Reports Top IP Rates from Two Williston Wells

Whiting Petroleum (ticker: WLL), the largest producer and acreage holder in the Williston Basin, reported decreasing well costs and increasing production volumes in its Q1’15 earnings release issued on April 29, 2015. Total quarterly production averaged 166.9 MBOEPD (88% liquids), a sequential increase of 3% as compared to Q4’14, pro forma the acquisition of Kodiak Oil & Gas effective December 2014.

Management conveyed that completed well costs in WLL’s Bakken and Niobrara core plays have dropped by 20% to 25% on a year-over-year basis, and productivity continues to rise from increased knowledge, experience and operational efficiencies gained in those plays.

“We think WLL’s operational update is the more important aspect of the release,” wrote Global Hunter Securities in a note to clients. “WLL posted its strongest Bakken results ever this quarter and projects a meaningful drop in well costs, which, in our opinion, should enable the company to produce compelling rates of return in the Bakken even at today’s prices.”

Full-Year 2015 Snapshot

Whiting expects production to average 162 MBOEPD in fiscal 2015 – a 6% increase as compared to 2014 volumes. Capital spending on a quarterly basis will trend down in the quarters ahead, as $835 million of the company’s $2.0 billion annual budget was invested in Q1’15. Whiting will reduce its rig count to 11, with nine rigs running in the Williston and two in the Niobrara. Management did say it has the ability to quickly place more rigs online if oil prices reach the $70 mark.

“In terms of the production trend, we see a moderate decline in Q3 from Q2 levels and then stabilization of volumes in Q4,” said Michael Stevens, Chief Financial Officer of Whiting, in a conference call. Q2’15 production volumes are projected to reach 164.8 BOEPD.

Importantly, the notion of “stabilization” extends beyond production volumes and extends to cash flow. Jim Volker, President and Chief Executive Officer of Whiting, explained: “By Q4’15, we should be able to maintain a strong production profile of approximately 160 to 162 MBOEPD on a quarterly spend of only $375 million (on an 11 rig program). For 2016, as our base decline rate flattens, we believe this translates into a strong mid-single-digit growth profile on a $1.5 billion CapEx budget. This should approximate our cash flow at current strip prices.”

Spending within cash flow and focusing on returns is a desirable trait in today’s cautious market, and stands in stark contrast from Whiting’s previous emphasis on growth. For example, the company’s reference case 2016 budget is 62% below its 2014 capital budget of $4.0 billion.

Total revenue for Q1’15 was $529.2 million, down 24% from Q4’14’s total of $696.1 million. Realized prices played a significant part in the decline, considering Q1’15’s realized price of $37.97/BOE is 37% below Q4’14’s price of $59.86/BOE. The company reported a net loss of $106.1 million, or ($0.63) per share, although we note that includes various non-cash charges including $283.5 million in DD&A.

Making its Mark in the Williston

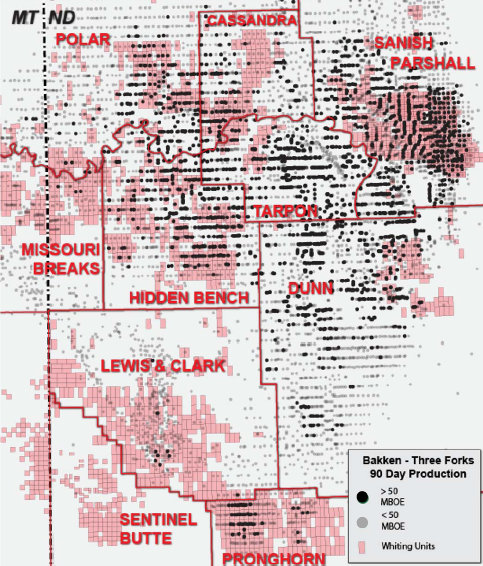

Whiting proved it is not just the biggest operator in the Williston Basin, but it is one of the best. Whiting announced that it has drilled the best-performing Three Forks and Bakken wells with 24-hour IPs of 7,874 BOEPD and 7,120 BOEPD, respectively and both are records. With 1,270,092 gross acres (774,022 net) in the Williston Basin, Whiting’s concentrated position is the largest in the region, and it covers the core of the Bakken and Three Forks plays.

