WTI Deals Permian Position for $376 Million to Private Equity Firm

W&T Offshore (ticker: WTI), a Houston-based exploration and production company, has increased its focus on assets… offshore. On September 1, 2015, WTI divested the majority of its position in the Permian Basin to Ajax Resources, LLC, for gross pre-tax proceeds of $376.1 million. WTI retains an overriding royalty interest in the field of 1% to 4%.

The buyer, Ajax Resources, is backed financially by Kelso & Company and was established for the sole purpose of acquiring WTI’s assets. Kelso & Company has been active in North American private equity for more than 30 years and its interests range span eight different industries. Past activity on the energy side includes investments in companies like Buckeye Partners (ticker: BPL), Crescent Point Energy (ticker: CPG) and Kinder Morgan (ticker: KMI). Since its inception, the firm has raised eight private equity funds representing $9.8 billion of capital.

Breaking Down the Deal

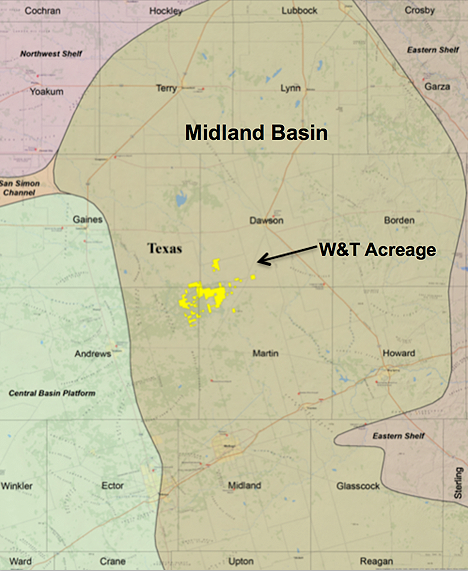

The divested assets, known as Yellow Rose Field, consist of 25,800 net acres in West Texas and is 90% held by production. Volumes in July 2015 averaged 3,000 BOEPD from 253 producing wells. WTI operations began as a vertical program but were expanding with horizontals to test additional benches. An additional 201 drilling locations have already been booked. On a metrics basis, Ajax paid $14,577 per acre and approximately $125,366 per flowing BOE.

W&T Offshore first entered the Permian in May 2011, securing 21,500 net acres for $366 million. At the time, 73 wells were producing 2,950 BOEPD and estimates of proved reserves were marked at 27 MMBOE (91% liquids). Undeveloped acreage was not mentioned by WTI said preliminary plans would target the Spraberry, Dean, Wolfcamp and Strawn formations. Based on the above metrics, WTI paid $17,023 per acre, approximately $124,067 per flowing BOE and $13.55 per reserve BOE.

W&T Offshore planned on allocating only 7.5% of its 2015 capital budget to the Yellow Rose Field, while more than 90% of the $200 million budget was targeting offshore development. The Permian provided 7% of WTI’s Q2’15 production, which averaged 46,500 BOEPD. Capital One Securities, Global Hunter Securities and KLR Group all placed adjusted estimates of undeveloped properties at $9,000 to $10,000 per acre after backing out production.

Gulf of Mexico Acquisition on the Horizon?

In a company-issued release, WTI management said proceeds from the sale will be used to pay off the outstanding balance of its credit facility, which was approximately $260 million as of June 30, 2015. Additionally, the company will be on the lookout for acquisitions in the Gulf of Mexico. Valuations are currently favorable, according to Tracy Krohn, WTI’s Chairman and Chief Executive Officer, adding that “We believe that current conditions are good for W&T to identify quality offshore producing assets that offer upside exploration and development opportunity.”

If the proceeds from Permian sale are used solely on a GoM acquisition, WTI will have more than $100 million at its disposal. Barring any acquisitions, KLR Group believes WTI will have $150 million in cash and an undrawn revolver by year-end 2015. Net debt to EBITDA will decline to 3.1x from 5.0x.

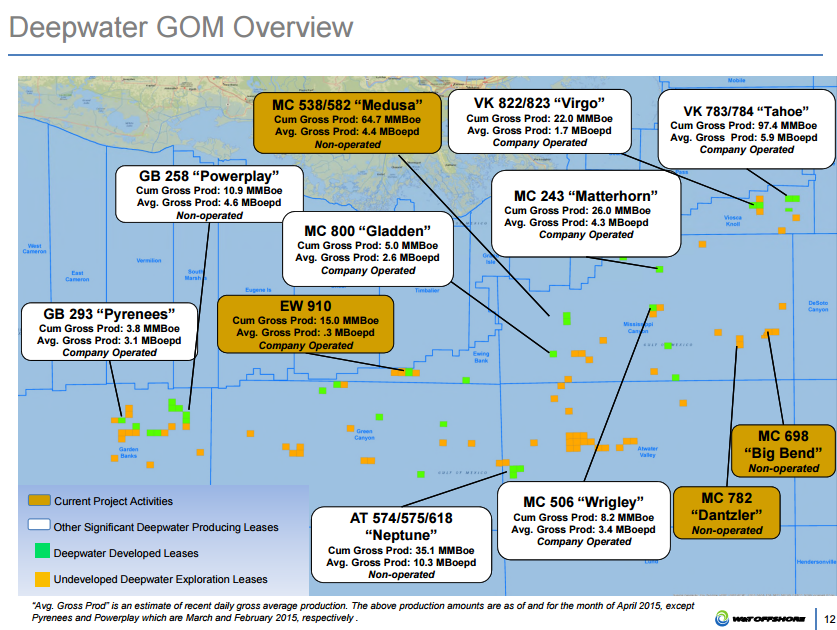

WTI has been quieter on the acquisition front in recent years and has yet to purchase any properties in 2015. Two acquisitions were completed in 2014 for a cumulative total of about $70 million and included various working interests in both shallow and deepwater blocks. Only one purchase was completed in 2013; the $100 million acquisition of working interest in 14 different offshore blocks from Callon Petroleum (ticker: CPE). Callon, coincidentally, sold the remainder of its portfolio last year and now operates exclusively in the Permian Basin.

W&T Offshore’s largest transaction occurred in October 2012, when the company secured rights to 65 blocks from Newfield Exploration for $208 million. More than $230 million was spent on two separate transactions in 2010 from giants like Royal Dutch Shell (ticker: RDS.B) and Total S.A. (ticker: TOT).

Gulf of Mexico Outlook

The Gulf of Mexico has received its fair share of bumps and bruises in the face of the commodity downturn. Two lease sales conducted by the Bureau of Ocean Energy Management (BOEM) in 2015 yielded only $562 million in high bids, with the latest sale generating $22.7 million. BOEM officials directly attributed the bids (or lack thereof) to the difficult price environment. Previous sales, such as Lease Sales 227 and 231 generated more than $2.3 billion in auctions that occurred in 2013 and 2014.

In its first public auction in decades, Mexico’s Energy Ministry managed to sell only two of the 14 shallow offshore blocks it offered in its July 2015 auction. Elsewhere, revenues in the North Sea have fallen by 75% in the first three months of 2015, reaching an all-time low.

Regardless of acquisitions, additional volumes are on the way for W&T Offshore. Projects in the Dantzler and Big Bend deepwater fields are expected to come online as early as Q4’15 and will provide 8,000 BOEPD net, which would increase company output by 20%, considering Q2’15 numbers pro forma the Permian divesture.