Senior VP Paul Geiger discusses operations

Day two at the 2017 EnerCom Conference began with a presentation from Southwestern Energy’s (ticker: SWN) Senior Vice President Paul Geiger, who outlined the company’s current strategy. Southwestern’s goal, as Geiger put it, is to “not just survive in a $3/Mcf and lower environment, but thrive.”

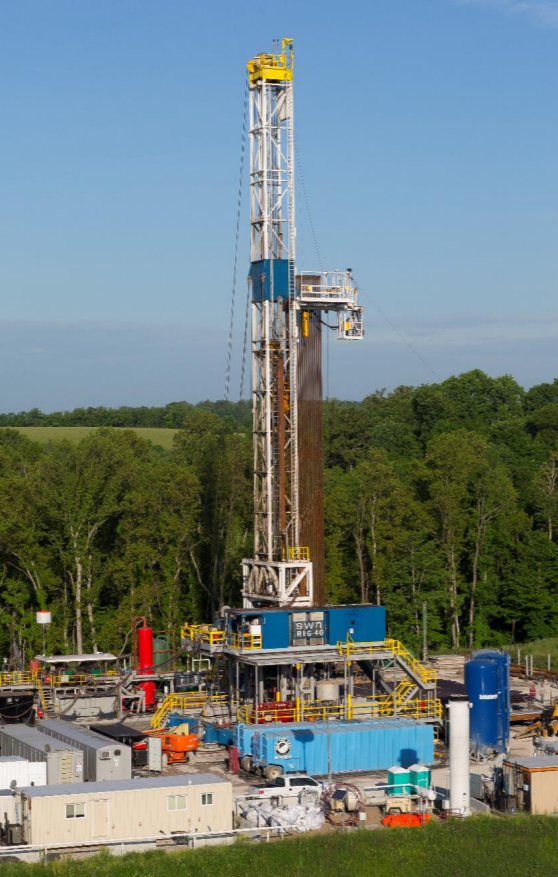

Vertical integration gives cost savings

Southwestern believes that its vertical integration has provided it with a competitive advantage that other companies may not be able to claim. The company owns seven state-of-the-art drilling rigs, which it uses for its operations. According to Geiger, these reduce well costs by an average of $50,000 per well, a significant improvement. In addition, these wells can walk to each well site in a pad, and Southwestern estimates that they can move about 1 day faster than peers.

Southwestern also owns a sand mine in the Fayetteville, which produces 30/70 and 100 mesh sand. While the Fayetteville may not have experienced the sand supply crunch seen in the Permian, it is subject to the same overall market dynamics. This means Southwestern owning its own mine will ensure supply despite overall demand hitting record levels this year.

Differentials falling

Like yesterday’s Marcellus producers Range Resources (ticker: RRC) and Cabot (ticker: COG), Southwestern is continually adding takeaway capacity to support further growth. Geiger reported that the company recently added about 140 MMcf/d of new takeaway capacity to its Northeast Appalachia operations for $0.10 per Mcf, a very low price.

The company’s Appalachian differentials are expected to decrease significantly in the next few years. Currently, Southwestern’s Southwest Appalachian assets experience a $0.71/Mcf differential. This is expected to fall by nearly 80% in the next two years, to a mere $0.15/Mcf. The company’s Northeast Appalachian assets will see differentials fall as well, dropping by about 60% in the next two years. Even the Fayetteville, which already has a tiny differential, will see this value fall further in the next two years.

In addition, Geiger discussed Southwestern’s corporate responsibility goals. The company seeks to be water neutral, primarily through the recycling of produced water and frac fluid. Southwestern is also active in gas leak detection, participating in studies and new technology to minimize methane emissions.