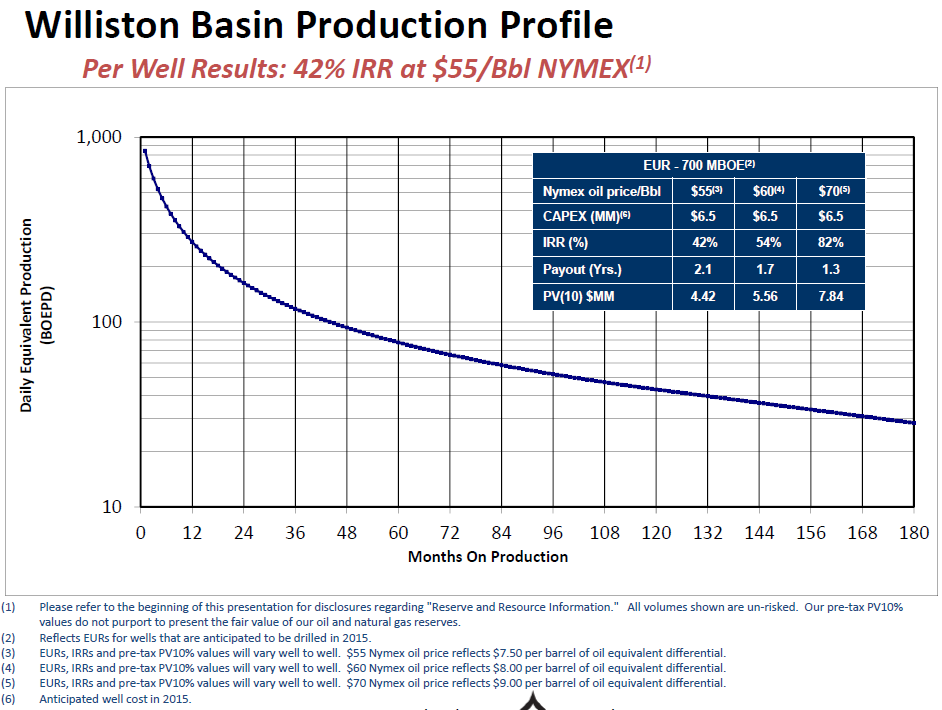

The chart below illustrates the quality of the company’s assets and the beneficent effect of reduced service costs and increased efficiencies. Whiting’s Williston Basin type curve and current drilling and completion costs indicates it can generate a compelling 42% IRR at a NYMEX oil price of $55 per barrel.

Whiting estimates it has 7,541 future gross drilling locations at year-end 2014, underscoring strong visible growth potential. In addition, the company’s concentrated acreage position should provide the ability to control operations and develop operational efficiencies over a broad acreage position.

Williston Overview

WLL is targeting the Bakken/Three Forks formation in its Williston properties, which account for about 80% of its overall production. Whiting management said typical wells on its properties rack up cumulative production of 50 MBOE in 90 days of production, which provide internal rates of return in excess of 50% at current prices.

Q1’15 volumes averaged 133.5 MBOEPD – about one-third of which was attributed to properties acquired in the Kodiak merger. Average well costs have dropped to $6.5 million from $8.5 million in 2014. The implementation of slickwater fracture stimulation technique is also proving its value – 15 completed slickwater wells in the Pronghorn Field averaged 90-day production rates of 832 BOEPD, an increase of 51%, as compared to 42 offsetting wells. The table below summarizes results from Whiting’s operations in various counties:

| County |

Wells |

IP Rate (BOEPD) |

30-day Rate (BOEPD) |

| Dunn |

4 |

3,181 |

1,255 |

| Koala |

4 |

2,630 |

1,130 |

| McKenzie |

4 |

2,584 |

1,395 |

Redtail: A Whiting within Whiting

Management has always spoken highly of its Niobrara properties in the Denver-Julesberg Basin, referred to as its “Redtail” asset. Production in Q1’15 increased to 13,000 net BOEPD, a sequential increase of 28% from Q4’14. The company has established production from four zones (Niobrara A, B, C and Codell/Fort Hays formations) and believes it has captured 6,685 future gross drilling locations on its 184,348 gross acres (134,027 net) in the basin. The Codell/Fort Hays zone is still in the early stages of development, but a test in September produced 71 MBOE in 200 days of production (355 BOEPD). WLL believes the test well trends along its Niobrara A and B type curves of 450 MBOE of estimated ultimate recovery (EUR).

Redtail well costs have declined to $4.5 million from $6.0 million on a year-over-year basis. Takeaway capacity is expected to increase in the current quarter, with its gas processing plant jumping to 70 MMcf/d from 20 MMcf/d. The company also locked in a premium discount rate via the Pony Express pipeline, which locks in a $4.75 discount to NYMEX compared to the current regional spread of roughly $12.00.

Balance Sheet Update

Whiting shored-up its liquidity position with the sale of mature, non-core assets for proceeds of $108 million, which included production of 2.2 MBOEPD and 8.2 MMBOE of reserves. Volker expects total asset sales in 2015 to fall in the range of $0.5 to $1.0 billion. “Speaking about that in terms of covering an outspend, I think we’ll sell more than enough assets to cover the outspend and perhaps even help us a little bit with some debt retirement,” he said, adding that the midstream assets are part of the potential divesture mix.

The company secured $3.0 billion in capital through a series of equity and debt offerings in March. The borrowing base on its credit facility was reaffirmed at $4.5 billion, of which WLL elected $3.5 billion in commitments. Whiting and its lenders replaced the 4.0 to 1.0 total debt to EBITDAX covenant with a 2.5 to 1.0 senior secured debt to EBITDAX covenant, a move that has been made by other operators like Range Resources (ticker: RRC).

At March 31, 2015, Whiting had no outstanding borrowings and had $5.2 billion in long term debt in the form of senior notes. The first of the senior notes mature in 2019.

WLL’s Road Ahead

Several analyst reports covering the release lauded WLL’s well results, but said the lower realized prices somewhat neutralized the well improvements. Volker said he eventually expects to realize EURs of 600 to 700 MBOE in the Bakken at costs of $6.0 to $6.5 million – not just for Whiting, but for nearly all operators in the Williston Basin.

Wells Fargo Securities commented: “Post the equity offering, WLL became a value name with oil beta upside – stock has reacted well. If oil momentum continues to grind higher, WLL over the next few weeks and months will likely continue to be strong.”

WTI prices were approaching the $60 mark just hours after Whiting concluded its conference call, where Jim Volker laid out the company’s long-term view. “Basically, what we’re looking there to do is get 3:1 on our money, 1.5-year payouts, 50% or better IRRs in all the areas where we concentrate on drilling,” he said.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.