from its peak in April. That decline puts the