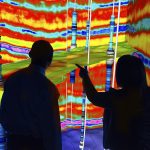

Chesapeake “Reinvents the Utica”

Chesapeake Energy Corporation (ticker: CHK) reported net income available to common stockholders of $268 million, or $0.29 per share for Q1 of 2018. Chesapeake’s average daily production for the first quarter of 2018 was approximately 554,000 BOE, compared to approximately 528,000 BOE in Q1 2017. Chesapeake reported an average rig count of 15 in Q1 2018, with 77 gross wells